- PRESS RELEASE

April 2024 euro area bank lending survey

9 April 2024

- Credit standards were broadly unchanged in the first quarter of 2024

- Loan demand from firms declined substantially, contrary to bank expectations of a recovery

- Ongoing central bank balance sheet reduction continued to exert tightening pressure

- The positive impact of policy rate decisions on bank profits is expected to diminish over the next six months

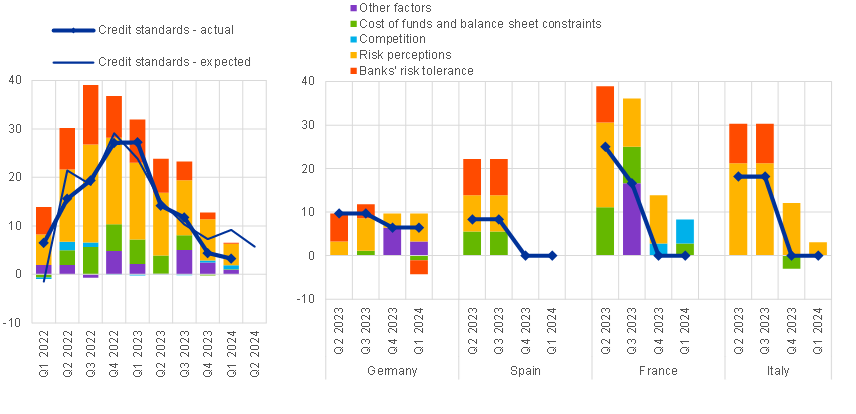

According to the April 2024 euro area bank lending survey (BLS), euro area banks reported a small net tightening of their credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises in the first quarter of 2024 (net percentage of banks of 3%; Chart 1), which was less than banks had expected in the previous round (9%). Banks, for the first time since the fourth quarter of 2021, reported a moderate net easing of their credit standards for loans to households for house purchase (net percentage of -6%), whereas credit standards for consumer credit and other lending to households tightened further (net percentage of 9%). Risk perceptions continued to exert tightening pressures across all loan categories, while competition and, for housing loans, also banks’ risk tolerance, contributed to an easing of credit standards. For the second quarter of 2024, banks expect moderate net tightening for loans to firms and unchanged credit standards for loans to households.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –remained broadly unchanged for loans to firms, while they eased for housing loans and tightened for consumer credit. Lending rates were the main driver of the net easing in terms and conditions for housing loans, while margins on average and riskier loans largely drove the tightening in terms and conditions for consumer credit.

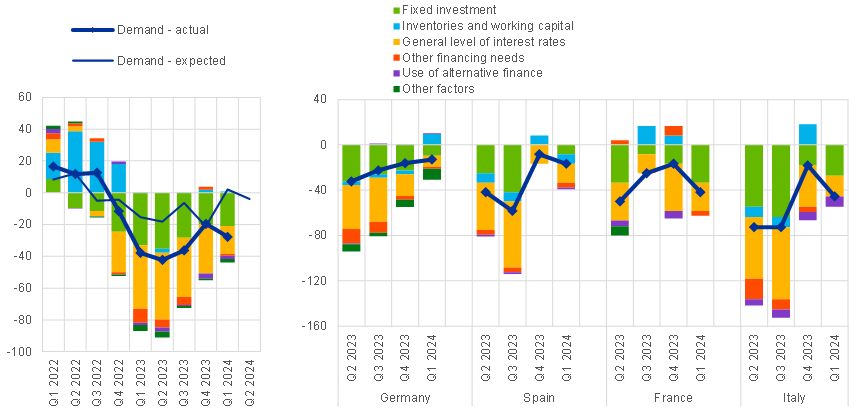

Banks reported a further substantial decline in demand from firms for loans or drawing of credit lines and a small decline in demand for housing loans, while demand for consumer credit and other lending to households was reported as broadly stable in the first quarter of 2024 (Chart 2). As has been the case in recent quarters, higher interest rates, as well as lower fixed investment for firms and lower consumer confidence for households, exerted dampening pressure on loan demand. The substantial decline in loan demand from firms contrasted with banks’ prior expectations of a stabilisation. Banks are expecting a moderate net decrease in demand for loans to firms and a net increase in demand for loans to households in the second quarter of 2024.

According to the banks surveyed, access to funding improved for debt securities and, to a lesser extent, for money markets, while access to retail funding deteriorated in the first quarter of 2024. The latter was driven by a further deterioration in banks’ access to short-term retail funding.

The reduction of the ECB’s monetary policy asset portfolio has had a further negative impact on banks’ financing conditions and liquidity positions over the past six months, resulting in a moderate tightening of terms and conditions and a negative effect on lending volumes. The impact on credit standards was seen as broadly neutral, although banks are expecting further tightening pressure over the next six months.

Euro area banks also indicated that the phase-out of the third series of targeted longer-term refinancing operations (TLTRO III) continued to negatively affect banks’ liquidity positions. Reflecting the very significant repayments made since November 2022 and the comparatively small remaining outstanding amounts of TLTRO III, banks reported only a small tightening impact on their overall funding conditions and a neutral effect on lending conditions.

Euro area banks reported a further markedly positive impact of the ECB’s key interest rate decisions on their net interest margins over the past six months, although the cumulative impact is expected to diminish over the next six months. Banks indicated a dampening impact via their net volumes, which is expected to persist over the next six months. The dampening impact of the ECB’s interest rate decisions expected over the next six months also extends to overall bank profitability, with a moderately negative contribution from provisioning and impairments.

The euro area BLS, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the April 2024 survey relate to changes observed in the first quarter of 2024 and changes expected in the second quarter of 2024, unless otherwise indicated. The April 2024 survey round was conducted between 29 February and 15 March 2024. A total of 157 banks were surveyed in this round, with a response rate of 100%.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

Source: ECB (BLS).

Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for “Other factors” refer to an average of the further factors which were mentioned by banks as having contributed to changes in loan demand.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found here too.

- The euro area and national data series are available on the ECB’s website via the ECB Data Portal. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the BLS, see Köhler-Ulbrich, P., Dimou, M., Ferrante, L. and Parle, C., “Happy anniversary, BLS – 20 years of the euro area bank lending survey”, Economic Bulletin, Issue 7, ECB, 2023, and Huennekes, F. and Köhler-Ulbrich, P., “What information does the euro area bank lending survey provide on future loan developments?”, Economic Bulletin, Issue 8, ECB, 2022.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts