T2S in 2012

2012 was a year of great achievements for the T2S project, and very important milestones were reached. The members of the T2S Community reinforced their commitment to the project by signing the T2S legal agreements and continued to work hand in hand with the Eurosystem to progress towards making T2S a reality. T2S in 2012 summarises in a single document the main activities and achievements of the year.

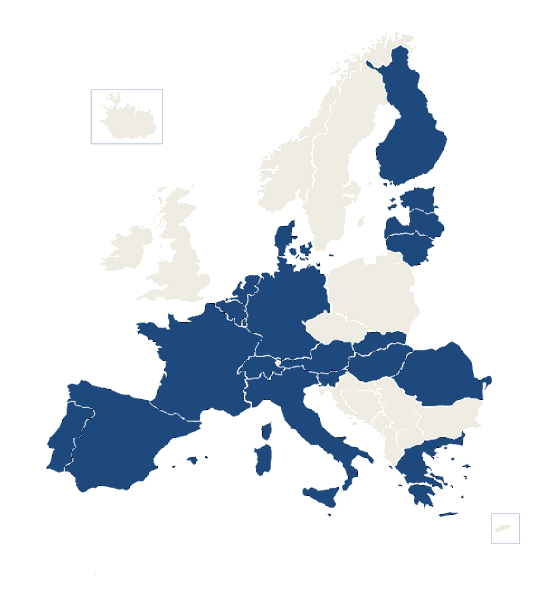

The project entered a completely new phase in 2012. In May and June 22 European central securities depositories (CSDs) signed the Framework Agreement, and Danmarks Nationalbank signed the Currency Participation Agreement. The CSDs that have signed up to T2S account for almost 100% of current euro settlement volumes. The setting up of legal relationships with T2S clients marked the end of a two-year negotiation phase and was accompanied by the establishment of a new – more solid – governance structure, under the aegis of the new T2S Board, appointed on 19 July. The signing of the T2S contracts also made the T2S Community a more tangible entity, including all those who are working together to deliver T2S and its benefits for Europe.

While the signing of the Framework Agreement was the most evident achievement of the year, substantial progress was made in all areas of the project. From a broader viewpoint, important developments also took place “around T2S”, i.e. more widely in the EU’s financial infrastructure environment. The most notable development in the field of securities settlement was the publication of the European Commission’s proposal for a CSD Regulation. This piece of legislation, like numerous other current initiatives at the EU level, aims to give renewed momentum to the goal of creating a truly single market for financial services in Europe. T2S plays a pivotal role in this respect, integrating securities settlement and triggering harmonisation in the post-trade area.

T2S, together with TARGET2, represents the main contribution currently made by the Eurosystem to the integration of the European market infrastructure. This is the reason why, despite the financial crisis, a long-term project like T2S with huge potential for changing European post-trading remains high on the European agenda. In 2012, the Governing Council of the European Central Bank (ECB) reiterated its commitment to delivering T2S by concluding the contractual agreement between the Eurosystem and the CSDs. Moreover, in May 2012 the ECOFIN Council confirmed its political support for T2S, which it referred to as “an important contributor for the establishment of the Single Market for securities services”.

The ultimate goal of the T2S project is to play a decisive part in making Europe a better place to invest. To achieve this goal, the project works towards a series of general objectives and targets, which represent how T2S aims to improve the European post-trade landscape by making it more secure and more efficient, i.e. more streamlined, more transparent, and cheaper. The objectives and benefits of T2S are presented in the annex to this report.

We will continue striving towards these objectives in the years to come, in cooperation with all members of the T2S Community and the other authorities involved in European financial integration.

T2S Community

The concept of the T2S Community was created to identify the numerous actors and market participants who are committed to the T2S project and who share the common aim of “making Europe a better place to invest”. The T2S Community’s vision of a more integrated European market for securities settlement will become a reality via the active pursuit of three main objectives:

- delivering T2S;

- fostering post-trade harmonisation both from a technical/operational standpoint and in terms of legal and regulatory agendas;

- significantly contributing to financial market integration, thus enhancing Europe’s competitiveness.

This approach is not new. Since 2006, the Eurosystem has involved and consulted CSDs and other market participants to ensure that T2S will fulfil the needs of the market. In his address at the event marking the first signatures to the T2S Framework Agreement on 8 May 2012, ECB President Mario Draghi called for closer and stronger cooperation between all actors who have a stake in T2S, saying: “From now on, the Eurosystem and the CSDs will be even more closely united in this mutual enterprise. The staff of our respective organisations will increasingly need to work together like a single team for the success of T2S”. Our aim is to make sure that the whole T2S Community can reap the benefits of T2S and achieve the objectives mentioned above. Of course, the T2S Community remains open and benefits could further increase in the future should other European markets and currencies decide to join at a later stage.

The T2S Community brings together the Eurosystem, the 22 CSDs which have already committed to the project (five of which are from outside the euro area), and Danmarks Nationalbank, which has decided to use T2S for securities settlement in Danish kroner as of 2018. Other key members of the T2S Community are the four central banks that are responsible for developing and operating T2S on behalf of the Eurosystem (i.e. Deutsche Bundesbank, Banque de France, Banco de España and Banca d’Italia, known as the 4CB), market participants in the T2S markets, public authorities at both the EU and the national level, regulators and overseers, and the two value-added network service providers that have been selected for T2S, i.e. SWIFT and a consortium composed of SIA and Colt. Counted together, the T2S governance bodies comprise as many as 192 T2S Community representatives who are working towards the completion of T2S.

Watch the video introducing the T2S Community.

