Foreword

Financial stability conditions have improved since the last edition of the Financial Stability Review was published. The near-term risk of a deep recession accompanied by rising unemployment – a major source of concern six months ago – is much lower from today’s perspective, and disinflation has proceeded in parallel.

At the same time, geopolitical tensions are a significant source of risk for not only euro area financial stability but also global financial stability. Policy uncertainty remains high around the world in a year featuring so many major elections. In such an environment, the scope for adverse economic and financial surprises is elevated, and the risk outlook for euro area financial stability remains fragile accordingly.

Financial markets have been looking through these risks, with risk premia and volatility remaining unusually compressed by historical standards. Yet sentiment can change rapidly, not least given the geopolitical environment and pricing-for-perfection which creates the potential for large market reactions to disappointing news.

While there are risks ahead, financial stability also depends on shock-absorbing capacity. So far, household and corporate balance sheets have proven resilient through this interest rate cycle, while euro area banks have withstood shocks well. This should not provide grounds for complacency, as pockets of vulnerability remain. Debt servicing capacities differ across corporates, with large real estate firms displaying greater vulnerability to rising interest rates. Lower-income households are finding it harder to service their debts, despite buoyant labour markets. At the same time, fiscal fundamentals remain vulnerable to negative growth surprises and fiscal slippage, as maturing debt is refinanced at higher interest rates. Parts of the non-bank financial intermediation sector, notably a cohort of open-ended investment funds, exhibit significant liquidity mismatches. At the same time, some non-bank entities may face risks related to relatively high leverage and portfolio concentration.

This issue of the Financial Stability Review (FSR) includes three special features. The first examines the implications of geopolitical risk for euro area financial stability. The second analyses the risks and benefits associated with the rise of artificial intelligence, while the third focuses on the growing footprint of private markets.

The FSR has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks. The FSR promotes awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Luis de Guindos

Vice-President of the European Central Bank

Overview

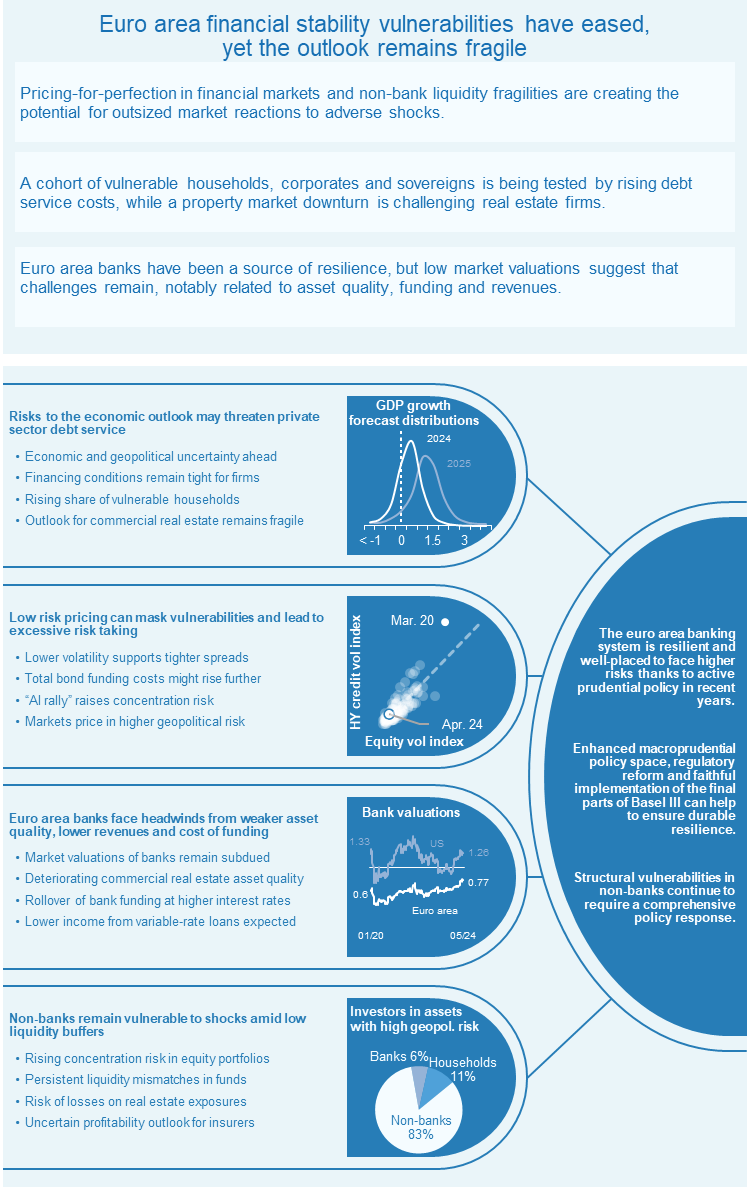

Euro area financial stability vulnerabilities have eased, yet the outlook remains fragile

