T2S in 2014

TARGET2-Securities (T2S) is a project implemented by the Eurosystem with the aim of creating a single platform for securities settlement in Europe. It will enter into operation in June 2015 and will help overcome the complexity and fragmentation of the current European market infrastructure.

2014 was an intense year of testing and preparations for the T2S Community, i.e. central banks, central securities depositories (CSDs), and those of their participants that will connect to T2S. The first technical connection between the ECB and the T2S application was successfully established in January 2014. Between April 2014 and September 2014 the Eurosystem tested the T2S application to ensure that it is in line with the T2S scope-defining set of documents. Given the absence of critical defects the Eurosystem confirmed that the T2S application was sufficiently stable for CSDs and central banks to start their testing. This paved the way for a key project milestone to be reached on 1 October 2014, when user testing began.

To ensure that the CSDs and central banks are ready for a smooth migration to the T2S platform, the ECB supports and monitors their readiness. Additionally, a number of training activities as well as information and technical sessions were organised throughout 2014. The first migration rehearsal with participants set to be in the first T2S migration wave was completed successfully in November 2014.

The T2S Community continued to pursue its commitment to fostering post-trade harmonisation in order to ensure that the T2S markets will operate in an efficient and safe manner after the migration to the platform. The good progress made in the implementation of the post-trade harmonisation agenda was reflected in the Fourth Harmonisation Progress Report published in March 2014. The work on T2S harmonisation was reinforced by the adoption of the CSD Regulation (CSDR) in 2014.

At the end of the year, the T2S project was awarded the Most Innovative Project of the Year by the magazine Custody Risk.

Governance

New T2S Board Chair

At the end of 2014 Mr Jean-Michel Godeffroy, one of the most dedicated T2S advocates, retired. He was succeeded by Marc Bayle as Chairman of the T2S Board and the T2S Advisory Group.

Read Mr Godeffroy’s last editorial in his capacity as Chairman of the T2S Board in the newsletter T2S OnLine.

Due to internal reorganisation, new chairpersons were also appointed in various groups of the T2S governance structure. For more information, please consult the T2S governance webpages.

Directly Connected Parties Group

Directly connected parties (DCPs) are the clients of CSDs and central banks that have a direct connection to T2S.

In order to track and monitor issues of general concern for DCPs, a new technical group was set up in 2014 within the T2S governance structure. It is called the Directly Connected Parties Group (DCPG). The group is composed of representatives of DCPs, CSDs, and central banks. It reports to the steering bodies (T2S Board, CSD Steering Group) and continues the work of the informal gathering of DCPs in the DCP Forum. Its inaugural meeting was held on 17 June 2014 on the periphery of the Advisory Group meeting.

A high number of parties have shown interest in connecting to T2S as a DCP. In 2014, a number of institutions declared their intention to connect to the T2S platform in application-to-application (A2A) mode for wave 1 and wave 2, and in user-to-application (U2A) mode for wave 1. This number will increase before the end of migration.

Platform development

The software for the T2S platform was delivered by the 4CB (Banque de France, Banca d’Italia, Banco de España and Deutsche Bundesbank) to the ECB for testing on 31 March 2014. Subsequently, the Eurosystem and selected CSDs and central banks tested the platform.

Eurosystem Acceptance Testing

The first connection between the ECB and T2S was successfully established in January 2014. This paved the way for the Eurosystem Acceptance Testing to be carried out between March and September 2014. The purpose of this testing phase was to ensure that the T2S platform is of the required quality and compliant with the scope-defining documents.

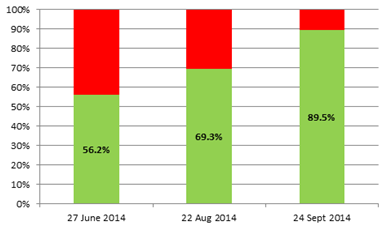

By the end of September 2014, the rate of positive test results, i.e. results showing no defects, was close to 90%, compared with 56.2% at the end of June 2014 – see Chart 1: Eurosystem Acceptance Testing defect test pass rate. Based on this the Eurosystem considered that the T2S platform was sufficiently stable for CSDs and central banks to start their testing activities on 1 October. A plan for correcting the remaining defects was put in place and shared with the CSDs and central banks.