CSDs participating in T2S

- Bank of Greece Securities Settlement System – BOGS (Greece)

- Centrálny depozitár cenných papierov (Slovakia)

- Clearstream Banking (Germany)

- Depozitarul Central (Romania)

- Eesti Väärtpaberikeskus (Estonia)

- Euroclear Belgium

- Euroclear Finland

- Euroclear France

- Euroclear Nederland (Netherlands)

- Iberclear – BME Group (Spain)

- Interbolsa – Sociedade Gestora de Sistemas de Liquidação e de Sistemas Centralizados de Valores Mobiliários (Portugal)

- KDD – Centralna Klirinško Depotna Družba (Slovenia)

- Központi Elszámolóház és Értéktár – KELER (Hungary)

- Lietuvos centrinis vertybinių popierių depozitoriumas (Lithuania)

- LuxCSD (Luxembourg)

- Malta Stock Exchange

- Monte Titoli (Italy)

- National Bank of Belgium Securities Settlement System – NBB-SSS (Belgium)

- Oesterreichische Kontrollbank (Austria)

- SIX SIS (Switzerland)

- VP LUX (Luxembourg)

- VP Securities (Denmark)

T2S is, and will remain, open to new participants: central banks and CSDs can still sign the Currency Participation Agreement or the Framework Agreement in the future, should they wish to. However, CSDs will now have to pay an entry fee and will not benefit from the financial incentive package offered by the ECB Governing Council to the CSDs that signed up for T2S early, as shown in the box below:

| Signature by April 2012 | Signature by June 2012 | Signature after June 2012 | |

|---|---|---|---|

| No fees for the first three months following the go-live date | X | - | - |

| A 1/3 reduction across the whole price list until the end of the last regular migration wave | X | - | - |

| Waiver of the entry fee | X | X | - |

T2S Governance

The new governance arrangements that entered into force in summer 2012 form the backbone of the agreement with CSDs and non-euro area central banks. With the signing of the Framework Agreement and of the Currency Participation Agreement, the Eurosystem’s contractual partners need to take a more active role in the decision-making process.

The current governance structure will remain in place after T2S goes live, ensuring continuity in the management of the platform. It provides each category of stakeholder with the necessary control to pursue their own commercial and policy objectives, and it also puts in place important means of mutual control in order to ensure the timely delivery of the platform, its safe and efficient operation, and a level playing field for all participants.

Final decisions on changes to T2S and other relevant matters follow a transparent and consensus-driven process, in which all stakeholder groups have a say. Should consensus between the different groups not be reached initially, a reconciliation process will start: the matter will be reassessed at the technical level and then reconsidered at the steering level, before the ultimate decision-making body for T2S, i.e. the Governing Council of the ECB, takes a decision. The decision-making process continues to be transparent, with all relevant decisions explained publicly.

The T2S steering level comprises bodies representing the Eurosystem and its contractual counterparts, i.e. the CSDs and the non-euro area central banks. The two steering bodies that were formed in July 2012 are the T2S Board and the CSD Steering Group. The Non-euro Currencies Steering Group (NECSG) will be formally established as soon as a second non-euro area central bank signs the Currency Participation Agreement (thereby joining Danmarks Nationalbank).

The T2S Board was established by the Governing Council of the ECB in Decision ECB/2012/6 of 29 March 2012 on the establishment of the TARGET2-Securities Board and repealing Decision ECB/2009/6. It began its work in July 2012, replacing the T2S Programme Board as the streamlined management body of the Eurosystem for the T2S project. The T2S Board is composed of 13 members: the Chairperson, the Deputy Chairperson, eight other members from Eurosystem central banks, one member from the non-Eurosystem central bank that signed the Currency Participation Agreement (Danmarks Nationalbank), and two members not originating from central banks. Once the project has been fully implemented, the T2S Board will ensure the smooth operation of T2S in accordance with the relevant technical and legal documents, and facilitate its continuous evolution in line with market needs.

The CSD Steering Group (CSG) was established as the “single voice” of the CSDs vis-à-vis the Eurosystem. The CSG discusses all matters of relevance for participating CSDs, is responsible for coordinating and articulating the views of these within the T2S governance framework, makes resolutions, and gives advice on behalf of the participating CSDs (with respect to a set of matters stipulated in the Framework Agreement). The CSG is composed of representatives from the managing board of each CSD or group of CSDs that has signed the Framework Agreement, as well as six user representatives with observer status and the T2S Board members with observer status.

At the working level, any governance body in the new structure can establish sub-structures to deal with specific issues falling under its mandate. The Framework Agreement already specifies three such sub-structures to support the steering level, called technical groups, comprising representatives from CSDs, national central banks (NCBs), the ECB, the 4CB and, for the last two of the three groups as listed below, user representatives. These groups were established in July 2012 following the signature of the Framework Agreement and the Currency Participation Agreement.

The Project Managers Group (PMG), which reports to the T2S Board, is in charge of ensuring that T2S will go live and that all participating CSDs and NCBs will be ready on time. The group is composed of project managers from participating CSDs, the 4CB, the ECB, and Eurosystem and non-Eurosystem central banks. The PMG has set up specific groups to deal with user testing and migration, which come under its mandate.

The Change Review Group (CRG) reports to the CSD Steering Group and is composed of product managers and functional experts. The group assesses and prepares change requests. The change management procedure is transparent and the related documentation is published on the T2S website.

The Operations Managers Group (OMG), which reports to the T2S Board, is primarily responsible for developing and maintaining the Manual of Operational Procedures, thus replacing the AG’s “Sub-group on the Operational Framework”. Once T2S is in operation, the OMG will coordinate the management of operational incidents and review the T2S service performance.

At the advisory level, the T2S Advisory Group (AG), with a total of 93 participants, continues to give a voice to all stakeholder categories. It provides advice to the Eurosystem on T2S-related issues, to ensure that T2S is developed and implemented according to market needs. Central banks, CSDs and the user community (e.g. banks and central counterparties) are all represented in the AG. In addition, the AG provides a forum for the continuous involvement, as observers, of the European Commission, the European Securities and Markets Authority and other representatives of the industry, such as banking associations. Among the many issues tackled by the AG in 2012, connectivity, the timing of migration waves and the harmonisation agenda were of high priority.

Four sub-groups assist and report to the AG. The main task of the Harmonisation Steering Group is to foster the T2S post-trade harmonisation agenda, as well as to identify where T2S markets are lagging behind in the implementation of commonly agreed harmonisation standards (for details see also the section on harmonisation and cross-CSD settlement). To this end, it issues T2S harmonisation progress reports, detailing the progress made in T2S markets. The group is composed of T2S Board members and senior AG members; it has 25 participants.

The primary role of the Sub-group on Message Standardisation is to advise on the development of T2S-related messages, supporting the ECB and 4CB T2S teams in translating user requirements into message standards. It is composed of 18 participants representing different stakeholder categories.

The Sub-group on Corporate Actions advises and reports to the AG and the Harmonisation Steering Group on the maintenance of T2S corporate actions standards and the monitoring of their implementation in the T2S markets. Its participants, of which there are currently 24, are selected by the AG.