Financial stability in the euro area has benefited from an improving economic outlook, but rising geopolitical risks could pose considerable downside risks. Favourable economic surprises in recent months have fostered investors’ baseline expectations that euro area inflation will reach the ECB’s target without a deep economic contraction, achieving a “soft-landing” scenario (Chart 1, panel a). Associated analyst expectations of interest rate cuts sparked a rally in financial markets, with growing signs of pricing-for-perfection creating the potential for outsized market reactions to disappointments. A key feature of post-pandemic balance sheet adjustment has been a fall in the debt ratios of euro area households, firms and sovereigns, which should bolster resilience in the medium to long term; however, some households, firms and sovereigns still have balance sheet vulnerabilities and could be challenged by rising debt service costs going forward. Euro area banks recorded strong profits in 2023 which, through the retention of earnings, helped to maintain resilience, but there are indications that the peak may have been reached. At the same time, the ongoing downturn in property markets, especially in commercial real estate, could have knock-on effects on the asset quality of some banks. Overall, despite reduced near-term recession risks and baseline expectations for an imminent return of moderate growth, risks to financial stability remain high. The likelihood of tail events materialising appears elevated as geopolitical risk has been on the rise (Chart 1, panel b). Should tensions ratchet up further, this could affect the supply of energy commodities, undermine confidence in the real economy, fuel inflation and spark risk aversion in financial markets (Special Feature A). Similarly, global economic policy uncertainty remains high, as countries with more than half of the world’s population are sending their citizens to the polls in 2024.

Against this backdrop, three key themes are shaping the outlook for euro area financial stability. First, benign risk pricing in financial markets and structural liquidity vulnerabilities in non-banks harbour the potential for sudden shifts in market sentiment in response to adverse shocks, triggered, for example, by negative macro-financial surprises or heightened geopolitical tensions. Second, rising debt service costs are challenging euro area households, firms and sovereigns with weak balance sheets, and the downturn in property markets is, in some cases, compounding household and corporate vulnerabilities. Third, euro area banks have remained resilient, supported by strong profitability. Bank earnings appear set to moderate somewhat from recent highs in the next two years. At the same time, bank market values, while having risen somewhat, remain stubbornly below book values − indicating deeper seeded investor concerns about the durability of bank profitability.

Chart 1

Positive macro surprises point to a soft landing, but tail risks remain elevated in the light of high macro-financial and geopolitical uncertainty

a) Citi Economic and Inflation Surprise Indices for the euro area and the United States | b) Global policy uncertainty and geopolitical risk index |

|---|---|

(May 2023-Apr. 2024, indices) | (Jan. 2004-Apr. 2024, indices) |

|  |

Sources: Bloomberg Finance L.P., Caldara and Iacoviello*, Baker, Bloom and Davis** and ECB calculations.

Notes: Panel b: the dashed lines represent the long-term averages over the period from January 1997 to April 2024. The global policy uncertainty index is shown until February 2024.

*) Caldara, D. and Iacoviello, M., “Measuring Geopolitical Risk”, American Economic Review, Vol. 112, No 4, April 2022, pp. 1194-1225.

**) Baker, S., Bloom, N. and Davis, S., “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics, Vol. 131, No 4, November 2016, pp. 1593-1636.

Asset prices remain vulnerable to adverse dynamics that may be amplified by liquidity risks in non-banks

