- 22 September 2021

- RESEARCH BULLETIN NO. 87.3

Avoiding a financial epidemic – the role of macroprudential policies

The COVID-19 pandemic has been a stark reminder of how important preventive measures are for promoting the welfare of populations. This applies in all areas of life, but especially in healthcare. Prevention requires focusing on the community as a whole – even more than on individuals – to achieve the greatest possible well-being for all of us.

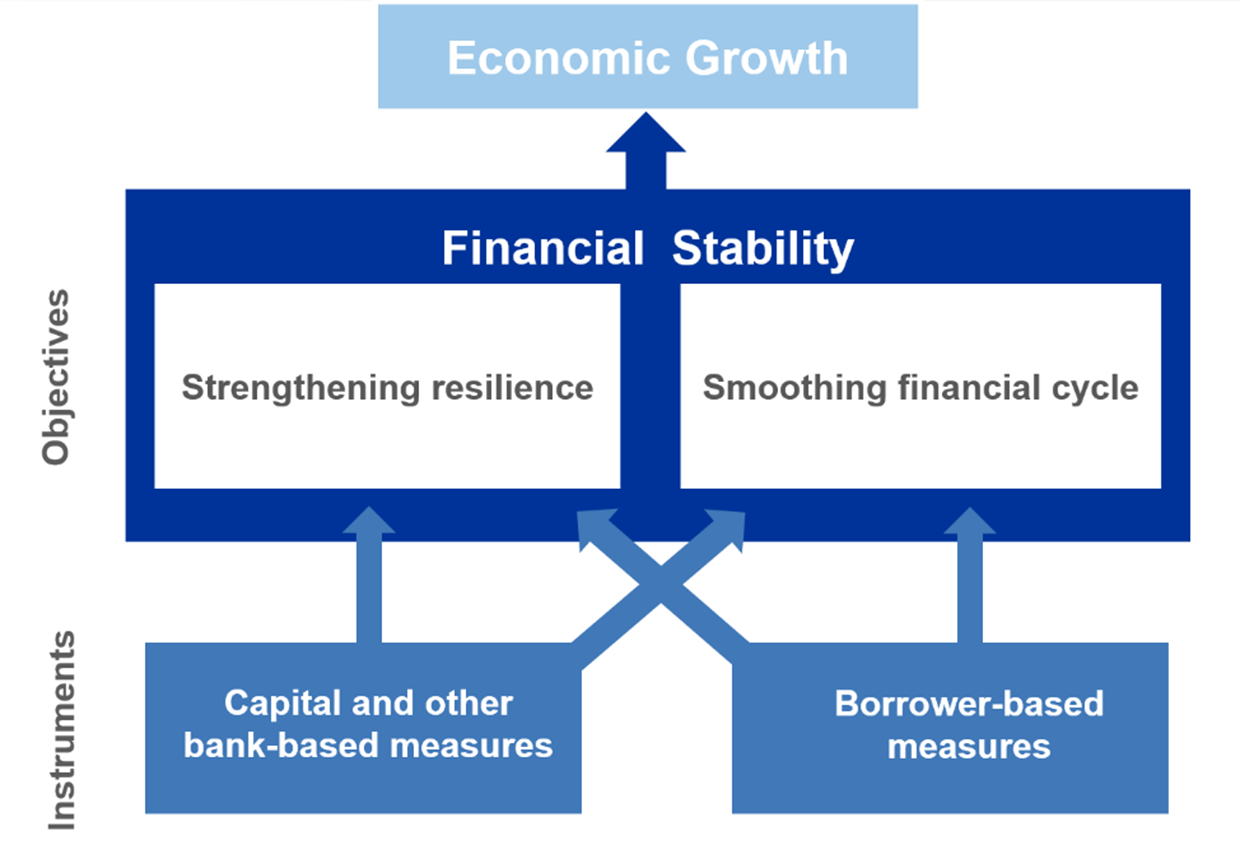

Macroprudential policies are also inspired by this philosophy of focusing on prevention to safeguard the system as a whole – in this case, the financial system.[2] This entails strengthening the resilience of the financial system and suppressing the build-up of vulnerabilities. By smoothing the financial cycle, macroprudential policies are meant to ensure a sustainable contribution of the financial sector to economic growth[3].

