- RESEARCH BULLETIN NO. 65

- 04 December 2019

How does sluggish updating of information affect consumer spending?

Many economic models assume that households have up-to-date information. Here, we relax this assumption and see how that affects consumption at the household and aggregate level. To be specific, our model assumes that households only occasionally update their information about macroeconomic quantities. What’s unique about our model is that it can reconcile the very low persistence of consumption growth seen at the household level with it being substantially persistent at the aggregate level. In short, our model better fits micro and macro data. Concerning fiscal policy, our model can explain the fact that consumption reacts little to the announcement of a fiscal stimulus but substantially to the actual receipt of a stimulus payment.

Imperfect updating of information

Many economic models assume that households use all available information in making decisions. In other words, households in such models are assumed to have up-to-date information and rational expectations. But some economists believe that these assumptions are too extreme. As evidence, they point to the fact that models that make these assumptions have trouble explaining the behaviour of economic variables as observed in the data. So what would happen if we relaxed the assumption that households have up-to-date information? Would our models then better explain the behaviour of economic variables?

In a recent ECB working paper, we do exactly that, focusing on changes in consumption at the household and aggregate level. In our model, as in the standard up-to-date information rational expectations model, consumers perfectly (i.e. “frictionlessly”) perceive their own personal circumstances (employment status, wage rate, wealth, etc.). However, in contrast to conventional models that feature rational expectations, information about macroeconomic quantities (e.g. aggregate productivity growth) only arrives occasionally, rather than being tracked continuously in time. Because of this, households' macroeconomic expectations are “sticky”, in the sense that they adjust slowly to news about aggregate variables.

This assumption is in line with both the casual observation that households do not have perfect knowledge about the value of economic aggregates (such as aggregate productivity growth or inflation) and studies documenting the fact that household expectations react only sluggishly to new information. In addition, the assumption is reasonable. In fact, as we show in the working paper, occasional updating of aggregate quantities has little effect on households’ welfare. Compared to the variation in household-level variables, the variation in aggregate variables is negligible, so that it is not essential for consumers to track it precisely.

Sticky expectations and consumption dynamics

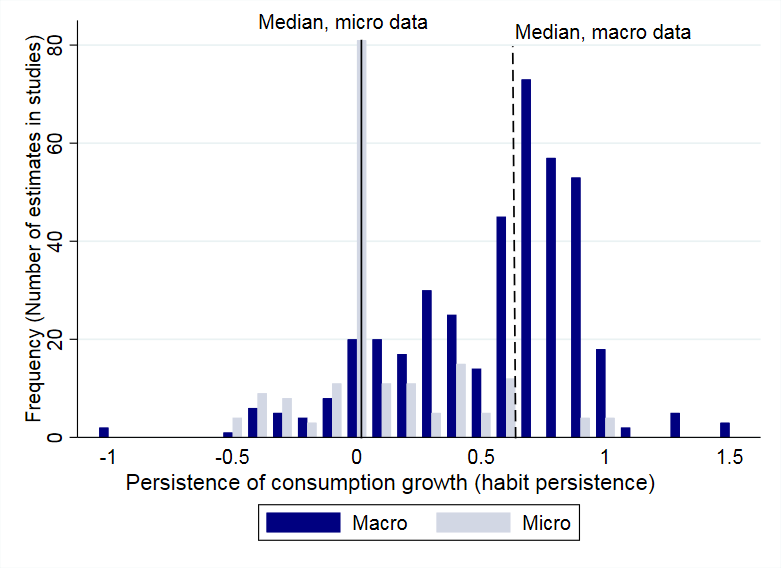

As we show in our working paper, our modified model can reconcile two important empirical facts about consumption growth in household-level data and in aggregate data (see Chart 1). First, at the household level, consumption growth exhibits very little persistence (and formally is close to a “white noise” process, in line with the random walk hypothesis of Hall, 1978; see the grey bars in Chart 1). Second, in contrast, at the aggregate level consumption growth is substantially persistent, so that strong current growth predicts strong growth next year. Formally, the autocorrelation of aggregate consumption growth is around 0.6 or more (see the dark blue bars in Chart 1).

Chart 1

Distribution of estimates of persistence of consumption growth in macro and micro studies

Note: Reproduced from Havranek, Rusnak, and Sokolova (2017), Figure 2. The figure shows the distribution of 597 estimates of persistence in consumption growth or “habit persistence” in studies based on macro and micro data. Solid and dashed lines show the median estimates in micro (0.0) and macro (0.6) studies, respectively.