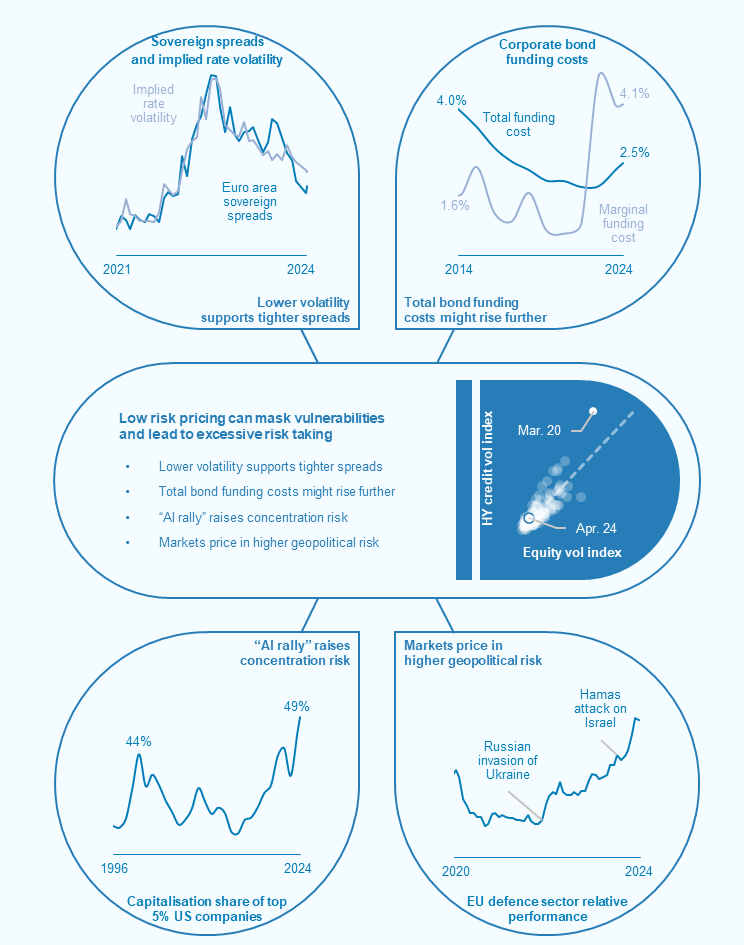

Expectations of monetary policy easing have boosted investor demand for risky assets, but risk sentiment in markets has been fickle. Expectations that monetary policy will ease around the world have been fuelling investors’ appetite for risky assets since October 2023, as markets have been pricing-in a soft landing for the global and euro area economies. Reflecting this, stock prices have increased and credit spreads have narrowed, with a short-lived reversal more recently (Chart 2, panel a). At the same time, equity market volatility has remained relatively subdued, despite the recent uptick and continued substantial uncertainty in both the macro-financial and geopolitical environments, and has diverged from volatility in interest rate markets, which has been elevated (Box 2). In this environment of substantial risks to growth and structurally higher funding costs, markets might underestimate and under-price the likelihood and the impact of adverse scenarios, which could cause vulnerabilities to build up. Moreover, there is a greater likelihood of negative surprises resulting in abrupt shifts in sentiment. Volatility in financial markets could increase significantly, should inflation deviate substantially from consensus expectations, if economic growth weakens or if geopolitical conflicts escalate further (Chart 2, panel b). Heightened concentration and high valuations in equity markets, notably in the United States, indicate scope for greater volatility and potential for a market correction. Given deeply integrated global equity markets, financial stability risks for the euro area might stem from adverse spillovers from the United States.

Chart 2

Geopolitical tensions may spark volatility and trigger adjustments in financial markets, which could be amplified by non-banks with low liquidity and high leverage

a) Global equity markets and high-yield corporate bond spreads | b) Historical volatility distributions, by geopolitical risk regime | c) Liquidity mismatch and leverage among euro area investment funds |

|---|---|---|

(1 Jan. 2021-7 May 2024; index, basis points) | (3 Jan. 2000-7 May 2024, indices) | (Q4 2023, ratios, bubble size: total assets, € trillions) |

|  |  |

Sources: Bloomberg Finance L.P., Caldara and Iacoviello, ECB (IVF) and ECB calculations.

Notes: Panel a: the MSCI All Country World Index is used for global equity markets; the ICE BofA Global High Yield Index is used for global high-yield bond spreads. Panel b: VIX – index for implied volatility in the US equity market, MOVE – index for implied volatility in the US Treasury bond market. Geopolitical risk is measured by the geopolitical risk index (GPRI) created by Caldara and Iacoviello, op. cit. High geopolitical risk denotes episodes when the GPRI was at least 2 standard deviations above its average since 2000. Boxplots show the distributions of standardised volatility measures since 2000, where whiskers denote the 5th and 95th percentiles. Panel c: includes open-ended investment funds only. Liquidity mismatch is defined as the ratio of investment fund shares issued to liquid assets (deposits and debt securities with a maturity of less than one year, euro area sovereign bonds, investment and money market fund shares, and advanced economy listed shares). Financial leverage is defined as total assets divided by shares issued.

The non-bank financial intermediation sector could still amplify any market correction, given liquidity vulnerabilities, leveraged exposures and rising concentration risks. Non-banks have benefited from improving market conditions in recent months, supporting their portfolio valuations, while higher interest rates have also boosted investment income from debt securities. However, asset quality in non-bank portfolios may still be impaired by worsening corporate sector fundamentals and real estate market conditions together with rising geopolitical risk (Special Feature A). In this context, any shocks to market valuations could trigger a rise in investment fund outflows or margin calls on derivative exposures. Given low liquid asset holdings and significant liquidity mismatches in some types of open-ended investment funds, this could result in forced asset sales that may negatively affect wider financial stability (Chart 2, panel c). Although generally limited, pockets of elevated financial and synthetic leverage in some entities may add to spillover risks. In addition, concentration in equity portfolios − notably in investment funds due to exposures to US-based technology firms − has increased markedly in recent years (Chapter 4), making investment portfolios more vulnerable to idiosyncratic shocks or adverse developments in the US economy. For the insurance sector, uncertainties around a weak macro-financial outlook highlight possible profitability headwinds. These include both underwriting profitability challenges for life insurers and consistently low returns on debt securities portfolios.

Tight financial conditions are testing the resilience of vulnerable households, firms and sovereigns

Euro area households, firms and sovereigns have so far remained resilient on aggregate, albeit with some pockets of vulnerability. The indebtedness of euro area households, firms and sovereigns has declined from post-pandemic highs (Chart 3, panel a), alleviating debt sustainability concerns. However, associated vulnerabilities remain elevated, especially among sovereigns. Here indebtedness remains above pre-pandemic levels, owing partly to a transfer of risk from the private sector to sovereign balance sheets during the pandemic as well as during the recent energy crisis and period of high inflation. The debt service costs of non-financial sectors are likely to remain at current high levels or even creep up further as the debt originally contracted at historically low interest rates and at long maturities continues to reprice at prevailing, significantly higher, interest rates. This means that a vulnerable cohort of highly indebted households, firms and sovereigns may still see their debt servicing capabilities challenged going forward.