Just as preventive healthcare hit the headlines in the COVID-19 crisis, the financial crisis of 2008 put macroprudential policy in the spotlight. It is a tool to address externalities and market failures associated with financial intermediation, complementing both microprudential supervision (De Nicolò et al. (2014)), and monetary policy (Martin et al. (2021)).

We present theoretical and empirical evidence showing that macroprudential policy has the power to improve financial stability, and that financial stability ultimately has a positive effect on economic growth.

Macroprudential instruments targeting the banking sector

While there are several types of macroprudential policy instruments, we concentrate our analysis on capital and borrower-based instruments affecting the banking sector.

Capital measures encompass a set of capital requirements which are designed to increase the loss absorption capacity of banks, fostering financial sector resilience. In addition, by altering banks’ cost of capital, higher capital requirements should affect the price and volume of credit. This helps tame the financial cycle by limiting credit excesses. The capital framework for banks is enshrined in the Basel III agreements, BCBS (2013). It comprises instruments such as the Countercyclical Capital Buffer, the Systemic Risk Buffer and buffers for “too-big-to-fail” institutions such as those for Globally Systemically Important Institutions and Other Systemically Important Institutions.

Borrower-based instruments directly impose limits on the terms and conditions of lending related to the riskiness of loans. These instruments encompass limits on the size of the loan in relation to either the value of the underlying collateral (loan-to-value ratio – LTV), the income of the borrower (the loan/debt-to-income ratio – L/DTI), limits to debt (loans), or servicing costs in relation to the income of the borrower (the debt/loan service to income ratio – D/LSTI), maximum maturity limits and amortisation requirements. Borrower-based measures contribute to financial stability because they are designed to foster both bank and borrower resilience. On the one hand, borrower-based instruments make debt more sustainable, thereby reducing the probability of default of individual borrowers and limiting amplification effects on consumption and investment in the event of negative shocks. On the other hand, they improve the quality of banks’ mortgage loan portfolios through more prudent lending standards, which gradually render loan portfolios less risky.

The general framework of the impact of macroprudential policy can be represented as shown in Chart 1.

Chart 1

Transmission mechanism of macroprudential policies to economic growth

Beyond financial stability – macroprudential policies and economic growth

Surprisingly, the overwhelming majority of papers in the literature concentrate on the effects of macroprudential policies on financial stability. Only a few measure the effect on the ultimate target, economic growth. In Ampudia et al. (2021), we review the literature, following the meta-analysis of Araujo et al. (2020). Our conclusion is that papers including GDP growth in their analysis find statistically significant negative effects of macroprudential tightening measures on economic activity. This effect is so obvious that it has been termed the “cost of macroprudential policies” (Richter et al., 2018).

Another strand of the literature – Jorda et al. (2013) and Claessens et al. (2011), among many others – concentrates on how recessions associated with financial imbalances, particularly credit booms, tend to be deeper with more sluggish recoveries. These empirical facts have clearly shaped the role of macroprudential policies: according to the above findings, preventing financial distress should result in milder recessions. This is key to obtaining higher average long-term economic growth to compensate for the short-term negative impact mentioned above.

Our work combines these different views on the effect of macroprudential polices on GDP growth, by analysing and measuring the benefits and costs of its implementation. We do so using a range of state of the art models and analytical tools. We assess how a variety of macroprudential policy instruments affect the stability of euro area banks, households and aggregate credit. The results demonstrate how novel models are able to balance the short-term costs of macroprudential measures, namely lower aggregate credit growth, with their long-term benefits. We proceed in two steps. First, we show how macroprudential policies affect financial stability and second, we show how financial stability affects economic growth.