Finally, the Task Force on adaptation to cross-CSD settlement, charged by the AG with proposing common solutions for adaptation to cross-CSD settlement in T2S, concluded its mandate in November 2012 with the delivery of its final report. The group was composed of 29 participants from all stakeholder categories and addressed important harmonisation issues. For more details, please see the section on harmonisation and cross-CSD settlement.

The National User Groups (NUGs) bring together providers and users of securities settlement services within national markets in order to support the development, implementation and operation of T2S. They create fora for involving national market participants in the AG’s work and establish a formal link between the AG and the national markets, including by contributing to T2S consultations of national markets. NUGs can suggest issues for AG consideration. They can contribute to the change and release management process thereby playing an important role in assessing change requests in the context of the operation of the national markets. The NUGs’ mandate is to actively promote harmonisation and to avoid advocating the replication of national specificities in T2S. A channel for communication between the T2S Programme Office and the individual NUGs is provided by the NUG Experts Network, which organises regular meetings attended by the secretaries of NUGs belonging to T2S markets.

Finally, the role of the ECB T2S Programme Office and the 4CB has remained crucial. The T2S team at the ECB is composed of about 70 experts and consultants. It relies on unique expertise, combining central banking and industry backgrounds. It supports the T2S Board and acts as a “hub”, ensuring that information flows in an appropriate and timely manner between the working level and the steering level, and also to the AG. The 4CB are the service providers and future operators of T2S. They prepare the specifications and develop and test the future settlement service, and they are responsible for infrastructure procurement and deployment as well as for preparing internally for the operation of T2S. Furthermore, they actively participate in the various areas of work and governance groups to ensure efficient dialogue among all stakeholders on vital issues such as training, user testing, migration and operational procedures.

Overall, following the approval in 2012 of the new T2S governance structure by the Governing Council of the ECB, 31 working groups actively met throughout the year to discuss all T2S-related matters. In total, 94 meetings were held, hosted by various T2S actors in different venues across Europe.

Progress made in 2012

Compliance with T2S programme plan

In 2012 the T2S project progressed well and remained on track.

The T2S Programme Plan sets out a total of 17 Synchronisation Points (SPs) leading up to the “go-live” of the T2S platform and the migration of all participating CSDs. SPs are defined as points in time at which the T2S Programme is to reach specific objectives. The purpose is to monitor at set time intervals whether the progress of all parties is in line with the Programme Plan. Two important SPs were scheduled for 2012.

After the delivery of the feasibility assessments by the CSDs and NCBs at the end of June, the T2S Programme Plan was re-assessed in order to be consistent with the timelines proposed by the T2S clients. As a result, the SP2 objective (“Feasibility confirmation by CSDs/NCBs”) was met in August according to plan.

SP3 (“T2S Programme Plan comprehensiveness”), marking “the mutual assessment and confirmation that the T2S Programme Plan is comprehensive, and adequately reflects any agreed additional specifications, deliverables and/or CSD/central bank planning elements (arising from their updated feasibility assessments)”, was initially scheduled for December 2012. As the finalisation of the migration plan and the assessment of the final change requests took longer than expected (see the section entitled “Support of clients’ preparations”), the CSD Steering Group and the T2S Board agreed to postpone SP3 until 30 April 2013. The postponement of SP3 has no impact on the subsequent SPs or on the T2S go-live date.

Further planning activities in 2012 concerned the preparation of the next phases of the project, in particular Eurosystem acceptance testing and user testing. The Eurosystem acceptance test preparation phase was planned in detail including all the deliverables necessary to start the execution phase in early 2014 and to run and monitor the test execution as smoothly as possible. Also, in light of the CSDs’ and NCBs’ feasibility assessments, the user testing preparation phase and the preparations for migration were mapped out in more detail and complemented with new deliverables (for more information please see the section entitled “Status of T2S development and testing”).

Turning to the main activities foreseen for 2013, important Programme Plan issues to be taken into account are the internal acceptance tests, to be conducted by the 4CB, and the conclusion of the Eurosystem acceptance test preparations. Another important milestone scheduled for 2013 is the completion of the Eurosystem’s acceptance of the two value-added network service providers (see the section on connectivity for more details). Finally, a number of planning activities will be taken forward in 2013 and will then continue into 2014, for example regarding T2S user training, user testing preparation, and migration preparation.

Legal matters

2012 was a fundamental year for the finalisation of the T2S legal framework. From this perspective, three main “legal pillars” were successfully built.

The first pillar was formed with the signing of the T2S Framework Agreement and the Currency Participation Agreement after over two years of negotiation. A first group of nine CSDs signed the Framework Agreement on 8 May 2012 during an event hosted by the ECB in Frankfurt. By 30 June 2012, the deadline for CSDs to indicate whether or not they would participate in T2S, a further 13 CSDs had signed the Framework Agreement (for the full list of signatories, please see the T2S Community section). The commitment to the Framework Agreement by 22 CSDs represents a major building block in the T2S legal framework, and in the T2S project as a whole, and constitutes the basis for the final T2S governance structure. The signature of the Framework Agreement was followed on 20 June 2012 by the signature of the Currency Participation Agreement between the Eurosystem and Danmarks Nationalbank. The central banks of Sweden, Norway and Iceland decided not to sign the agreement for the moment, but announced that they are considering doing so at a later stage.

The second pillar took shape with the entry into force of the new T2S governance structure by means of Decision ECB/2012/6 of 29 March, which established the T2S Board. This Decision also contains the mandate of the T2S Board, its Rules of Procedure, the Code of Conduct for its members and the procedure and requirements for the selection, appointment and replacement of its non-central bank members. Additionally, Guideline ECB/2012/13 of 18 July 2012 on TARGET2-Securities (recast) abrogated Guideline ECB/2010/2 and set out the final T2S governance framework, which entered into force on 1 July (for more information see the dedicated section of this report).

The setting up of the internal legal framework for the Dedicated Links constituted the third legal pillar established during 2012 (more information is provided in the Connectivity section).

Technical and functional documentation

The definition of the technical and functional framework for T2S proceeded in 2012 as scheduled. All documents produced were published on the T2S website in line with the T2S full transparency principle.

The documents below were published on 7 September.

