Compositional changes behind the growth in euro area employment during the recovery

Published as part of the ECB Economic Bulletin, Issue 8/2018.

In the third quarter of 2018 the total number of people in employment in the euro area was 9.6 million higher than in the second quarter of 2013 (when it fell to its lowest point during the crisis). The increase in employment over the course of the recovery has more than offset the decline observed during the crisis. As a result, euro area employment is currently at its highest level ever, standing at 158.3 million.[1] This box describes the net employment growth in the euro area over the course of the recovery and compares it to the period from the first quarter of 1999 to the first quarter of 2008 (i.e. from the introduction of the euro to the start of the crisis), which was also characterised by a continuous increase in employment across the euro area as a whole.

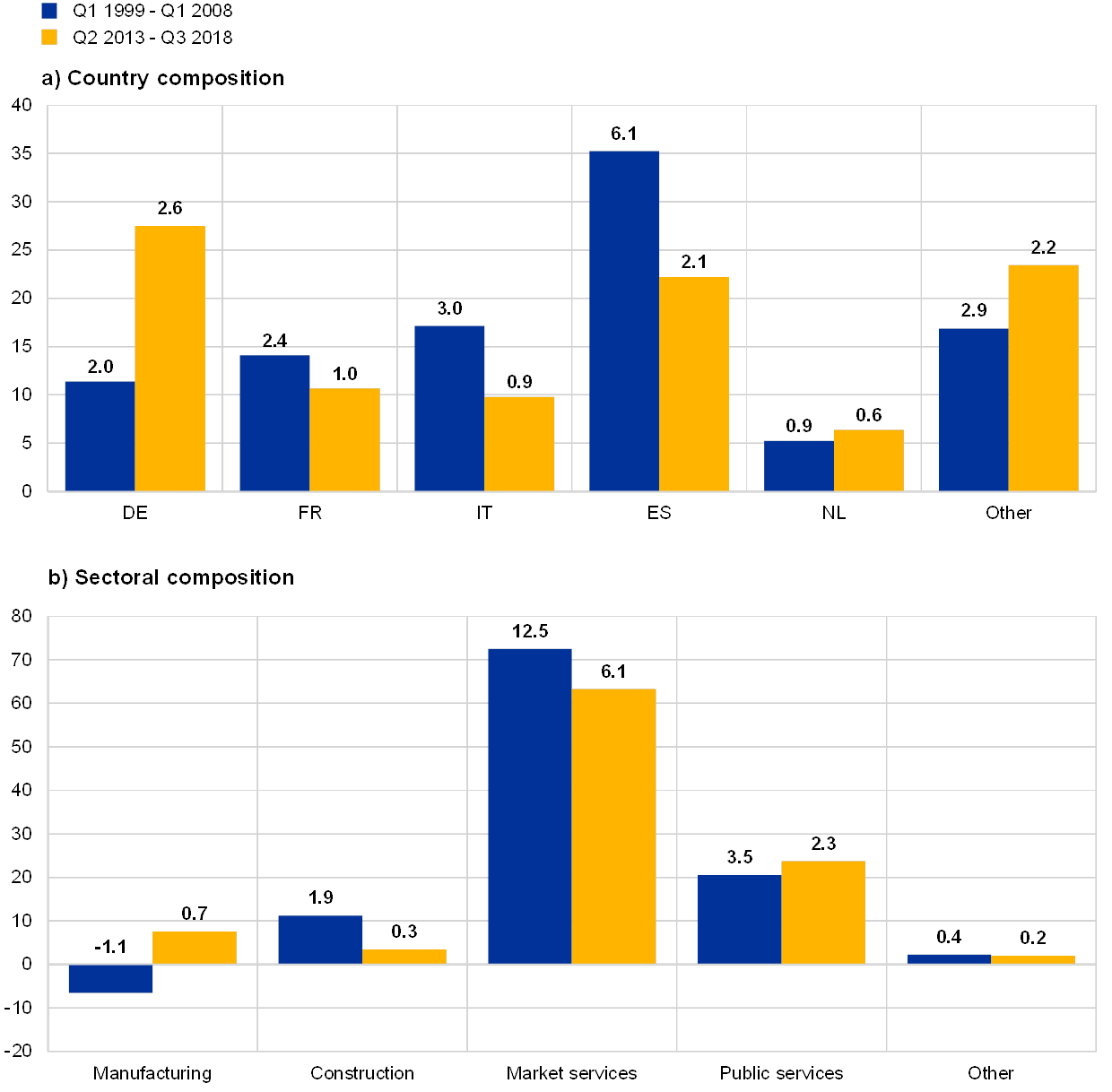

In the recent recovery, the country composition of employment growth has been somewhat different from that observed during the pre-crisis period. The 9.6 million increase in the number of people employed in the euro area is similar to that seen in the five years before the crisis, during which an increase of 10 million was recorded.[2] The main difference is that Germany now accounts for a significantly larger percentage of employment growth than it did before the crisis, while the relative shares of the other large euro area countries – particularly Spain – have declined (see Chart A). This largely reflects the relative strength of the economic growth seen in those countries over the two periods. On a related note, while Spain was the euro area’s main destination country for immigrants before the crisis, during the recovery Germany has been the country with the largest inflow of immigrants. Lithuania, Austria, Portugal and Slovakia have also increased their contributions to euro area employment growth during the recent recovery.

Chart A

Breakdown of cumulative employment growth by country and sector in the pre-crisis period and during the recovery

(y-axis: shares of cumulative employment growth in percentages; data labels: cumulative employment growth in millions)

Sources: Eurostat and national accounts.

Market services drove employment growth in both periods, although it accounted for a smaller percentage of total employment growth during the recent recovery. In both periods, employment growth in market services was dominated by professional and administrative services and the trade and transport sectors. Meanwhile, the contribution made by construction has been smaller during the recent recovery than it was before the crisis. By contrast, employment in manufacturing has made a small positive contribution since the second quarter of 2013 after declining in the period before the crisis. Finally, the public sector has accounted for about one-fifth of cumulative employment growth during the recent recovery, much as it did in the pre-crisis period.