Chart 1: Eurosystem Acceptance Testing defect test pass rate

Change requests

Change requests stemming from different sources (e.g. requests for changes from stakeholders, documentation alignment following testing activities or identified editorial errors) are regularly considered and discussed within the T2S Community. Change requests are first discussed within the governance structure by the Change Review Group, the Advisory Group and the CSD Steering Group, and finally approved by the T2S Board. In 2014 a total of 37 change requests were approved (see Table 1).

| Approved change requests (CRs) in 2013 | ||||

|---|---|---|---|---|

| Type | Description | Number of CRs | Project phase costs | Average annual maintenance and running costs |

| Market requests | Changes requested by the market and considered mandatory for the start of T2S | 6 | €662,277.56 | €68,301.02 |

| Migration activities | Changes raised in the context of the migration framework | 7 | €407,227.95 | €12,237.62 |

| 4CB testing | Changes stemming from the 4CB testing activities | 15 | €149,127.27 | €14,540.31 |

| Editorial nature | Changes of a mostly editorial nature to the T2S documentation | 6 | ||

| Scope decrease | Changes to remove obsolete and/or unnecessary functionalities from T2S | 3 | ||

| Total | 37 | €1,218,632.78 | €82,841.33 | |

Several technical publications on T2S and how to use the platform were updated in 2014.

A full list of the T2S technical/functional documents is available here.

T2S Community in final preparation phase

With the announcement that the T2S platform was considered sufficiently stable to start user testing, the T2S Community, in particular wave 1 participants, entered the final phase of preparations. The aim is to adapt their systems for connection to the platform. The Eurosystem continues to support the community in their preparations in order to ensure a smooth migration.

Client readiness

In order to ensure the readiness of CSDs and central banks and their smooth migration to T2S, the ECB performs a number of tasks and activities.

Each CSD and each central bank has been assigned an ECB relationship manager, who supports them in their preparations for T2S. In this context, Client Readiness self-assessment templates are sent each quarter to the contracting CSDs and central banks for their completion. The clients’ own assessment is based on the relevant Synchronisation Points that need to be achieved, and which form the key structure of the T2S Programme Plan. The current Synchronisation Points are migration-wave dependent, i.e. the dates of the Synchronisation Points vary according to wave number but their content does not. The results are published in Client Readiness Dashboards. Overall, the readiness of the CSDs and central banks shows good progress as all T2S clients have reached the relevant milestones so far. See the Client Readiness detailed dashboard for 2014 Q4.

The preparation of the T2S user training programme started mid-2012. The first T2S user training course was run at the end of 2013 and continued to be offered throughout 2014. The course was run for all CSDs and central banks participating in T2S, and was based on the train-the-trainer approach. It was structured into a Basic User Training module (providing a comprehensive overview of T2S), and three subsequent Advanced User Training modules on functional, technical and operational aspects. The user training course was delivered in (a) 20 classroom sessions with in total 456 participants from the CSDs and central banks, and (b) 12 webinar sessions, with a considerable number of both CSDs and central banks participating.

Another means to support the T2S Community in their preparations for using the platform is a knowledge base which was introduced to the T2S website in 2014. It contains presentations which provide insight into key technical and functional topics, grouped into four thematic sections: Access to T2S, General, Liquidity management and collateral management, and Settlement. The knowledge base will be periodically enhanced with new topics relating to T2S.

The ECB also organises T2S Info Sessions in order to inform the T2S Community and other interested stakeholders about T2S and prepare them for its launch. In 2014 three Info Sessions were hosted by key T2S stakeholders around Europe.

The Info Sessions offer an update on the project status and present insight sessions on specific topics. In 2014 the insight sessions discussed the UK market in the context of T2S, optimising the use of collateral with T2S, the impact of the CSD Regulation on post-trade activities, and how T2S will impact the securities chain from issuer to investor. The Info Sessions are open to any interested market participants.