- Version 5.02 of the T2S User Requirements Document, the document describing the features of T2S required by CSDs and market participants. The document embodies the users’ concept of T2S and provides the foundations for all further T2S technical documentation.

- Version 1.2.1 of the T2S User Detailed Functional Specifications, the user-oriented document that illustrates the features of T2S from a business perspective. This document provides details about application-to-application (A2A) dialogue between T2S actors and T2S and gives a detailed description of the set of messages processed by T2S.

- Version 1.8 of the Business Functionality Document for the T2S Graphical User Interface, providing a list of business functions available in the user-to-application (U2A) mode of interaction with T2S, i.e. via the Graphical User Interface, as well as a brief description covering the purpose and key features of these business functions. This document forms the basis for the design and implementation of screens for interaction with T2S. In addition, during the SIBOS convention that took place on 29 October and 1 November in Japan (for more information see the Communication section), the Graphical User Interface demo was presented to T2S stakeholders. The demo is available on the T2S website.

Additionally, version 1.0 of the T2S User Handbook, a user manual for the T2S Graphical User Interface focusing exclusively on the U2A dialogue with T2S, was published on 14 December for a market consultation that will end on 15 March 2013. A workshop took place in February 2013 to present the document to the market.

Two more documents were published before the end of the year. Version 1.1 of the T2S Business Process Description was released on 16 November. The document describes and illustrates the business processes involving CSDs, central banks and other technically directly connected parties that interact with T2S. Version 1.1 mainly reflects the updates resulting from the relevant change requests approved since the publication of version 1.0 in November 2011. Finally, version 1.0.1 of the Data Migration Tool Specifications and Related Procedures, which outlines the process by which CSDs can utilise the tool for the migration of data into the T2S database, was released to the Migration Sub-group on 19 December 2012.

During 2012, a total of 69 change requests were tackled by the Change Review Group (details). The 69 requests can be broken down as follows.

- 25 change requests were approved in the first quarter of 2012. Some of them followed requests from CSDs and NCBs, while others incorporated clarifications into the T2S documentation.

- One change request leading to changes in the testing requirements was also approved.

- Six change requests were approved leading to changes of a mostly editorial nature to the T2S documentation.

- 34 change requests were submitted by CSDs in June 2012 as a result of their feasibility assessments. By the end of December, two of them had been approved. The others were pending or had either been discarded or put on hold for possible implementation in later releases of T2S.

- Three change requests, still pending, relate to the migration tools.

In the coming two years (2013-2014), the technical and functional documentation of T2S will be reviewed and updated in line with that of those change requests mentioned above that will eventually be implemented.

Status of T2S development and testing

By the end of 2012, the 4CB had developed more than 95% of the T2S software related to the core functions of the single platform. Some additional requests and the correction of the bugs identified during the very first testing phases required the prolongation of the development efforts beyond 2012, together with the development of some non-core functions, like statistics and billing. The shifting of some development activities – largely due to the change requests raised by the market – created the risk that the 4CB might not have sufficient time to stabilise the application before delivering it to the ECB for acceptance. Therefore, the Eurosystem decided that, at this stage, only change requests which are indispensable for the proper functioning of the platform could be approved for the first release of T2S.

The T2S testing policy foresees that each of the central banks that make up the 4CB will test its single modules of the software in the Module Acceptance Test. In 2012, the 4CB started to integrate the respective modules into one platform for further testing during the Internal Acceptance Test. Next, the Eurosystem Acceptance Test will take place outside of the 4CB development and test environments. This test will be the pre-requisite for the start of user testing, i.e. the testing by CSDs and NCBs, and will be the basis for the acceptance of T2S by the T2S Board. Finally, the non-functional testing covering security, business continuity and performance will be carried out in the production environment, before the start of user testing.

In 2012, the testing of the T2S software by the 4CB progressed well. At the end of 2012, 60% of the test cases foreseen at module level had been performed. The Internal Acceptance Tests, which consist of end-to-end tests involving the different components of the T2S application, started in April 2012 and a number of tests had already been completed by the end of 2012. Nonetheless, the bulk of the Internal Acceptance Tests remains to be conducted in 2013, once the T2S application is fully developed.

As planned, in 2012 the T2S Programme Office started preparing the Eurosystem Acceptance Testing phase. The T2S team acquired test tools and operational support, and designed the test processes, thus ensuring the necessary level of resources and infrastructure to perform the test. In the first half of 2012, the team completed the preparation activities for enhancing the test organisation, and clarified some basic questions regarding connectivity to the T2S platform. Further activities in this field will follow in 2013.

Before starting the specification of the test cases, the T2S key documents such as the User Requirements Document and the User Detailed Functional Specifications were reviewed in order to assess their relevance for the test cases. By the end of 2012, specification and a review procedure had been completed for more than 85% of the Eurosystem Acceptance Test cases, and it is envisaged that in the first months of 2013 the test case specification will be finalised and the basic test data prepared (thus defining parties, Bank Identifier Codes (BICs), currencies and other pre-requisites for the execution of the test cases).

The team also started investigations into how a part of the Eurosystem Acceptance Test cases execution could be supported by automated or semi-automated procedures. Good progress was made in this area and in 2013 an automation solution will be developed and tested in parallel with the hands-on training of the Eurosystem Acceptance Testing team in T2S functionalities.

In addition, a Terms of Reference document was agreed with the participants of the first migration wave, who will be involved in the pilot testing. This document defines the modalities for sharing the Eurosystem Acceptance Test environment with pilot participants. In 2013, there will be additional coordination with pilot testing participants in order to prepare the Eurosystem Acceptance Test environment for such shared usage.

In 2012 the 4CB also started preparations for the non-functional tests that are scheduled to be carried out in 2014 on a stabilised version of the T2S application. Moreover, during 2012 the Eurosystem Acceptance Test team was involved in the non-functional test cases quality assurance by running review workshops with 4CB teams, as a contribution to the preparation of the non-functional test cases. The team is expected to complete this work in 2013.

At 4CB level, in addition to the significant progress achieved in the development and testing of the T2S application, major steps were also undertaken to set up the underlying T2S environments. After clarification of the number of test environments needed and after completion of the technical design, several procurement tenders were launched to build, step by step, the environments to serve the different test campaigns (Eurosystem Acceptance Testing, pilot testing, user testing, non-functional testing) and, finally, the production environment.