In our model, the persistence in aggregate consumption arises as follows. A household whose beliefs about the aggregate economy are out of date will behave in line with the outdated information. The lag in perception generates a lag in the response of aggregate spending to aggregate developments.

For aggregate consumption, any household-specific “shocks”, such as sudden changes in personal income, cancel each other out. Thus, the degree of persistence in aggregate spending will depend on the frequency with which consumers update their aggregate information. We set the updating frequency in the model to match the degree of inattention reported in economic studies that examine how consumers update their inflation and unemployment expectations: according to these studies, only about 25% of households update their aggregate information each quarter. The model then quantitatively matches the substantial persistence in aggregate consumption growth estimated in macroeconomic studies.

Despite generating appropriate aggregate persistence, the simulated household-level data reproduce the finding that consumption growth is almost impossible to predict. This is because the effect of aggregate shocks is negligible at the micro level; thus; the dynamics of consumption at this level are dominated by household-level shocks, for which the information is up-to-date (consistent with rational expectations).

In contrast to our model – in which aggregate information is only imperfectly updated – standard models with rational expectations have difficulty reproducing the contrasting degrees of persistence in aggregate and household-level consumption growth. They often hardwire “habits” to generate sluggishness. However, if habits are a true structural characteristic of people's preferences, we should see their effects in both microeconomic data and macroeconomic aggregates (which we do not, as evidenced by the grey bars in Figure 1). In short, our model with relaxed assumptions generates predictions that better fit the data.

Implications for the reaction of consumption to the 2008 US tax rebate

Our sticky expectations model can be used to analyse how policies and shocks (think sudden changes in taxes or aggregate productivity) affect households and spread through the economy. For example, unlike the standard model with frictionless rational expectations, our model with sticky expectations is able to match the response of household spending to the 2008 US tax rebate. It is in line with evidence showing that consumption reacted little to the announcement of this stimulus measure but substantially to the receipt of the stimulus payment itself. Such spending behaviour was estimated in data from recent episodes of tax rebates in the United States by J. A. Parker and various collaborators, estimating the response of consumption to fiscal stimulus payments.

To demonstrate this point, we specifically perform a model experiment designed to correspond to the 2008 US federal economic stimulus. In this experiment stimulus payments are announced before they are received, and we assume that the announcement of this programme is treated in the same way other macro news is treated.

Our exact experiment is as follows. An announcement is made in quarter t-1 that stimulus payments will arrive in consumers' bank accounts in the next quarter, t. In line with our sticky expectations parameter, we assume 25% of households learn about the payment when it is announced, while the other 75% are unaware until the payment arrives in quarter t. Furthermore, we assume the households who know about the upcoming payment are able to borrow against it in quarter t-1.

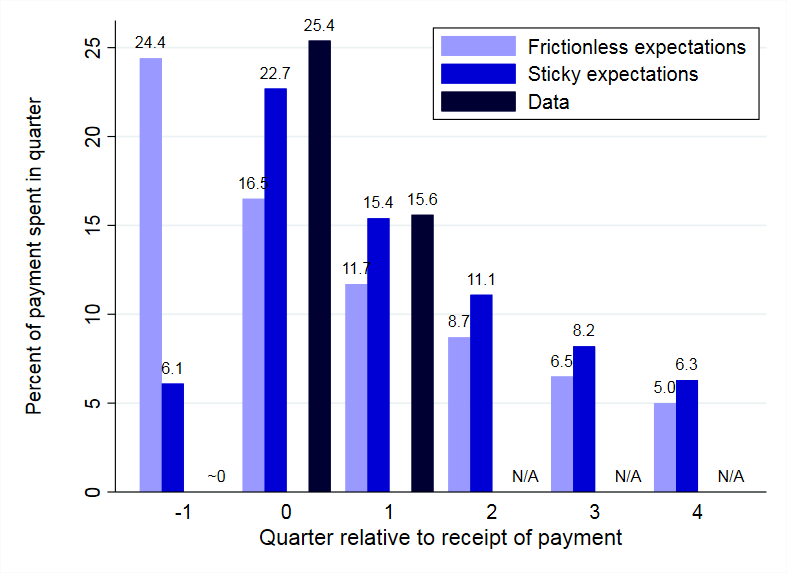

Chart 2

Effects of fiscal stimulus payments on consumption, models vs. data

Note: The figure shows how consumption reacts to a fiscal stimulus payment in data and in models with frictionless and sticky expectations. The evidence from data is based on Parker, Souleles, Johnson, and McClelland (2013), Table 5, and Broda and Parker (2014). The “N/A” indicates that, to our knowledge, the literature does not estimate the reaction in quarters 2 to 4.