Employment growth has been fairly equally divided between men and women during the recent recovery (see Chart B). Before the crisis, women experienced very strong employment growth, in line with their rising participation rate and reflecting increases in their level of education, labour market reforms and the growing importance of services in the economy. However, more recently the female participation rate has risen less strongly as the factors that contributed to past increases have started to stabilise, and this is also reflected in women’s contribution to employment growth. At the same time, male employment fell during the crisis and, although it has been recovering, it has yet to return to pre-crisis levels. Reflecting these trends, women’s share of the stock of employment has levelled off recently at 46.3% (up from 42.6% in the first quarter of 1999 and slightly above the 45.9% that was seen in the second quarter of 2013).

Chart B

Breakdown of cumulative employment growth on the basis of personal characteristics in the pre-crisis period and during the recovery

(y-axis: shares of cumulative employment growth in percentages; data labels: cumulative employment growth in millions)

Sources: Eurostat and LFS.

Notes: As regards the level of educational attainment, “low” denotes less than primary, primary and lower secondary education, “medium” denotes upper secondary and post‑secondary non-tertiary education, “high” denotes tertiary education, and “other” denotes a non-response. The negative percentage for “other” in the pre-crisis period most likely reflects an improving response rate in this period.

There has been a change in the age breakdown of cumulative employment growth, with older workers making a considerably larger contribution during the recent recovery (see Chart B). Before the crisis the prime-age population (i.e. people aged between 25 and 54) accounted for more than two-thirds of employment growth, but this group has only made up around one-fifth of employment growth in the recent recovery. In contrast, people aged between 55 and 74 have accounted for three‑quarters of cumulative employment growth during the recent recovery, up from less than one-third before the crisis. The contribution of the young (i.e. people aged between 15 and 24) has been limited in the recent recovery, as it was in the pre-crisis period.