User testing

Eurosystem Acceptance Testing (EAT) ran between April and September 2014, with the objective of ensuring that the platform is of the required quality and compliant with the scope-defining documents. In parallel, on 1 July 2014, three CSDs of the first migration wave, namely Bank of Greece Securities Settlement System (BOGS), Monte Titoli and SIX SIS, as well as six national central banks (Banque de France, Bank of Greece, Banca d’Italia, Nationale Bank van België/Banque Nationale de Belgique, Deutsche Bundesbank and Banco de España) started pilot testing the platform.

The successful outcomes of EAT and the pilot testing paved the way for user testing, which was initiated on 1 October 2014. The CSDs and central banks began testing how well their internal systems interact with the T2S platform, the so-called bilateral interoperability testing.

The objective of the user testing phase as a whole is to ensure that the T2S platform fully meets the user requirements. In addition, the successful completion of user testing will enable CSDs, central banks, DCPs and directly connected holders of T2S dedicated cash accounts (DCA) to migrate to and operate in T2S.

User testing involves four different phases of testing activity. The remaining three phases for the participants of migration wave 1 will start in 2015:

- Multilateral interoperability testing: each CSD and central bank tests settlement processes with the other participating CSDs and central banks within its migration wave or earlier migration waves.

- Community testing: each CSD and central bank extends its testing activities with other CSDs and central banks to include its users.

- Business day testing: a simulation of several consecutive business days of operation including all CSDs and central banks of a migration wave, as well as their users.

Migration preparations

The migration to T2S will take place in four migration waves between 22 June 2015 and 6 February 2017. The distribution of the 24 CSDs’ migration to T2S is listed below in Table 2.

| First wave 22 June 2015 |

Second wave 28 March 2016 |

Third wave 12 September 2016 |

Fourth wave 6 February 2017 |

|---|---|---|---|

| Bank of Greece Securities Settlement System (BOGS) |

Euroclear Belgium |

Clearstream Banking (Germany) |

Bank of New York Mellon CSD SA/NV (Belgium) |

| Depozitarul Central (Romania) |

Euroclear France |

KELER (Hungary) |

Centrálny depozitár cenných papierov SR (CDCP) (Slovakia) |

| Malta Stock Exchange |

Euroclear Nederland |

LuxCSD (Luxembourg) |

Eesti Väärtpaberikeskus (Estonia) |

| Monte Titoli (Italy) |

Interbolsa (Portugal) |

Oesterreichische Kontrollbank (Austria) |

Eesti Väärtpaberikeskus (Estonia) |

| SIX SIS (Switzerland) |

National Bank of Belgium Securities Settlement Systems (NBB-SSS) |

VP Lux (Luxembourg) |

Iberclear (Spain) |

| VP Securities (Denmark) |

KDD - Centralna klirinško depotna družba (Slovenia) |

||

| Latvijas Centrālais depozitārijs (Latvia) |

|||

| Lietuvos centrinis vertybinių popierių depozitoriumas (Lithuania) |

The involved CSDs and central banks together with the ECB and the T2S operator (the 4CB) are close to finalising the detailed plans for the migration of wave 1. Only minor updates are expected to arise out of the ongoing testing activities. For the other waves preparations are also progressing according to plan, in view of their scheduled start of migration testing activities.

On 25 June 2014, the ECB hosted a technical session on the status of the preparations for T2S user testing and migration. Representatives from the network service providers, the central banks and the CSDs shared preparation experiences and gave an update on their status. Watch the full recording of the session.

In order to ensure successful migration to T2S, several rehearsals of the pre-migration phase and the migration weekend itself are taking place for wave 1 between November 2014 and April 2015. All tests executed in 2014 met the expectations and showed that preparations for migration had been good on all sides.

Certification of DCPs and dedicated cash account holders

Directly connected parties (DCPs), including DCPs on the securities side and those on the cash side, i.e. directly connected dedicated cash account (DCA) holders, will have to pass a number of tests in order to be certified by the Eurosystem. These tests have been approved by the T2S Board. Each DCP and directly connected DCA holder has been requested to identify and inform their CSD or central bank of the tests that it intends to take depending on the connectivity mode, communication mode and functionalities it will use in T2S. The list of certification tests was published on 10 February 2014. The CSDs and central banks help the relevant institutions in planning for, and assessing the effort involved in, taking such tests. Each DCP will start certification testing when the migration wave it will go live with begins community testing.