Step 1. Macroprudential policies and financial stability

We start by providing theoretical evidence that capital measures decrease bank default risk and thereby smooth credit supply. We show these facts by:

- changing the capital ratio of the three-layers-of-default model of Clerc et al. (2015);

- computing the probability of bank default and the evolution of total credit in response to an adverse financial shock.

The model highlights how frictions in the financial sector affect the credit market for investment goods, housing capital and deposits, amplifying the transmission of exogenous shocks to the economy. In the model, households and firms borrow from banks to finance house purchases and capital investment, respectively. The macroprudential authority sets capital requirements so that banks have to retain equity in proportion to the amount of loans issued. In Ampudia et al. (2021) we introduce LTV limits that constrain the credit take-up for housing.

Simulation results show that, in the long run, tighter capital regulation makes banks more resilient, by reducing banks’ leverage and making them less likely to default. LTV limits reduce the exposure of GDP and credit growth to housing-related shocks. They also increase exposure to firms, as lending to firms increases. Our dynamic stochastic general equilibrium (DSGE) model concludes that both capital requirements and LTV limits are effective in smoothing out the credit cycle and shielding the economy: not only does credit decrease when requirements are tightened, but the impact of adverse shocks is also contained.

In addition, our study provides empirical evidence of these findings. Existing empirical studies are mostly based on cross-country panel regressions. They largely neglect the effect of macroprudential policy on GDP and inflation, as well as potential second-round effects of these variables on future values of credit. The narrative panel vector autoregressive approach, based on Budnik and Rünstler (2021), addresses these shortcomings. It provides deeper insights into the dynamics of the transition to the new steady state following macroprudential policy interventions. We study a sample covering 11 euro area countries (the initial adopters, excluding Luxembourg, and Greece) and focus on three categories of instruments, namely minimum capital requirements, LTV limits and other borrower-based measures (such as DTI and DSTI limits). We find a sizeable impact of macroprudential policy measures on credit – and house prices – and a small effect on output and inflation. Additionally, on average, borrower-based measures have a higher impact than capital requirements, in line with the DSGE model simulations.

To complement the macroeconomic results, we analyse the impact of macroprudential policy on the resilience of individual agents. We use two empirical models relying on microeconomic data. To explore the relation between borrower-based instruments and borrowers’ resilience, we use household-level survey data for Italy and Spain[4] to study the effect of LTV ratios at origination, i.e. at the start of loans, on borrowers’ probability of default. We estimate a model which relates the effect of the LTV at origination for the main loan on a household’s main residence to the probability of default. Does this LTV affect whether the household has been late or missed payments on its loans during the last 12 months, controlling for a series of loan and household characteristics? The results are shown in Table 1. As can be seen in the table, the probability of default increases with the level of the LTV at origination. Increasing the LTV ratio cuts out some of the riskiest loans, decreasing the average probability of default.

Table 1

Probability of default for mortgage loans within different LTV at origination

Notes: The table shows the estimated probability of late or missed payments on loans during the last 12 months from the date of the survey. Regression controls for relevant variables. See Ampudia et al. (2021) for details. Source: ECB staff calculations based on the Household Finance and Consumption Survey.

Next, we study the interaction of different borrower-based measures and their impact on the resilience of banks and borrowers, while accounting for macroeconomic feedback effects. We use a more complex modelling framework: the semi-structural, micro-macro integrated household balance sheet model of Gross et al. (2021). This has also been implemented, with country-specific modifications, in a related policy analysis for Slovakia (Jurča et al. 2020). The methodology integrates an empirical microeconomic module simulating the unemployment status of borrowers and a semi-structural macroeconomic module (Structural VAR) that relates dynamically the main macroeconomic magnitudes into a dynamic household balance simulator. The aim is to determine the impact on household and bank resilience of borrower-based measures, relative to a “no-policy” scenario.