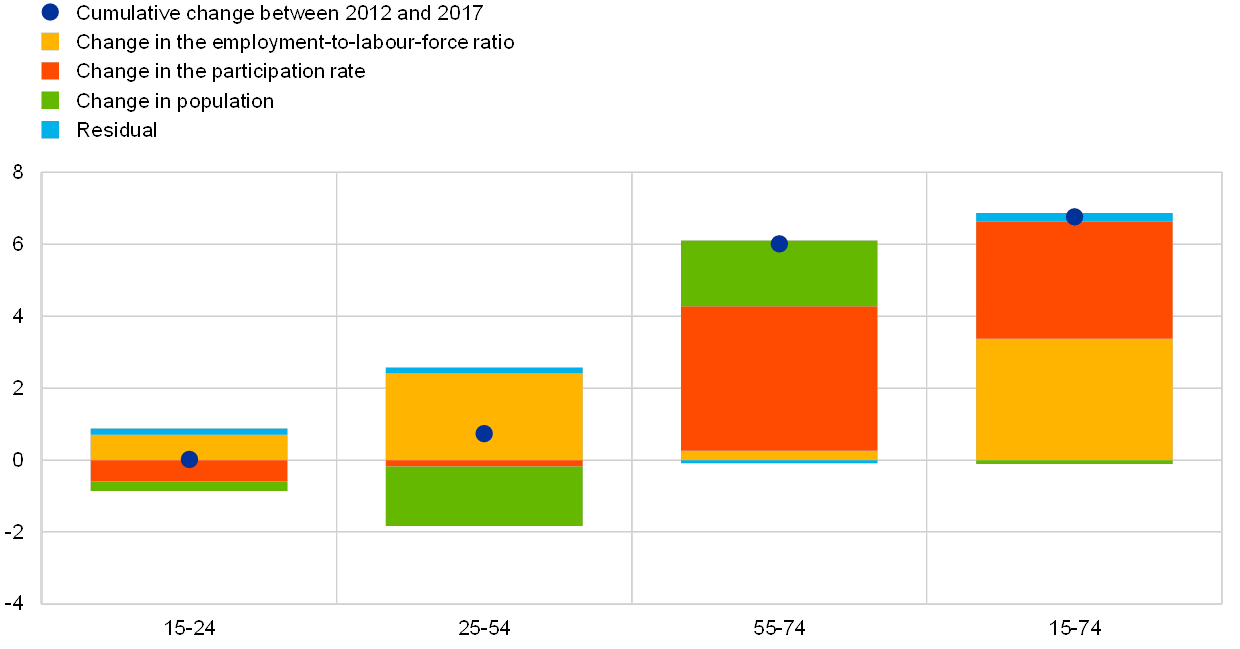

Demographics and pension reforms are likely to be the main explanatory factors underlying changes in the age breakdown of employment growth. These developments largely reflect changes in the labour supply. The number of older people has been rising as members of the “baby boomer” generation enter the 55‑74 age category, while the number of people below the age of 55 has been falling.[3] At the same time, the participation rate of older people has also risen considerably.[4] In the recent recovery, around one-third of the increase in employment of people aged 55 to 74 has been due to their increasing numbers, and two-thirds has been explained by their rising participation rate (see Chart C). One reason for the rising participation rate of the 55‑74 age group is the increase in their education level, which is positively correlated with the participation rate. However, that only explains a small percentage of the overall increase in the participation rate. It seems more likely that the main factor driving this increase in participation has been the fact that statutory and effective pension ages have risen across the euro area.[5]

Chart C

Breakdown of cumulative employment growth by age group during the recovery

(percentage changes; percentage point contributions)

Sources: Eurostat, LFS and ECB calculations.Note: These data are based on annual figures.

Employment growth in the recent recovery has been dominated by people educated to tertiary level. Indeed, people who have completed tertiary education have accounted for almost 80% of total employment growth in the current recovery, up from 60% pre-crisis, while the contribution made by people with a medium level of educational attainment has shrunk significantly. The employment of people with a low level of education has declined in the recent recovery, as it did in the pre-crisis period. These developments are also linked to changes in the population as the number of people with a low level of education declines and the number of people with a tertiary education increases.