Sovereign financing conditions have improved, but fiscal fundamentals remain vulnerable to negative growth surprises and fiscal slippage. Sovereign borrowing costs have benefited from easier financing conditions of late and positive rating actions in some countries (Chart 3, panel b). Interest costs are set to rise further, however, especially for sovereigns with high short-term refinancing needs, as maturing public debt is rolled over at higher interest rates. Despite falling debt-to-GDP ratios in recent years, fiscal fundamentals remain fragile in a number of countries, as indicated by missed deficit targets in some cases in 2023. Given structural headwinds to potential growth from factors such as weak productivity, persistently elevated debt levels and budget deficits would be more likely to reignite debt sustainability concerns and push sovereign credit risk premia higher in the event of adverse macro-financial surprises. Risks of fiscal slippage in the light of a busy electoral agenda in 2024-25 (at both national and EU levels) or uncertainties around the exact implementation of the new EU fiscal framework could lead market participants to reprice sovereign risk. On the other hand, greater fiscal reform to ensure that public finances have a more growth-friendly composition could enhance the medium-term economic growth potential of the euro area, thereby mitigating debt sustainability risks.

Chart 3

Debt levels in the non-financial sectors have fallen from pandemic highs, but debt service costs may still rise further

a) Household, NFC and sovereign indebtedness | b) Ten-year government bond yields and credit ratings of euro area sovereigns | c) Lending rates to the euro area non-financial private sector |

|---|---|---|

(percentages of GDP) | (percentages, rating buckets) | (Jan. 2015-Mar. 2024, percentages) |

|  |  |

Sources: Bloomberg Finance L.P., LSEG, S&P Global Market Intelligence, Moody’s Analytics, Fitch Ratings, Eurostat and ECB (QSA), ECB (MIR) and ECB calculations.

Notes: Panel a: NFCs stands for non-financial corporations. NFC debt is illustrated in unconsolidated terms, i.e. including intra-sectoral loans. “Pre-pandemic” indicates figures as at Q4 2019, “Pandemic peak” refers to Q1 2021, and the latest observation captures Q4 2023. Panel b: ratings and rating outlooks are aggregated from S&P, Moody’s and Fitch and are shown as at 31 October 2023 and 30 April 2024. Rating outlooks are only indicated for those sovereigns for which the aggregated outlook has changed since October 2023. Aggregated outlooks can be determined by the outlook from a single agency; for instance, two stable outlooks and one negative outlook, which was the case for Italy in October 2023, are aggregated to form an overall negative outlook.

Euro area household and corporate balance sheets have been bolstered by a resilient labour market and strong post-pandemic profits. Corporate profitability has continued to hold up relatively well, supporting firms’ debt servicing capacity (Section 1.3). Declining energy and other input costs have boosted corporate earnings despite weak consumer demand, although the impact of anaemic growth and higher labour costs on profit margins might not have fully materialised yet. While corporate insolvencies have continued rising to above pre-pandemic levels in a number of euro area countries, defaults and non-performing loan rates have remained relatively low. At the same time, euro area household vulnerabilities have been mitigated by the resilience of labour markets, coupled with government support measures and excess savings accumulated during the pandemic. While household and corporate debt-to-GDP levels have dropped below pre-pandemic readings, the pass-through of higher interest rates to debt service costs is incomplete. Continued loan repricing at higher market rates than on outstanding loans (Chart 3, panel c), together with weaker than expected growth and deteriorating labour market conditions, could erode household and corporate debt servicing capacity. At the same time, evaporating liquidity buffers (Chart 4, panel a) may render households and firms vulnerable to unexpected adverse shocks.

Pockets of vulnerability remain, as high interest rates weigh on the debt servicing capacity of vulnerable households and firms. High debt service costs could prove especially challenging for firms with lower credit ratings, as reflected by the rise in expected default frequencies in the high-yield segment. Expected default rates are also highly uneven across economic sectors, with firms operating in wholesale trade or in real estate seeing some of the largest increases in expected default rates (Chart 4, panel b). Defaults could rise if yields remain high, energy prices soar again or global supply chain disruptions intensify. Euro area households, especially those with lower incomes and in countries with mainly floating-rate mortgage lending, are being relatively more challenged by higher interest rates (Chart 4, panel c). However, middle-income households may be affected too, especially if labour market conditions were to weaken considerably. In such a scenario the implications for banks mortgage portfolios could become notable.

Chart 4

Declining liquidity buffers of euro area households and firms in recent years may weigh on the debt servicing capabilities of vulnerable cohorts

a) Cash and deposit holdings of euro area households and NFCs | b) One-year default rate forecasts in Europe, by industry | c) Household expectations of payment difficulties in the next three months, by income |

|---|---|---|

(Q1 2016-Q4 2023, percentages of GDP) | (June 2022, Mar. 2024, percentages) | (Q1 2021-Q1 2024, percentages of consumers) |

|  |  |

Sources: Eurostat and ECB (QSA), ECB (CES), Moody’s Analytics and ECB calculations.

Notes: Panel b: June 2022 is the month before the start of the recent monetary policy hiking cycle. Panel c: the share of consumers is calculated using survey weights, and the total number of surveyed households includes those who report not having a loan or answering “don’t know”. The sample of countries comprises Belgium, Germany, Spain, France, Italy and the Netherlands, and from April 2022 also includes Ireland, Greece, Austria, Portugal and Finland. The share of lower-income households is calculated as the average of the first and second income quintiles, middle-income households correspond to the third income quintile, and higher-income households comprise the average of the fourth and fifth income quintiles. The total shares are equal-weighted averages of the shares for mortgages and other loans.