Furthermore, several subgroups (User Testing Subgroup, Migration Subgroup, Operations Managers Group) were introduced and the work to prepare user testing and migration and the operational procedures was significantly intensified in the course of 2012. Within this operational pillar – aside from the work carried out on the software application and on infrastructure – it was possible to finalise important deliverables such as the Data Migration Tool Requirements and Related Procedures (Version 1.0.1) and the User Testing Terms of Reference (Version 1.2).

All in all, the building of T2S has progressed well in 2012. However, a lot still needs to be done in 2013, before the different testing campaigns can start in 2014.

Connectivity

Following a tender procedure carried out by Banca d’Italia on behalf of the Eurosystem, in January 2012 the Eurosystem granted a licence to two value-added network operators (SWIFT and a consortium composed of SIA and Colt) for the delivery of value-added network (VAN) services to T2S actors. The T2S Connectivity Licences, the Licence Agreement and its attachments were published on 2 January 2012 on the T2S website. The T2S actors (central banks, CSDs and their customers) that intend to connect to T2S via a value-added connection will have to select one of these two providers and negotiate with them the relevant terms and conditions, within the constraints set out in the Licence Agreements.

The Proof of Concept phase, during which the two VAN providers had to demonstrate that their connectivity solution was able to fulfil the T2S technical requirements, was completed in August, which allowed confirmation of the solution proposed by the two network operators in line with the pre-agreed timetable. The roll-out of the VAN solutions in the different technical environments started in the last quarter of 2012 and will continue over 2013.

At the same time, the Eurosystem reached an internal agreement for the provision of the Dedicated Link service. The ECB Governing Council selected CoreNet, the Eurosystem’s existing communication network, for the provision of the physical communication layer of the Dedicated Link services. In March 2012 the Eurosystem launched a tender procedure to select the telecommunications operator that will provide the new generation of CoreNet services for the Eurosystem, taking into account T2S connectivity requirements. Furthermore, the ECB Governing Council decided that the value-added communication services and the logical communication layer, which are necessary for but not specific to the Dedicated Links, would be provided by the 4CB as an inherent part of the T2S platform. Version 1.0 of the Dedicated Links Connectivity Specifications was published on 29 June on the T2S website.

From a contractual perspective, the drafting of the Dedicated Link Directly Connected Actors agreement began in the last quarter of 2012 and is expected to be finalised in the first half of 2013, whereas the CoreNet tender is expected to be completed by the end of March 2013. Should market participants express interest in the Dedicated Link solution by the end of June 2013, its development will start immediately, for delivery in June 2014. Should no CSD express interest, the Eurosystem will withdraw the Dedicated Link offer from the User Requirements Document.

Support of clients’ preparations

As stipulated in the Framework Agreement and the Currency Participation Agreement, CSDs and national central banks participating in T2S were required to conduct detailed feasibility assessments and confirm by the end of June 2012 that they would be able to adapt their IT systems and processes to T2S in accordance with the T2S Programme Plan. The CSDs’ and NCBs’ feasibility assessments were based mainly on the User Detailed Functional Specifications version 1.2, as published on 31 October 2011, and on the changes to this version approved by the T2S Advisory Group in March 2012. During these feasibility assessments, the CSDs and NCBs sent more than 1,600 enquiries to the T2S Programme Office. Over 99% of these enquiries were either clarifications of general issues or indications of minor editorial or typographical improvements needed in the User Detailed Functional Specifications. As a result of the feasibility assessments, a total of 34 change requests were raised by CSDs and submitted at the end of June 2012. More details can be found in the Technical and Functional Documentation section above.

After the signing of the Framework Agreement, in the second half of the year the new governance body representing the CSDs, the CSD Steering Group, mainly debated how to organise the migration to the T2S platform and how to follow up on the change requests raised by CSDs. Meetings with individual CSDs also took place bilaterally to discuss issues relating to specific markets.

Migration emerged as a challenging topic. The Framework Agreement only defines the timing and the overall rules for composition of the migration waves. In addition, there needs to be a minimum of three months between any two migration waves and the entire migration should be completed within 18 months. The vast majority of CSDs determined in their feasibility assessments that they could not migrate sooner than June 2016, and this made the planning of migration waves extremely difficult given the operational preconditions defined in the Framework Agreement, which aim at reducing operational risk. At the end of 2012, three waves had been agreed upon, the first in June 2015, the second in July 2016 and the third in November 2016. The Eurosystem considered this situation sub-optimal since the time between the first and second wave was very long while the time between the second and third wave was fairly short. Furthermore, more than 80% of T2S settlement volumes would be migrating within the last months of the migration window. Therefore, the Eurosystem was still exploring with CSDs at the end of 2012 whether it would be feasible to improve this situation.

In 2012 the T2S Programme Office clarified with project managers from national central banks issues regarding their adaptation to T2S. One of the topics covered was how the auto-collateralisation functionality will work in T2S (please see the T2S Special Series issue on Auto-collateralisation and the video tutorial). Furthermore, bilateral meetings with NCBs were held to discuss issues specific to the national markets. Several meetings with Eurosystem NCBs were also held under the umbrella of the Payment and Settlement Systems Committee of the Eurosystem to discuss a variety of topics such as feasibility assessments, testing issues and the work related to the T2S operational framework.

Another very important topic discussed by the market and the Eurosystem towards the end of 2012 was the organisation of the Eurosystem’s review of CSD links in the T2S context. Given that only eligible links can be used for the mobilisation of collateral for monetary policy purposes and for auto-collateralisation, links between CSDs are regularly assessed against the Eurosystem user standards. The Eurosystem started discussions with the market on how to carry out the assessment efficiently and in time for the launch of T2S. More information is expected to be made available in early 2013.

The Public Training Framework, including market feedback, was finalised together with the 4CB, and published on 29 June 2012 on the T2S website. The framework sets out the key elements regarding T2S user training. A “train the trainer” approach will be used, and both classroom training and webinars (web-based seminars) will be offered. T2S user training consists of four distinct training modules, each one focusing on specific topics and aimed at identified target audiences. Towards the end of 2012, the T2S Programme Office, together with the 4CB, started to develop the detailed content of the individual training modules. The first User Training is planned to be delivered in October 2013, and will be primarily aimed at the CSDs and central banks set to take part in pilot testing.