The results suggest that borrower-based measures can significantly enhance borrower resilience and support bank solvency ratios. Income-based policies (DSTI and DTI limits) improve the resilience of borrowers and the risk profile of mortgage exposures. They do so primarily by compressing probabilities of default, reducing them by 50-60 basis points relative to a no-policy baseline scenario. Meanwhile collateral-based policies exert their impact primarily through reducing the loss-given-default, by 300 basis points relative to a no-policy baseline scenario. Borrower-based measures are also found to increase the quality of bank mortgage portfolios over time and thereby help banks improve their capital positions.

Step 2. Financial stability and economic growth

Using state-of-the-art methods, we have shown how macroprudential policies have a clear and direct positive impact on financial stability, particularly on controlling the evolution of credit. But the picture is not complete without establishing the link as shown the top panel in Chart 1: the final step is to address how financial stability ultimately affects economic growth. The rationale is simple – in order to justify macroprudential policy intervention, the financial stability benefits of macroprudential policy should exert a positive effect on long-term growth.

To explore the role of financial stability – and particularly of credit – in business cycle characteristics, the study uses the results of Gadea et al. (2020). They compare the effect of macroprudential policies on both expansions and recessions. Their study uses data from 53 countries for an unbalanced panel of quarterly data starting in 1947. They find that, in the two years prior to the onset of recessions, the variation in credit relative to GDP has a non-linear relationship to the amount of wealth loss during the recession. Adjusting a mixture of normal distributions, they show that if the variation of credit belongs to the first quartile of the distribution of the data, with an 80% probability, the recession will imply a loss in wealth of 3% of GDP, and a loss in wealth of 20% of GDP otherwise. By contrast, being in the fourth quartile implies a loss in wealth of 6% in the mild scenario, which has a probability of 58%, and a loss of 30% – a financial epidemic – in the severe one (with a 42% probability).

During expansions, the relation between credit and wealth is completely different: the duration of expansions depends on the intensity of credit growth during the expansion. Specifically, on average, without taking the level of credit into account, the expected duration of an expansion is close to 25 quarters. If credit is low, the expected duration is reduced to 18 quarters. Meanwhile if an expansion has been correctly fuelled by credit[5], the expansion lasts around 35 quarters on average. Bringing these results together, the paper finds that credit growth rates in the third quartile of the distribution imply the maximum amount of wealth accumulation over the cycle. Therefore, the increase in wealth associated with higher expected GDP growth due to longer expansions more than compensates for the deeper recessions.

Conclusion

The COVID-19 pandemic has shown that, in healthcare, epidemics and pandemics are fought by focusing on populations – more than on individuals – and that the costs of restrictions in the short term can be more than offset by the long-term gains.

Our study shows that macroprudential policies, focusing on prevention to safeguard the financial system as a whole, imply a set of restrictions, and, as in the case of healthcare, the costs of restrictions in the short term can be more than offset by the long-term gains.

In our paper we provide evidence of that result in two steps. First, we find clear evidence that macroprudential measures boost financial stability. Based on both macro-level and micro-level evidence, we find that they make banks and borrowers more resilient and can curb excessive credit growth – but that’s not all. Second, we find that financial stability raises long-term economic growth by making recessions shallower and, in particular, financial epidemics less likely. At the same time, if credit constraints are not too tight the right amount of credit fosters longer expansions, boosting economic growth. Therefore, in order to maximise economic growth, macroprudential policies should be well calibrated – similarly to preventive healthcare measures – to allow for longer expansions but avoid financial epidemics.

References

Ampudia, M., Farkas, M., Lo Duca, M., Perez Quiros, G., Pirovano, M., Rünstler, G., and Tereanu, E. (2021), “On the effectiveness of macroprudential policy”, ECB Working Paper Series, No 2559, May.

Araujo, J., Patnam, M., Popescu, A., Valencia, F. and Yao, W. (2020), “Effects of Macroprudential Policy: Evidence from Over 6,000 Estimates,” IMF Working Papers, WP/20/67, April.

BCBS (2011), Basel III: A global regulatory framework for more resilient banks and banking systems, revised version June 2011.