Tight financial conditions have underscored vulnerabilities in real estate markets, compounding the challenges faced by some households and firms. The sharp downturn in the commercial real estate (CRE) sector has continued (Chart 5, panel a), with subdued market activity continuing to hamper price discovery. Prices could decline further, given structurally lower demand for some CRE assets post-pandemic, notably in the office segment (Section 1.5). Sharp drops in rental income and profit margins since early 2022 have made real estate firms particularly vulnerable to losses, compounding the challenges posed by refinancing debt at higher rates (Box 1). The ongoing adjustment in residential real estate (RRE) markets has remained orderly, as households’ financial positions have been underpinned by the strength of the labour market. There have also been signs of incipient stabilisation of euro area house prices at the aggregate level, but risks remain tilted to the downside, especially in countries with elevated debt levels and overvalued property markets. That said, the expected decline in borrowing costs might alleviate affordability challenges and boost loan demand going forward. Overall, the downturn in the RRE market should remain orderly, unless labour market conditions deteriorate significantly.

Banks remained resilient, but face headwinds from weaker asset quality, lower revenues and cost of funding

There are signs of deterioration in the asset quality of euro area banks, notably in CRE portfolios. While banks’ non-performing loan ratios remained at historically low levels just above 2% in 2023, there have been nascent signs of rising losses on a subset of loan portfolios that are more sensitive to cyclical downturns. In fact, CRE loan books have been the main driver of asset quality deterioration, reflecting both the downturn in euro area CRE markets and spillovers from the ongoing correction in US CRE markets to euro area banks with material exposures. That said, these portfolios are generally modest in size and should not have a systemic impact on the banking sector. For some banks with above-average CRE exposure, though, a marked deterioration in CRE asset quality could pose challenges. At the same time, the credit risk outlook for household and corporate portfolios remains tilted to the downside, as macro-financial conditions are weak and borrowers are increasingly feeling the impact of higher interest rates. As a result, banks may face the risk of higher provisioning costs if risks in the non-financial sectors materialise, not least because collateral values may not to be fully reflected in banks’ balance sheets.

Euro area banks continue to face funding cost headwinds. Since the previous issue of the Financial Stability Review was published, bank bond yields have declined and new business deposit rates have lost upward momentum in line with market expectations of looming policy rate cuts (Chart 5, panel b). However, the average cost of outstanding bank funding has risen further, reflecting a shift in composition towards more expensive sources of funding. In particular, depositors seeking higher remuneration have been shifting from overnight deposits to higher-yielding term deposits. At the same time, bond funding has also been growing as it replaces other sources such as the ECB’s targeted longer-term refinancing operations (TLTROs). Looking ahead, bank funding costs seem set to remain high as maturing liabilities reprice at higher levels and the composition of funding continues moving back towards long-run averages featuring a higher share of term deposits and bonds. Overall funding costs might therefore still increase further, even if policy rates start to decline.

Low bank valuations indicate market concerns regarding the longer-term sustainability of bank profits. In recent years, strong euro area bank profitability has primarily been driven by rising net interest margins. This is because bank funding costs adjusted more slowly than lending rates due to the automatic repricing of floating-rate loans. As such, floating-rate assets could now turn into a headwind for banks’ interest income as policy rates are expected to fall, while overall funding costs may increase still further. Indeed, the recent decrease in interest rate spreads suggests that euro area banks are likely to see their net interest margins decline (Chart 5, panel c). Margin compression, together with continued muted lending volumes, could serve to reduce banks’ operating income and compound the challenges stemming from deteriorating asset quality, ultimately weighing on bank profitability. These profitability uncertainties are also visible in euro area bank price-to-book valuations, which have continued to hover around 0.7 (Chapter 3), well below those of some major international peers.

Chart 5

Euro area bank profitability has likely peaked, with signs of worsening asset quality and higher funding costs posing headwinds to euro area banks going forward

a) CRE values, RRE prices and net NPL inflows across euro area countries | b) Bank funding costs on new funding, by type of funding source | c) Euro area banks’ net interest rate spread and margin |

|---|---|---|

(Q4 2023, annual percentage changes) | (Jan. 2016-Mar. 2024, percentages) | (Jan. 2016-Mar. 2024; percentage points, percentages) |

|  |  |

Sources: Bloomberg Finance L.P., Dealogic, Eurostat and ECB (RESR), ECB (MIR, RESC, supervisory data) and ECB calculations.

Notes: Panel a: NPL stands for non-performing loan. Panel b: market implied €STR is shown for April 2024 until March 2026. Panel c: net interest margin is shown until the fourth quarter of 2023.

From a structural perspective, a greater need to respond to cyber and climate risks, and strong interlinkages with the non-bank financial intermediation (NBFI) sector, may also challenge euro area banks. Next to the headwinds associated with challenging macro-financial conditions that lie ahead, euro area banks need to press ahead with digital transformation, not least so that they can respond to the growing threat of cyber risks as well as address the opportunities and challenges associated with the rise of artificial intelligence (Special Feature B). Euro area banks also need to carefully manage the implications of the transition to a greener economy. In addition, elevated vulnerabilities in the NBFI sector may produce spillover risks for euro area banks, given strong interconnections between these sub-sectors of the financial system, not least via the funding channel (Box 4).