T2S Manual of Operational Procedures

The Manual of Operational Procedures (MOP) is a reference guide providing T2S stakeholders with a framework for smoothly conducting their daily operations in both normal and abnormal situations and includes procedures for decision making during a crisis. Awareness of and adherence to the procedures set out in the MOP is of key importance for the smooth functioning of T2S. In late November 2014, the MOP was approved by the Operations Managers Group (OMG) and subsequently by the T2S Steering Level.

For more information see also the insight article in our newsletter T2S OnLine: “T2S – preparing for operations”.

Harmonisation

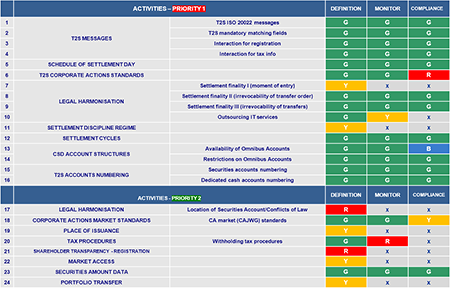

Contributing to post-trade harmonisation is a critical objective of T2S in view of the further integration of financial markets in Europe. In 2014 the T2S Advisory Group (AG) continued working towards the creation of a single rulebook for post-trade activities (messaging protocols, legal rules, operating hours, corporate actions, etc.) across the 21 T2S markets covering the 24 CSDs which will connect to T2S. Table 3 shows the progress made in relation to the identified T2S harmonisation activities. It shows, for each of the 24 T2S harmonisation activities, the progress made towards achieving the following three objectives: the definition of a T2S standard, the launch of a monitoring process for assessing the level of compliance of T2S markets, and the actual compliance level observed at this stage.

Table 3: Status of the T2S harmonisation activities (as at July 2014)

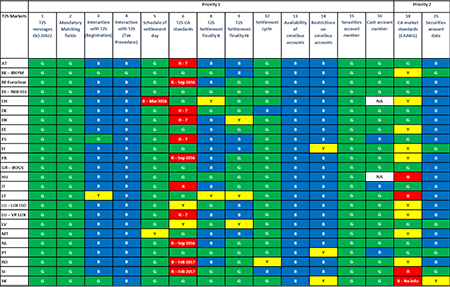

The AG published its Fourth T2S Harmonisation Progress Report on 19 March 2014. The report includes the monitoring results regarding the T2S markets’ compliance with the agreed T2S standards. The current status of implementation for each of the T2S markets is presented using a “traffic light” approach (see Table 4). The fourth report shows the overall good progress towards harmonisation, with remarkable progress in some T2S markets. This is reflected in the decrease in red, i.e. non-compliance, statuses. The AG published a mid-year update of the report in July 2014.

Table 4: Compliance status of the T2S markets (as at July 2014)

An important driver of post-trade harmonisation has been the CSD Regulation , which was published in the Official Journal of the EU on 28 August 2014 and entered into force on 17 September 2014. This new piece of EU legislation complements the operational integration provided by T2S and gives further momentum to the post-trade harmonisation efforts of the T2S Community. In May the AG provided feedback on the discussion paper on the CSD Regulation that was released by the European Securities and Markets Authority (ESMA) in March 2014. More specifically, the AG provided ESMA with input on the procedures pertaining to the detailed regulatory technical standards as well as on the timing of implementation of an EU settlement discipline regime. Following the adoption of the CSD Regulation, ESMA published in December 2014 a consultation paper on the final wording of the regulatory technical standards. The AG provided a response to ESMA in early 2015.

Finally, in May 2014, the Harmonisation Steering Group provided the EU public authorities with some proposals for best practices pertaining to the migration of T2S markets to the new EU settlement cycle rule (i.e. T+2). The migration to the new settlement cycle went smoothly in T2S markets on 6 October 2014.