Budnik, K. and G. Rünstler (2020), “Identifying SVARs from Sparse Narrative Instruments,” ECB Working Paper Series, No 2353, January.

Claessens, S., Kose, A. and Terrones. M. E. (2011), “What happens during recessions, crunches and busts?” Economic Policy, pp. 653-700.

Clerc, L., Derviz, A., Mendicino, C., Moyen, S., Nikolov, K., Stracca, L., Suarez, J. and Vardoulakis, A. (2015), “Capital Regulation in a Macroeconomic Model with Three Layers of Default,” International Journal of Central Banking, Vol. 11 (No 3), pp. 9-63.

Constâncio, V., Cabral, I., Detken, C., Fell, J., Henry, J., Hiebert, P., Kapadia, S., Altimar, S.N., Pires, F. and Salleo, C. (2019), “Macroprudential policy at the ECB: Institutional framework, strategy, analytical tools and policies,” ECB Occasional Papers, No 227, July.

De Nicolò, G. and Favara, G., and Ratnovski, L. (2014), “Externalities and Macroprudential Policy,” Journal of Financial Perspectives, Vol. 2, No 1, 2014.

European Systemic Risk Board (2014), The ESRB Handbook on Operationalising Macro-prudential Policy in the Banking Sector.

Financial Stability Board, International Monetary Fund and Bank of International Settlements (2011), Macroprudential Tools and Frameworks, Update to G20 Finance Ministers and Central Bank Governors (February).

Financial Stability Board (2020), Global Monitoring Report on Non-Bank Financial Intermediation 2020.

Gadea, M.D., Laeven, L. and Perez Quiros, G. (2020), “Growth at risk trade-offs,” ECB Working Paper Series, No 2397, April.

Gross, M., Giannoulakis, S., Forletta, M., and Tereanu, E. (2021) “The Effectiveness of Borrower-Based Macroprudential Policies: A Cross-Country Perspective Using an Enhanced Integrated Micro-Macro Model Approach”, mimeo.

Jorda, O., Schularick, M. and Taylor, A. M. (2013), “When credit bites back: leverage, business cycles and crises,” Journal of Money, Credit and Banking, Vol. 45 (2), pp. 3-28.

Jurča, P., Klacso, J., Gross, M., Tereanu, E. and Forletta, M. (2020), “The effectiveness of borrower-based macroprudential measures: a quantitative analysis for Slovakia”, IMF Working Papers, No 20/134.

Martin, A., Mendicino, C., Van der Ghote, A. (2021), “On the interaction between monetary and macroprudential policies”, ECB Working Paper Series, No 2527, February.

Richter, B., Schularick, M. and Shim, I. (2019), “The costs of macroprudential policy”, Journal of International Economics, Vol. 118, pp. 263-282.

- This article was written by Miguel Ampudia, Marco lo Duca, Mátyás Farkas, Mara Pirovano, Gerhard Rünstler and Eugen Tereanu (European Central Bank) and Gabriel Perez Quiros (Banco de España). The authors gratefully acknowledge comments from Michael Ehrmann, Alexander Popov and Zoë Sprokel. “The article is based on ECB Working Paper 2559 “On the effectiveness of Macroprudential Policy”. It features research-based analysis conducted within the ECB’s Research Task Force on monetary policy, macroprudential policy and financial stability. ”The views expressed here are those of the authors and do not necessarily represent the views of either the European Central Bank, the Banco de España or the Eurosystem.

- See European Systemic Risk Board (2014) or FSB-IMF-BIS (2011).

- Constâncio et al. (2019) point to this effect on economic growth.

- In particular, we use data from the Italian Survey of Household Income and Wealth (SHIW) and the Spanish Encuesta Financiera de las Familias (EFF).

- The “correct measure” in the paper is defined as credit being high but not too high. Technically, the authors consider this to be the case when credit intensity, defined as the variation in credit to GDP, from the beginning of the expansion to the current period is in the third quartile of the empirical distribution of credit intensities.