Macroprudential policies can help safeguard and strengthen resilience across the financial system

All in all, financial stability vulnerabilities have eased, but the outlook remains fragile. Financial stability conditions have improved somewhat since the previous issue of the Financial Stability Review was published. This includes some positive economic surprises and faster than expected disinflation, underpinning expectations in financial markets of a soft landing. That said, despite improved baseline expectations, the likelihood of tail events appears elevated. In particular, the materialisation of downside risks to economic growth, more persistent inflation outturns or acute geopolitical stress could expose existing vulnerabilities. This would notably concern risks associated with the potential for disorderly adjustments in financial markets, coupled with debt servicing challenges for highly indebted households, firms and sovereigns and their adverse knock-on effects on the asset quality of euro area banks.

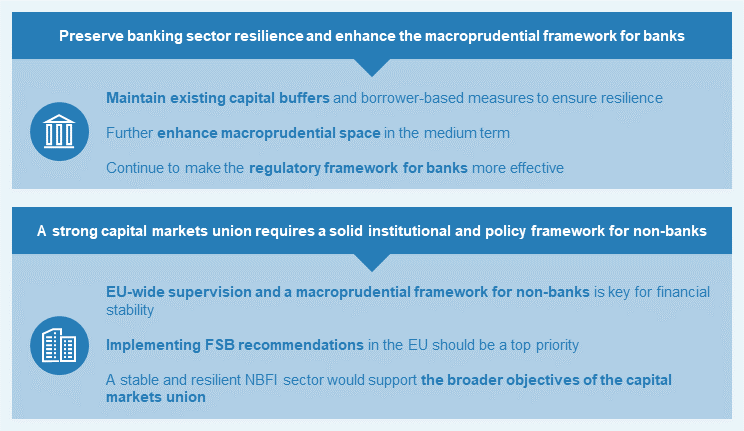

Preserving the resilience of the banking sector and, where conditions are favourable, further increasing macroprudential space remain crucial in an uncertain macro-financial environment. The resilience of the euro area banking sector is, on aggregate, underpinned by strong capital and liquidity positions. Standard regulatory metrics point towards strong liquidity resilience overall, despite more than 90% of borrowed TLTRO funds being repaid over recent quarters. On aggregate, solvency ratios remain robust, supported by organic growth from high bank profitability. In recent years, euro area macroprudential authorities have also implemented a comprehensive set of measures that have bolstered banks’ resilience and enhanced the availability of releasable capital buffers. As such, it is prudent to maintain macroprudential capital buffers to ensure that they remain available in case of headwinds. Prevailing borrower-based measures can continue to act as structural backstops to ensure sound lending standards in a framework where capital-based and borrower-based measures complement each other. The recent strength of profitability of the banking sector can be used to further increase macroprudential space through releasable capital buffers, to further strengthen the resilience of bank lending to the economy in the event of marked economic downturns.

Structural vulnerabilities in the NBFI sector require a comprehensive policy response to enhance its resilience from a macroprudential perspective. A large market footprint and the interconnectedness of non-bank financial institutions call for a comprehensive set of policy measures to increase the sector’s resilience. This includes policies aimed at enhancing the liquidity preparedness of non-bank market participants to meet margin and collateral calls (Box 5), tackling risks from non-bank leverage (Box 6), mitigating liquidity mismatch in open-ended funds and enhancing the resilience of money market funds to liquidity shocks (Section 5.2). A more integrated EU-wide system of supervision for non-banks would also build a level playing field and reduce the potential for regulatory arbitrage. A resilient NBFI sector would also help to foster more integrated capital markets, which could enhance financial stability and complement the objectives of the capital markets union.

1 Macro-financial and credit environment

1.1 While risks of a deep recession have declined, geopolitical risks are on the rise

Investor sentiment has been recovering alongside an improving macro-financial outlook, although prospects for growth vary across euro area countries. Headline inflation in the euro area is now projected to fall to 2.3% in 2024, compared with 2.7% expected just six months ago. In parallel, although economic growth in 2024 is likely to be weaker than previously hoped, there is less likelihood of the euro area experiencing a severe downturn. Taken together, this has improved near-term investor sentiment. Looking ahead, the financial stability outlook will increasingly depend on mixed medium-term growth prospects. On the one hand, economic activity is expected to pick up more strongly over the period 2025-26 (Chart 1.1, panel a), supported by resilient labour markets and a recovery in households’ real incomes. On the other hand, structural challenges (related to, for example, slow digitalisation, weak innovation and an ageing population) remain a drag on productivity and income growth. Finally, current growth expectations vary considerably across the euro area (Chart 1.1, panel b), making some countries more vulnerable to future adverse shocks than others.

Chart 1.1

The near-term economic outlook is improving unevenly across countries, while medium-term growth challenges remain

a) Economic growth outlook in the euro area | b) Distribution of real GDP growth forecasts across euro area countries for 2024 and 2025 |

|---|---|

(2018-26; index, 2018 = 100) | (Apr. 2024, percentages) |

|  |

Sources: ECB staff macroeconomic projections for the euro area, March 2024, Consensus Economics Inc. and ECB calculations.