Financial matters

T2S will operate on a full cost recovery basis. Thus, for financial equilibrium T2S requires that the costs incurred are covered by the revenues generated. The latter are driven by the volume that will be settled on the single settlement platform as of start of operations.

In 2014 T2S costs only increased to reflect the changes requested and agreed by the T2S Community (see Table 1: Approved change requests (CRs) in 2014, in section 3 on Platform development The cost changes registered in the course of 2014 were reviewed by the Governing Council of the ECB with the objective of keeping cost increases to an absolute minimum, and were approved in March 2015. The evaluation took into account the 2014 decision to implement changes to the T2S User Requirements deemed by the market as indispensable for the smooth functioning of T2S.

At the beginning of 2015, when reviewing the financial situation of T2S for 2014, the Eurosystem estimated that the total investment in T2S until it starts live operations would amount to €401.8 million. By the end of 2014, the Eurosystem had paid €362.6 million of this amount to the entities conducting the work in the development phase, i.e. the 4CB and the ECB (the payment to the ECB for costs incurred in 2014 is included in this figure though it was made in early 2015). In that context, it was estimated that:

- operating and maintaining T2S would cost €64.6 million per annum;

- capital costs for the financing of T2S stood at €26.1 million according to the updated rates as per end-2014; and

- the provision for unforeseeable T2S costs incurred during operations to be included in the T2S pricing envelope remained at €45.0 million.

| Development cost (total) | 401.8 |

| 4CB | 299.3 |

| ECB | 100.2 |

| Others | 2.3 |

| Running cost (per annum) | 64.6 |

| 4CB | 51.9 |

| ECB | 10.5 |

| Others | 2.2 |

| Capital cost (total) | 26.1 |

| Contingency reserve (total) | 45.0 |

Figures might not add up because of rounding.

The total of T2S fees depends on three parameters:

- the volume of securities settlement transactions that will be settled in T2S as of the start of its operations;

- the length of the cost recovery period; and

- the T2S fees that will be charged according to the fee structure announced in 2010.

In 2014, the Eurosystem continued its regular settlement volume analysis, in order to allow for realistic T2S volume projections and thus also projections of future T2S revenue streams. The analysis is conducted on the basis of the information provided by European CSDs in line with what has been agreed in the Framework Agreement. Based on the volumes reported by CSDs, projected volumes are calculated for the length of the cost recovery period using the growth rates anticipated by the T2S Advisory Group in 2010.

According to the latest data reported by CSDs to the Eurosystem, the traffic among the CSDs that have signed the T2S Framework Agreement grew by 9.1% in 2014 compared with 2013. This growth is higher than the expected 4.7% and contributes to slightly reducing the gap vis-à-vis the initial volume projections from -20.1% in 2013 to -16.8% in 2014. However, the gap for total EU volumes, including non-signatory CSDs, remained around -20%.

Chart: Projected versus actual volumes of transactions by T2S CSDs, per year since 2010

The pricing policy stipulated in the Framework Agreement foresees the possibility of increasing the T2S prices under two conditions, namely (i) if the additional volume deriving from the contribution of non-euro currencies is less than 20% of the euro settlement volume, or (ii) if market volumes are more than 10% below the initial projections. In March 2012, the T2S Programme Board clarified the T2S pricing policy, emphasising that it did not intend to propose any revision of the benchmark price of 15 euro cent per delivery-versus-payment (DVP) settlement instruction until at the earliest one year after the last migration wave (i.e. not before 2018). This is to allow for the build-up of a stable volume basis in T2S before assessing the two above-mentioned conditions of the T2S pricing policy. In 2014 the T2S team continued to monitor the market trends, and the position of the T2S Board did not change. The T2S Board also continued exploring further the markets inside and outside Europe to attract additional sources of revenue to T2S.

Public outreach

Sibos 2014

The annual Sibos conference took place in Boston between 29 September and 2 October 2014. The Eurosystem was present with a stand and organised two sessions on topics related to market infrastructure. One of the most discussed issues during Sibos was T2S. There was a general agreement that T2S is a key enabler of harmonisation and of improved collateral management.