Since January 2012, the T2S Programme Office has been discussing and negotiating with the CSDs and NCBs how to organise the T2S user testing phase. Version 1.0 of the User Testing Terms of Reference was approved by the T2S Board in September.

Harmonisation and cross-CSD settlement

Substantial progress was made in 2012 in the field of post-trade harmonisation. The T2S objectives in this area were increasingly recognised by the T2S Community and the T2S Board as being key to maximising the system’s benefits and realising its potential for market integration. Harmonisation is a key objective of the T2S project for three reasons: a) it provides the T2S Community with a single rule book for post-trade processes, b) it protects the “lean T2S” concept, i.e. the exclusion of national specificities from the T2S operational blueprint, and c) it contributes to financial integration in the EU.

The 2012 harmonisation work was steered by the T2S Advisory Group (AG) and supported by the Harmonisation Steering Group (HSG), a group composed of senior level representatives from the industry and the public sector, which is responsible for supporting the AG in formulating and monitoring the T2S harmonisation agenda. The HSG defined a set of top priorities and functional targets for harmonisation activities and indicated the specific actors responsible for the definition, monitoring and timely implementation of standards in the T2S markets. The objective is to deliver concrete results before the launch of T2S in 2015. A full list of the activities managed by the HSG in 2012 is provided in the box below.

Priority 1 activities*

Activities necessary to ensure the successful launch of T2S – the primary focus of the HSG and the T2S team.

- T2S ISO 20022 messages

- T2S matching fields

- Interaction with T2S (registration procedures)

- Interaction with T2S (tax info requirements)

- Interaction with T2S (CSD ancillary services)

- T2S schedule for the settlement day and calendar

- T2S corporate actions standards

- Settlement finality I (moment of entry)

- Settlement finality II (irrevocability of transfer order)

- Settlement finality III (irrevocability of securities transfer)

- Location of securities accounts/conflict of law

- IT outsourcing (settlement services)

- Settlement discipline regime

- Settlement cycles

- Availability of omnibus accounts

- Restrictions on omnibus accounts

- Registration procedures

- Cash account numbers

- Securities accounts numbers

Priority 2 activities*

Important harmonisation activities which, though not strictly necessary for the T2S launch, are beneficial for the environment of competition and efficiency surrounding T2S and are therefore monitored in the context of T2S.

- Corporate actions market standards

- Place of issuance

- Withholding tax procedures

- Settlement-related tax procedures

- Cross-border shareholder transparency

- Market access and interoperability

- Securities amount data

* As of February 2013

In order to monitor developments, the AG regularly produces harmonisation progress reports providing a detailed analysis of the status of all T2S harmonisation activities. The reports also highlight who is responsible for the definition, monitoring and implementation of the related standards either within or outside the T2S Community and set deadlines for compliance by T2S markets.

The AG published its second harmonisation progress report in January 2012, focusing on the identification of the harmonisation issues relevant for T2S and of the actors required to solve them. The AG also worked on the third harmonisation progress report in 2012, the publication of which is planned for March 2013 ahead of the joint ECB-European Commission conference on “Post-trade harmonisation and financial integration in Europe” (Frankfurt, 19 March 2013) . The third progress report focuses on monitoring the compliance of T2S markets against ten concrete standards and market practices defined and endorsed by the T2S Community and other relevant authorities so far. In addition, it provides a detailed analysis of the status of each harmonisation activity and, for the first time, detailed information on the compliance level of each T2S market.

In 2012, the HSG and the AG also completed the establishment of a post-trade harmonisation monitoring tool. The tool enables the AG to identify areas where national markets lag behind in implementing T2S/EU standards and, where necessary, to take action to remedy the situation or alert the relevant stakeholders to any such action needed.

A monitoring methodology was developed in detail in 2012. The methodology allows the consistent assignment of progress statuses to all activities (definition and monitoring of progress) as well as to all T2S markets (compliance status). The assessment is based on the information received from a number of sources, i.e. T2S National User Groups, ad hoc surveys, CSD/NCB feasibility assessments (SP2/SP3), AG substructures, and bilateral contact with CSDs and markets participants. The monitoring work focuses on the T2S markets exclusively.

Ten items from the T2S Harmonisation List were monitored during 2012 based on the standards already agreed upon and endorsed by the AG:

- T2S messages – ISO 20022;

- T2S messages – matching fields;

- schedule for the T2S settlement day;

- T2S corporate actions standards;

- T2S settlement finality II (irrevocability of transfer order);

- T2S settlement finality III (irrevocability of securities transfer);

- availability of omnibus accounts;

- restrictions on omnibus accounts;

- corporate actions market standards;

- securities amount data.

Work will proceed in 2013 in defining standards and market practices for the remaining activities and in subsequently monitoring their implementation in the T2S markets.

Some of the T2S harmonisation activities are dependent on the adoption and implementation of the CSD Regulation, a proposal for which was published by the European Commission on 7 March 2012. The CSD Regulation aims to improve securities settlement in the European Union and to regulate CSDs at the EU level. It introduces, among other things, an obligation of dematerialisation for most securities, a harmonised settlement period for on-exchange transactions, a proposal for a single settlement discipline regime, and important provisions for increased market access and freedom of issuance location. The Commission’s proposal is currently under consideration by the European Parliament and the Council.

Indeed, the CSD Regulation can be regarded as complementary to T2S in fostering European financial market integration and establishing a new European model for securities settlement: the Regulation will establish a uniform legal and regulatory framework while T2S will provide a level playing field from an operational perspective. The importance of the link between the two initiatives in improving securities settlement in Europe was also highlighted by the ECOFIN Council in its meeting on 11 May 2012 (see its conclusions).

The CSD Regulation affects T2S in several respects, with an expected positive impact on the legal soundness of T2S and on the harmonised framework and competitive environment in which T2S will be launched and operated. Some provisions of the Regulation are crucial for the launch of T2S, for instance the possibility for CSDs to outsource IT services to public entities. These views were reflected in Opinion CON/2012/62 of 1 August 2012 on a proposal for a regulation on improving securities settlement in the European Union and on central securities depositories. The opinion conveyed the ECB Governing Council’s support for a timely adoption of the Regulation and the implementation of the related technical standards before the launch of T2S.