Notes: Panel a: alternative post-2019 GDP paths use different assumptions about annual GDP growth rates. Panel b: the cross-country distributions of GDP growth forecasts are based on average country forecasts made by professional forecasters in April 2024 for Belgium, Germany, Ireland, Greece, Spain, France, Italy, the Netherlands, Austria, Portugal and Finland.

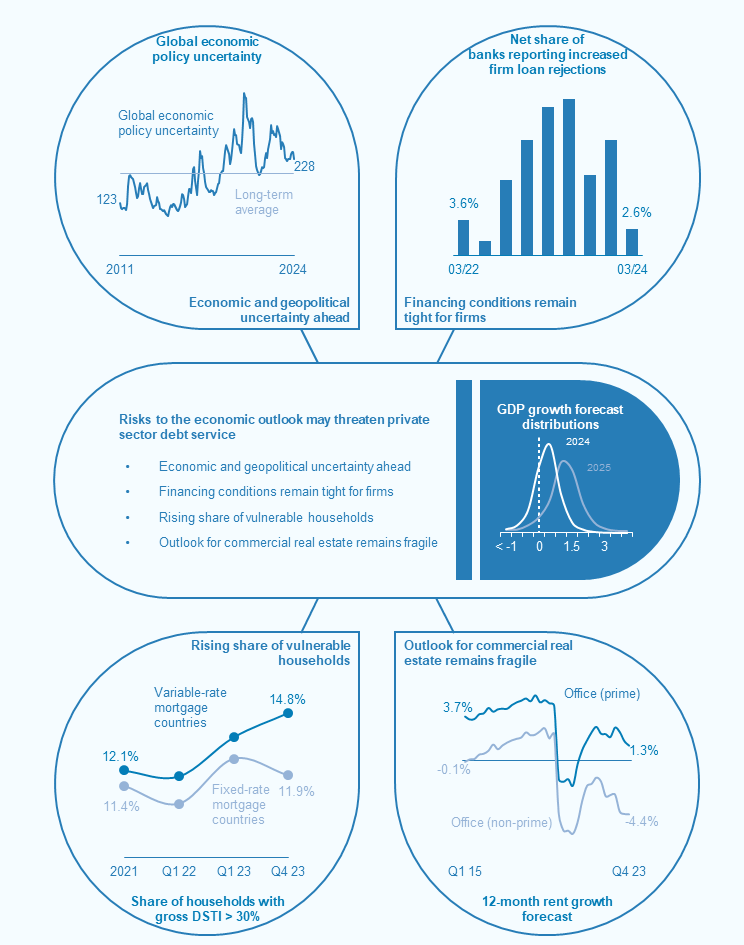

Risks to the macro-financial outlook remain elevated. Several such risks are related to external factors. Global demand could surprise to the downside if tight financing conditions continue to squeeze incomes and expenditure more strongly than expected, or if higher than expected inflation in the United States leads to a delayed easing of US monetary policy spilling over to tighter financing conditions globally. Divergent policy paths between the United States and the euro area would in turn increase the risk of adverse spillovers to European financial markets (Chart 1.2, panel a). Demand for euro area exports could be further weakened if the ongoing adjustment in property markets in China has a more pronounced, negative impact on its broader economy. As some euro area economies with relatively weaker near-term growth prospects depend heavily on exports to China, this would further amplify divergence between growth outcomes in the euro area. While progress has been made in bringing euro area inflation down, domestic price pressures are still high, owing in part to strong wage growth which could still surprise to the upside given how tight labour markets are. Globally diverging monetary policy paths could also lead to higher inflation via their impact on the euro exchange rate and import prices.[1] Finally, geopolitical tensions could, as a result of their impact on commodity prices and global supply chains, lead to renewed inflationary pressures in the euro area as well.

Chart 1.2

Elevated external risks cloud the macroeconomic outlook for the euro area

a) Evolution of economic growth forecasts for 2024 | b) Container shipping costs and global supply chain pressures | c) New trade restrictions around the world, by year of introduction |

|---|---|---|

(Jan. 2023-Apr. 2024, percentages) | (Jan. 2018-Apr. 2024; index, USD) | (2014-May 2024, number of measures) |

|  |  |

Sources: Consensus Economics Inc., Bloomberg Finance L.P., Federal Reserve Bank of New York (AMEC), Global Trade Alert and ECB calculations.

Notes: Panel a: average GDP growth forecasts among professional forecasters. Panel b: higher values for the Global Supply Chain Pressure Index represent greater pressures on supply chains. Panel c: all measures introduced globally that restrict cross-border flows of goods, services and foreign direct investment. Data for 2024 are as of 7 May 2024.