The Eurosystem’s panel discussion “Ready, steady, go! How CSDs are preparing for T2S” attracted a lot of attention. The session coincided with the start of user testing and CSDs used this opportunity to stress their readiness for T2S.

On 1 October, Marc Bayle and Jean-Michel Godeffroy teamed up to offer a unique insight into the main initiatives and projects of the Eurosystem in the field of financial market infrastructure, securities and payments during a session entitled “Making integration possible – the ECB and Eurosystem perspective on the evolution of market infrastructures”. Watch the full recording of the session.

T2S Special Series

Two issues of the T2S Special Series were published in 2014.

Corporate actions in T2S, January 2014 download

The paper outlines how corporate actions (CAs) will be managed in the context of T2S. It describes the general set-up of CA processing in T2S and the T2S CA standards, which specify how the European market standards for processing corporate actions on flows (transaction management) will be implemented in T2S. It emphasises the need for harmonisation, not only among the CSDs but also among all the relevant actors involved in corporate action processing, in order to achieve safe and efficient transaction management across all T2S markets.

T2S: from issuer to investor, September 2014 download

In this paper representatives of issuers, investors, banks, CSDs, and a central counterparty share their views on how T2S will change the securities chain from issuer to investor and the interactions along the chain. For the first time, this Special Series issue sheds a more detailed light on the expected changes along the securities chain by giving the floor to those most affected.

The significant interest generated by the publication “T2S: from issuer to investor” was catered to in a follow-up panel discussion at the T2S Info Session on 5 December 2014 in Frankfurt.

T2S OnLine

Three issues of the newsletter T2S OnLine were published in 2014:

T2S OnLine No 18 (April 2014) download

This issue focused on how the T2S governance structure has shown its effectiveness in resolving difficult matters in a swift and efficient manner. It also provided more information on the Eurosystem Acceptance Testing (EAT) and a comprehensive assessment of the Fourth T2S Harmonisation Progress Report.

T2S OnLine No 19 (July 2014) download

This issue explained the motivation behind the recent organisational changes within the European Central Bank in the area of market infrastructure and payments. Paul Bodart, member of the T2S Board, was interviewed about Europe’s new settlement cycle T+2, and representatives of CSDs and national central banks provided insight into their preparations and expectations as pilot testers.

T2S OnLine No 20 (December 2014) download

The last issue for 2014 contained the farewell editorial of Jean-Michel Godeffroy, former Chairman of the T2S Board, an interview with Olivier Guersent, Deputy Director General of the European Commission’s DG Financial Stability, Financial Services and Capital Markets Union, and a report on the preparations for T2S operations.

Video “Making integration possible”

In September 2014, at Sibos, the Directorate General Market Infrastructure and Payments presented its new video entitled "Making Integration Possible", which explains how the European market infrastructure for payment and securities settlement makes the daily lives of Europeans easier.

Social media outreach

In 2014 T2S also focused on reaching out to a larger public via the social network Twitter. @T2SECB regularly informs its 500 followers on the latest project developments and promotes T2S-related events.

Most Innovative Project of the Year

On 11 November 2014 Jean-Michel Godeffroy, the then Chairman of the T2S Board, received on behalf of the Eurosystem the European Award for the Most Innovative Project of the Year, granted by the magazine Custody Risk. T2S was given the award in recognition of the contribution it will make in the future, as a European financial market infrastructure, to “reducing cost and complication”. The T2S team thanks everyone who has contributed to making this innovative vision a reality – in particular the 24 participating CSDs and the 21 national central banks in T2S, as well as the T2S Board for managing the delivery of T2S, and the 4CB, which has developed and will operate the platform. Their hard work and excellent cooperation has ensured that T2S will graduate from project to working infrastructure on 22 June 2015.

T2S general objectives and targets

To reduce risk in the post-trade environment in Europe

- by delivering real-time gross settlement exclusively in central bank money, ensuring the safest possible settlement of securities in Europe and significantly reducing the risks still affecting cross-border settlement today.

- by employing the so-called "integrated model", in which securities and cash accounts are held on a single platform, overcoming the delays in processing transactions and the risks of error which still exist in securities settlement systems based on the "interfaced model".