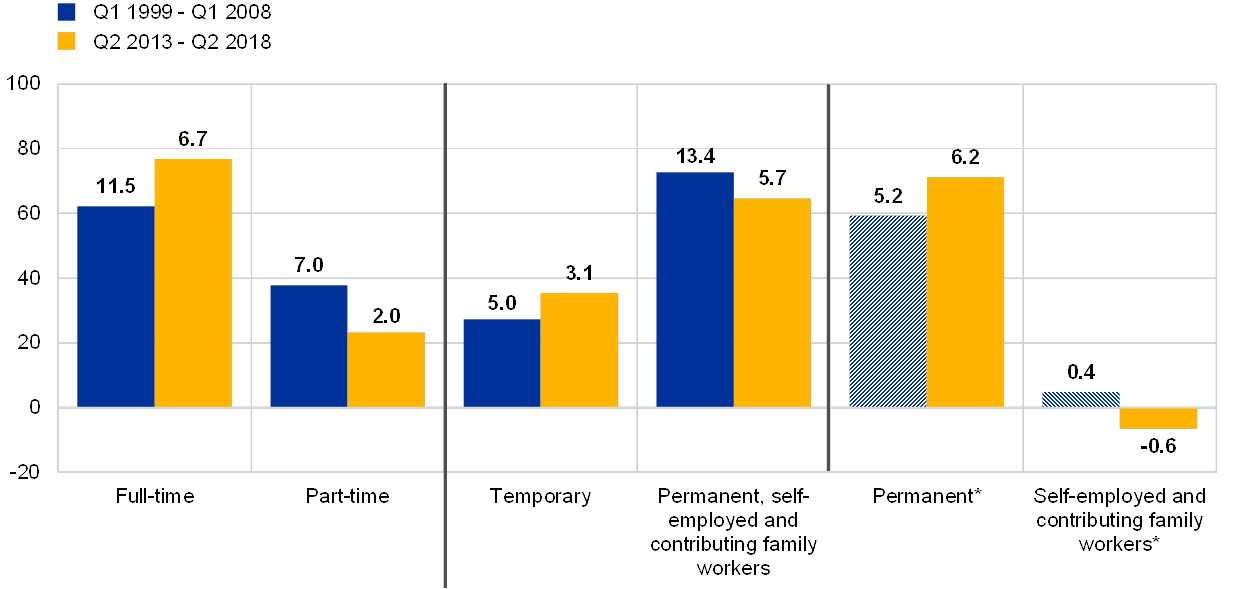

Euro area employment growth during the recent recovery has been driven by full-time and mostly permanent contracts, with nearly 80% of all growth stemming from an increase in full-time employment. That being said, full-time employment remains below its pre-crisis level after falling sharply during the crisis. Part‑time employment rose throughout the crisis, and has continued to do so during the recovery, but its contribution to employment growth has recently declined while its share in total employment has flattened. This can be explained by a decline in the number of underemployed part-time workers (i.e. people who would like to work more hours), while the contribution made to employment growth by non‑underemployed workers (i.e. people who are satisfied with their part-time hours) has been similar to that observed before the crisis.[6] At the same time, while employment growth is still concentrated in permanent positions, temporary employment now accounts for a larger percentage of employment growth, while self‑employment is falling (see Chart D).

Chart D

Breakdown of cumulative employment growth on the basis of contract characteristics in the pre-crisis period and during the recovery

(y-axis: shares of cumulative employment growth in percentages; data labels: cumulative employment growth in millions)

Sources: Eurostat, LFS and ECB calculations.

Note: Data have been corrected for level shifts by ECB staff.

* Separate data for permanent contracts and self-employment and contributing family workers have only been available since 2005.

- The figures reported here are based on data from the national accounts. These allow developments in euro area employment to be broken down by country and sector. Data from the EU Labour Force Survey (LFS) are used for a detailed breakdown of employment on the basis of personal characteristics and types of contract. While the dynamics of these two sets of statistics are similar, the resulting levels of employment and cumulative growth rates are somewhat different for methodological reasons. In the case of LFS data, for example, figures are based on a national concept, some sections of the population are not covered and employment data relate to the 15‑64 or 15‑74 age groups. In contrast, the national accounts data are based on a domestic concept, they contain an estimate of employment in the hidden economy and employment data cover people of all ages. Please see here for a detailed explanation. According to LFS data, the number of people in employment increased by 8.9 million between the first quarter of 2013 (its lowest point according to that dataset) and the second quarter of 2018 (the last available data point for those statistics).

- See “The outlook for the euro area economy”, speech by Mario Draghi, President of the ECB, at the Frankfurt European Banking Congress, Frankfurt am Main, 16 November 2018.

- See the box entitled “Recent developments in euro area labour supply”, Economic Bulletin, Issue 6, ECB, 2017.

- The participation rate of this age group has followed an increasing trend over time, standing at 22.4% in the first quarter of 1999, 33.6% in the second quarter of 2013 and 39% in the second quarter of 2018. See also the article entitled “Labour supply and employment growth”, Economic Bulletin, Issue 1, ECB, 2018.

- A simple shift-share analysis shows that this participation rate would still have increased considerably even if the composition in terms of educational level had remained unchanged.

- See the box entitled “Recent developments in part-time employment”, Economic Bulletin, Issue 2, ECB, 2018.