The experiment sharply differentiates the models with frictionless and sticky expectations, both upon announcement of the payments and when households receive the payments (Chart 2). Let’s first look at when the payments are announced. Upon announcement of the stimulus at time t-1, consumption in the frictionless model substantially increases: households spend 24.4% of the payment. In contrast, recall that in the sticky expectations model only a quarter of households update their beliefs when the announcement is made; thus, consumption rises by only 6.1% of the stimulus payment. What’s important to note here is that the smaller percentage is in line with studies by Broda and Parker (2014) and Parker (2017), who estimate no economically or statistically significant change in spending when the household learns that it will receive a payment. In other words, consumption in the sticky expectations model – our model with the relaxed assumptions – rises to a degree consistent with the results of empirical studies.

Once the stimulus payment is received, however, households with sticky expectations substantially increase their spending – by 22.7% of the payment, right in the middle of the 12-30% range estimated by Parker et al. (2013) – as three quarters of them then learn about the payment by seeing it arrive in their bank account. In contrast, in the frictionless model the reaction of spending to the receipt of the payment is more muted (16.5%). In the following two quarters, consumption in the sticky expectations model is higher by 15.4% and 11.1% of the payment amount respectively. This result also fits with the empirical evidence suggesting around 40% of the stimulus payment is spent in the first three quarters (Parker et al., 2013). In short, the predictions of the sticky expectations model match the evidence on how spending reacts to a fiscal stimulus reported in the literature.

The assumption of sticky expectations provides one way to rationalise evidence on the US episodes of tax rebates with a small departure from full rationality. There are other explanations referring, for example, to households’ impatience or lack of sophistication and planning. Both the empirical and the modelling literature are currently actively investigating how to analyse the effects of announcing various fiscal policies across countries.

Concluding remarks

Many economic models assume that households have up-to-date information and rational expectations. Our work illustrates that relaxing these assumptions produces models whose predictions are more consistent with actual data. In particular, such models can reconcile the contrasting empirical evidence on consumption growth at the household level and at the aggregate level. We also document that a model in which consumers only occasionally update their aggregate information implies little reaction to an announcement of a fiscal stimulus in the form of a tax rebate, in line with the data.

In addition, sticky expectations can also provide insights into the effects of monetary policy. It has long been known that sticky expectations can generate inertia in inflation and inflation expectations. Recently, it has also been proposed that they substantially affect the transmission of monetary policy: for example, when households have sticky expectations, they do not react much to central bank announcements, thus providing a possible explanation for the limited effectiveness of forward guidance (i.e. the “forward guidance puzzle”).

References

Broda, C., and Parker, J. A. (2014), “The economic stimulus payments of 2008 and the aggregate demand for consumption,” Journal of Monetary Economics, Vol. 68(S), pp. 20-36.

Carroll, C., Crawley, E., Slacalek, J., Tokuoka, K. and White, M. N. (2018), “Sticky expectations and consumption dynamics”, ECB Working Paper Series, No 2152, May.

Hall, R. E. (1978), “Stochastic implications of the life-cycle/permanent income hypothesis: Theory and evidence,” Journal of Political Economy, Vol. 96, pp. 971-87.

Havranek, T., Rusnak, M., and Sokolova, A. (2017), “Habit formation in consumption: A meta-analysis,” European Economic Review, Vol. 95, pp. 142-167.

Parker, J. A. (2017), “Why don’t households smooth consumption? Evidence from a $25 million experiment,” American Economic Journal: Macroeconomics, Vol. 4(9), pp. 153-183.

Parker, J. A, Souleles, N. S., Johnson, D. S., and McClelland, R. (2013), “Consumer spending and the economic stimulus payments of 2008,” The American Economic Review, Vol. 103(6), pp. 2530-2553.

- Disclaimer: This article was written by Jiri Slacalek (Principal Economist, Directorate General Research, Monetary Policy Research Division). It is based on ECB Working Paper 2152 “Sticky Expectations and Consumption Dynamics”. The author gratefully acknowledges the comments of Paul Dudenhefer, Christophe Kamps, Alberto Martin and Zoë Sprokel. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank or the Eurosystem.