- by incorporating several features that aim to help banks optimise their liquidity and collateral management, the importance of which has never been as pronounced as it is today. T2S endeavours to give banks the possibility to have a single (and thus reduced) buffer based on their total European business by abolishing the need for market participants to hold multiple buffers of collateral and liquidity when settling in several European markets. Furthermore, the highly efficient auto-collateralisation mechanisms T2S plans to extend to all T2S markets should significantly reduce the need for pre-funding of cash accounts during both daytime and, in particular, night-time settlement.

- by promoting greater diversification and sharing of risk, which will help make the whole system more stable. Through dramatically increasing the ease of cross-border transactions, T2S allows investors to hold a more geographically diversified portfolio of securities. T2S should provide investors with the possibility of higher risk-adjusted returns, and benefit issuers through a more diversified and stable investor base as well as a lower cost of capital. In general, T2S will help to increase financial stability in Europe, dampening the impact of asymmetric shocks by spreading economic gains and losses more widely.

To streamline the settlement process in Europe

- by providing a single pan-European platform for securities settlement, following a "lean" T2S concept. Combining this with the drive for deeper harmonisation of financial markets, T2S seeks to enable banks to streamline and potentially consolidate their back offices, facilitating considerable cost savings. T2S aims to be a major step forward towards a fully straight-through processing world.

- by making cross-border settlement as efficient as domestic settlement, while avoiding the cementation of national specificities into the system’s operational blueprint. T2S will force harmonisation in many crucial areas, such as the adoption of a common interface and common message formats, a common set of rules for intraday settlement finality and a harmonised daily timetable and calendar. Through this process, T2S aims to help remove Giovannini barriers 1, 2, 3, 4, 5 and 7.

To enhance freedom of choice in the securities settlement industry in Europe

- by increasing transparency, openness and competition between CSDs, penetrating the largely monopolistic national environment that they currently operate in. With 40 CSDs active in Europe today, the range of different national regulations and market practices have created a very opaque settlement industry that investors are not able to navigate without difficulty. Although the publication of settlement tariffs was made compulsory in the European Code of Conduct for CSDs, T2S endeavours to increase comparability with a fully transparent and uniform price list.

- by separating the "infrastructure" from the "service", giving customers in T2S more freedom of choice as regards where they want to trade and settle. Following the delivery of the system, CSDs will need to compete to be their customers’ preferred gateway to T2S, and in doing so must become open about what they are able to offer. T2S aims to ensure that customers will no longer be prevented from crossing national borders owing to technical and market practice restrictions, progressively transforming the securities settlement landscape in Europe.

To reduce the cost of settling securities transactions in Europe

- by reducing the current cross-border settlement fees thanks to the economies of scale deriving from the concentration of settlement on a single platform. Cross-border settlement across European countries today is up to ten times more expensive than domestic settlement owing to the fragmentation of the process over several platforms and the need for the contribution of a long chain of intermediaries.

- by assisting CSDs in their adaptation plans, in order to help them to also reduce domestic settlement fees.

- by dramatically changing the competitive environment for European CSDs in combination with CSD legislation, and in doing so providing a higher degree of freedom for all participants. T2S aims to ensure that CSDs respond to this changing settlement landscape with a business model set to lead to cheaper securities settlement, whether through efficient reshaping, specialisation, consolidation or simply strategic pricing.

- by expanding the system beyond the euro area. Through encouraging non-euro area CSDs and central banks to join the T2S Community, T2S plans to deliver a further reduction of prices in the future, exploiting fully the huge economies of scale present in such a system.

* The Giovannini barriers are a set of 15 specific barriers that prevent efficient EU cross-border clearing and settlement, identified by the Giovannini Group in a report in 2001. The barriers referred to that T2S seeks to help remove are the following:

- National differences in information technology and interfaces.

- National clearing and settlement restrictions that require the use of multiple systems.

- Differences in national rules relating to corporate actions, beneficial ownership and custody.

- Absence of intraday settlement finality.

- Practical impediments to remote access to national clearing and settlement systems.

- National differences in operating hours/settlement deadlines.