Furthermore, intensive work was conducted in 2012 by a special AG task force established in 2011 to develop commonly agreed solutions for adaptation to cross-CSD settlement in T2S, with the aim of increasing the efficiency of cross-CSD settlement for CSDs and their participants on a non-discriminatory basis. The task force, comprising experts from CSDs, banks and central banks, thoroughly examined several cross-border issues relating to managing information on registration, tax, CSD ancillary services, and other processes that may impede efficient cross-CSD settlement in the T2S context. The task force drew up 25 recommendations for further action based on the existing standardised T2S functionality. These recommendations were presented to the AG in the task force’s final report in November. The Harmonisation Steering Group was charged with considering how to further pursue the task force’s recommendations and reporting back to the AG at its meeting in February 2013.

Regarding the compliance of T2S markets with the T2S corporate actions standards, a Gap Analysis was carried out by the Sub-group on Corporate Actions in 2012, as in previous years. All T2S markets responded to the survey, launched on 2 April and concluded in mid-September. Subsequently, the sub-group assessed the compliance status for each market on the basis of current standards implementation and the reported barriers to achieving full compliance on time, i.e. prior to the T2S testing phase.

Finally, in 2012 the ECB contributed to the work of the newly established European Post-Trade Group (EPTG), a joint initiative of the EU Commission (Internal Market and Services Directorate General), the European Securities and Markets Authority (ESMA), the Association for Financial Markets in Europe and the ECB. The group’s mandate is to contribute to the development of an efficient, safe and sound post-trade market in the EU, building on the work of the Expert Group on Market Infrastructures (which published its final report in October 2011). The scope of the group’s work is limited to post-trade harmonisation areas that are not covered by existing public authority initiatives, and is therefore complementary to the current regulatory initiatives of the European Commission, the implementation of T2S and other initiatives in the area.

Financial matters

T2S operates on a full cost recovery basis. Thus, the T2S financial equilibrium requires that the costs incurred during the project phase and once T2S is in operation are covered by the revenues generated by T2S. The latter are driven by the volume that will be settled on the single settlement platform as of start of operations.

In 2012, the Governing Council of the ECB reviewed the T2S financials with the objective of keeping cost increases to an absolute minimum. The review took into account the 2011 decision to implement changes to the T2S User Requirements deemed by the market as indispensable for the smooth functioning of T2S. In addition, the review took into account two other decisions, namely the decision to insure the Eurosystem’s liability resulting from the relevant provisions in the Framework Agreement and the Currency Participation Agreement, and the agreement in 2011 to postpone the T2S go-live date by nine months.

In the review, the Eurosystem estimated that the total investment in T2S until it starts live operations will amount to €398.6 million. Of this amount, by the end of 2012 the Eurosystem had paid €183.3 million, which was paid to the entities conducting the work in the development phase, i.e. the 4CB and the ECB (the payment to the ECB for costs incurred in 2012 is not included and will be made in early 2013). It was estimated that operating and maintaining T2S would cost €64.9 million per annum. In addition, €67.5 million capital costs for the financing of T2S were computed, as well as €45.0 million of reserve funds which could be used for unforeseeable T2S costs incurred during operations.

T2S financials

| Development cost | €398.6 million |

| 4CB | €296.7 million |

| ECB | €100.0 million |

| Others | €2.0 million |

| Average annual running cost | €64.9 million |

| 4CB | €52.3 million |

| ECB | €10.5 million |

| Others | €2.1 million |

| Capital cost | €67.5 million |

| Contingency reserve | €45.0 million |

Figures might not add up because of rounding.

The total of T2S fees depends on three parameters: 1) the volume of securities settlement transactions that will be settled in T2S as of the start of its operations, 2) the length of the cost recovery period, and 3) the T2S fees that will be charged according to the fee structure announced in 2011.

In 2012, the Eurosystem continued its regular settlement volume analysis, in order to allow for realistic T2S volume projections and thus also projections of future T2S revenue streams. The settlement volume analysis is conducted on the basis of the information provided by European CSDs under the rules of the T2S Memorandum of Understanding of 16 July 2009 between the Eurosystem and CSDs and, since the signing of the Framework Agreement, under the equivalent rules laid down in the contract. The volumes reported by CSDs are projected until the end of the cost recovery period using the growth rates anticipated by the T2S Advisory Group in 2010.

According to the latest data reported by CSDs to the Eurosystem, in 2012 the CSDs that have signed the Framework Agreement settled 18% less transactions than expected. This lower than expected volume is to a large extent due to subdued market activity as a result of the financial crisis, which has affected settlement volumes in the euro area and beyond.

The pricing policy stipulated in the Framework Agreement foresees the possibility of modifying the T2S prices under two conditions, namely if the volume deriving from the contribution of non-euro currencies is less than 20% of the euro settlement volume, and if market volumes are more than 10% below the projections. In March 2012, the T2S Programme Board clarified the T2S pricing policy, emphasising that it did not intend to propose any revision of the benchmark price of 15 euro cent per DvP settlement instruction until at the earliest one year after the last migration wave (i.e. in 2018), in order to have a stable volume basis in T2S for assessing the two above-mentioned conditions of the T2S pricing policy.

In 2013, the focus will be on containing costs and exploring options for revenue increases so as to avoid fee increases resulting from lower settlement volumes (see above) to the extent possible. Fee increases should be the measure of last resort in achieving full cost recovery.

Finally, in 2013 the Eurosystem will also launch a tender for liability insurance, to be implemented for T2S live operations.

Communication

The main communication event of the year was the high-level event that was hosted by the ECB in Frankfurt on 8 May 2012 marking the first signatures to the T2S Framework Agreement. Several senior representatives from the Eurosystem and from across the financial sector attended the event, during which ECB President Mario Draghi emphasised the importance of cooperative projects like T2S in achieving deeper financial integration in Europe, and Peter Praet, the member of the ECB Executive Board responsible for T2S at the time, outlined how the project was expected to evolve. Interesting key statements were also made by representatives from the signing CSDs and some Eurosystem representatives (see http://www.ecb.europa.eu/events/conferences/html/t2s_signing.en.html).

T2S was in the spotlight in several debates at the SIBOS convention (Osaka, 29 October-1 November). The impact of T2S was discussed during the two Eurosystem sessions, one dedicated to the challenges entailed by adapting to T2S, and the other addressing the future of the European financial market infrastructure more in general. In addition, a session was held for the non-European audience, providing interesting insights into how T2S will enable non-European market participants to access European financial markets. Finally, during the session “In Conversation with Benoît Cœuré”, the ECB Executive Board member underlined the importance of the Eurosystem’s market infrastructure initiatives and praised market infrastructures for the high degree of resilience they showed in the worst moments of the crisis.

A new T2S video was also launched during SIBOS, introducing the T2S Community and its objectives. The video, together with all T2S multimedia features, was published on the newly created T2S YouTube channel (accessible from the T2S homepage).

The market was also involved in four T2S Info Sessions held during the year in several locations in Europe, namely in Milan (dedicated to the topic “getting ready for cross-CSD settlement”), Malta, Amsterdam (T2S Technical Dialogue “Implementing the relationship between payment banks and their clients in T2S”) and Vienna (focusing for the most part on auto-collateralisation services in T2S).

In 2012, important efforts were made to further enhance the project’s communication with stakeholders and the public and to increase information on specific technical and business topics. In particular, two new publications were launched: first, the T2S annual review, the first edition of which, T2S in 2011, was published on 2 April; and second, the T2S Special Series, a series of papers addressing in detail specific topics related to T2S, ranging from strategic and business matters to technical and operational issues. Two papers were published as part of the series in 2012: “T2S benefits: much more than fee reductions” and “T2S Auto-collateralisation”.

As always, stakeholders were kept updated through the quarterly review T2S OnLine. All news and all key technical and legal documents continued to be made available to the public on the T2S website (www.t2s.eu), along with all documents discussed by the T2S Advisory Group and its sub-structures during their meetings. The T2S project thus remained faithful to its transparency principle.

Finally, T2S was one of the featured topics at a large number of conferences relating to securities settlement across Europe and beyond. These events provided important opportunities for explaining T2S and discussing it more widely with the industry and authorities, as well as linking the project to other initiatives in the field.

T2S general objectives and targets

To reduce risk in the post-trade environment in Europe

- by delivering real-time gross settlement exclusively in central bank money, ensuring the safest possible settlement of securities in Europe and significantly reducing the risks still affecting cross-border settlement today.

- by employing the so-called “integrated model”, in which securities and cash accounts are held on a single platform, overcoming the delays in processing transactions and the risks of error which still exist in securities settlement systems based on the “interfaced model”.

- by incorporating several features that aim to help banks optimise their liquidity and collateral management, the importance of which has never been as pronounced as it is today. T2S endeavours to give banks the possibility to have a single (and thus reduced) buffer based on their total European business by abolishing the need for market participants to hold multiple buffers of collateral and liquidity when settling in several European markets. Furthermore, the highly efficient auto-collateralisation mechanisms T2S plans to extend to all T2S markets should significantly reduce the need for pre-funding of cash accounts during both daytime and, in particular, night-time settlement.

- by promoting greater diversification and sharing of risk, which will help make the whole system more stable. Through dramatically increasing the ease of cross-border transactions, T2S allows investors to hold a more geographically diversified portfolio of securities. T2S should provide investors with the possibility of higher risk-adjusted returns, and benefit issuers through a more diversified and stable investor base as well as a lower cost of capital. In general, T2S will help to increase financial stability in Europe, dampening the impact of asymmetric shocks by spreading economic gains and losses more widely.

To streamline the settlement process in Europe

- by providing a single pan-European platform for securities settlement, following a “lean” T2S concept. Combining this with the drive for deeper harmonisation of financial markets, T2S seeks to enable banks to streamline and potentially consolidate their back offices, facilitating considerable cost savings. T2S aims to be a major step forward towards a fully straight-through processing world.

- by making cross-border settlement as efficient as domestic settlement, while avoiding the cementation of national specificities into the system’s operational blueprint. T2S will force harmonisation in many crucial areas, such as the adoption of a common interface and common message formats, a common set of rules for intraday settlement finality and a harmonised daily timetable and calendar. Through this process, T2S aims to help remove Giovannini barriers 1, 2, 3, 4, 5 and 7* .

To enhance freedom of choice in the securities settlement industry in Europe

- by increasing transparency, openness and competition between CSDs, penetrating the largely monopolistic national environment that they currently operate in. With 40 CSDs active in Europe today, the range of different national regulations and market practices have created a very opaque settlement industry that investors are not able to navigate without difficulty. Although the publication of settlement tariffs was made compulsory in the European Code of Conduct for CSDs, T2S endeavours to increase comparability with a fully transparent and uniform price list.

- by separating the “infrastructure” from the “service”, giving customers in T2S more freedom of choice as regards where they want to trade and settle. Following the delivery of the system, CSDs will need to compete to be their customers’ preferred gateway to T2S, and in doing so must become open about what they are able to offer. T2S aims to ensure that customers will no longer be prevented from crossing national borders owing to technical and market practice restrictions, progressively transforming the securities settlement landscape in Europe.

To reduce the cost of settling securities transactions in Europe

- by reducing the current cross-border settlement fees thanks to the economies of scale deriving from the concentration of settlement on a single platform. Cross-border settlement across European countries today is up to ten times more expensive than domestic settlement owing to the fragmentation of the process over several platforms and the need for the contribution of a long chain of intermediaries.

- by assisting CSDs in their adaptation plans, in order to help them to also reduce domestic settlement fees.

- by dramatically changing the competitive environment for European CSDs in combination with CSD legislation,, and in doing so providing a higher degree of freedom for all participants. T2S aims to ensure that CSDs respond to this changing settlement landscape with a business model set to lead to cheaper securities settlement, whether through efficient reshaping, specialisation, consolidation or simply strategic pricing.

- by expanding the system beyond the euro area. Through encouraging non-euro area CSDs and central banks to join the T2S Community, T2S plans to deliver a further reduction of prices in the future, exploiting fully the huge economies of scale present in such a system.

* The Giovannini barriers are a set of 15 specific barriers that prevent efficient EU cross-border clearing and settlement, identified by the Giovannini Group in a report in 2001. The barriers referred to that T2S seeks to help remove are the following:

- National differences in information technology and interfaces.

- National clearing and settlement restrictions that require the use of multiple systems.

- Differences in national rules relating to corporate actions, beneficial ownership and custody.

- Absence of intraday settlement finality.

- Practical impediments to remote access to national clearing and settlement systems.

- National differences in operating hours/settlement deadlines.