Geopolitical tensions have risen, posing risks to the global growth outlook and the euro area disinflation process. Russia’s war against Ukraine and the conflict in the Middle East are key sources of tail risk. The recent attacks on cargo ships on the Red Sea trade route triggered an abrupt rise in shipping costs between Asia and Europe in December 2023 (Chart 1.2, panel b) and global supply chain pressures have been on the rise since last autumn. The immediate risks to inflation and growth in the euro area from the Red Sea attacks seem limited owing to their minimal impact on oil production costs, current spare capacity in global shipping and subdued global demand. However, the impact on euro area growth and inflation could be substantial if the disruptions were to escalate to the broader region and last longer. The recent intensification of the Iran-Israel conflict has increased the probability of such a tail-risk scenario materialising. The expected reduction in oil production by its main exporters, as well as supply disruptions to oil and gas facilities in Russia and Ukraine, pose further upside risks to oil and gas prices. The rise in geopolitical tensions between major economies in recent years is also leading to weakening global trade links. For example, the share of imports to the United States from China declined from 25% in 2017 to 15% in 2023, and the number of protectionist measures targeting cross-border trade is increasing globally (Chart 1.2, panel c). Continued geopolitical tensions pose the risk of economic and financial fragmentation in the world economy, with potential adverse effects on financial stability in the euro area and globally. These potential effects could include slower productivity growth and higher production costs resulting from less efficient resource allocation, greater macro-financial volatility due to reduced international risk-sharing opportunities, and lower profitability and a higher cost of funding for financial institutions on the back of reduced cross-border capital flows. In this context, the record number of elections due to take place across the world in 2024 are likely to keep the uncertainty around global economic policies elevated.

1.2 Lax fiscal policies may reinforce public debt sustainability concerns

While sovereign financing conditions have improved, borrowing needs are high and could be tested by rising geopolitical tensions and other risks. Euro area sovereigns have benefited from easier global financing conditions in recent months, and demand for sovereign debt has been strong as investors try to lock in higher yields before the expected cuts in central bank interest rates materialise (Chart 1.3, panel a). Spreads between lower- and higher-rated sovereigns have also declined (Chart 3, panel b in the Overview), reflecting favourable risk sentiment, as well as better prospects for growth in lower-rated countries and declining debt-to-GDP ratios. Nevertheless, since yields on new sovereign issuances are still above average yields on outstanding debt, sovereign interest burdens are continuing to rise. This could lead to greater challenges ahead, particularly for countries with greater short-term financing needs. Any reassessment of sovereign risk by market participants due to high debt levels and lenient fiscal policies could raise borrowing costs further and have negative financial stability effects, including via spillovers to private borrowers and to sovereign bond holders. Finally, rising geopolitical tensions and upcoming elections in many countries are increasing uncertainty around future borrowing needs.

Chart 1.3

Sovereign debt issuance is currently benefiting from strong investor demand, but projected large financing needs leave sovereigns vulnerable to adverse shocks

a) Cumulative sovereign debt issuance in the euro area, by maturity at origination | b) Past and projected structural primary balances across euro area countries |

|---|---|

(Jan. 2020-Mar. 2024; € billions, years) | (2016-19 and projections for 2024-25, percentages of GDP) |

|  |

Sources: Eurostat and ECB (GFS), European Commission (AMECO) and ECB calculations.

Notes: Panel a: the bars in the chart show cumulative debt issuance since the start of the calendar year. Panel b: for Greece (not shown), the average structural primary balance was 8.7% of GDP in the period 2016-19 and is expected to average 1.9% of GDP in the period 2024-25.

National budget deficits are expected to stay larger than they were before the pandemic as many of the support measures taken have remained in place. While most of the energy and inflation support measures introduced after the Russian invasion of Ukraine are being phased out, many of the measures taken during the pandemic have not been fully rolled back. Moreover, structural primary balances (i.e. budget balances adjusted for the impact of changes in economic growth due to business cycle fluctuations and excluding interest payments on outstanding debt) are expected to remain well below pre-pandemic levels over 2024-25. This is the case for almost all euro area countries, irrespective of their starting level of sovereign debt (Chart 1.3, panel b). Potential fiscal slippages are an additional concern, as weakening economic activity has already contributed to some countries missing deficit targets in 2023, and the upcoming cycle of elections is increasing the risk of fiscal targets being missed as well. The lack of envisaged fiscal consolidation, combined with high debt levels, makes national budgets vulnerable to intensifying geopolitical tensions should these require increases in spending on defence, for example. It would also be more difficult to accommodate additional investment in areas such as climate change and digital technology, which would have a negative effect on euro area growth potential.

Chart 1.4

Despite falling somewhat in recent years, projected sovereign debt levels remain high

a) Change in euro area government debt-to-GDP and its drivers | b) Projected government debt-to-GDP ratios across euro area countries |

|---|---|

(2021-25, percentages of GDP and percentage point contributions) | (2019 and 2025, percentages of GDP) |

|  |

Sources: European Commission (AMECO), Eurostat and ECB (GFS) and ECB calculations.

Note: Panel a: values for 2024 and 2025 are projections.

High levels of debt make euro area sovereigns vulnerable to adverse shocks, especially given the structural weakness in productivity and potential growth. While the government debt-to-GDP ratio in the euro area has fallen gradually from its pandemic-era peaks, the drop has been primarily driven by the post-pandemic recovery in nominal GDP, which has more than offset the impact of higher debt service costs on debt levels (Chart 1.4, panel a). With weaker nominal growth prospects ahead and little change expected in the structural primary balances, the debt-to-GDP ratio is falling at a slower pace. As a result, public debt levels in most euro area countries are expected to remain above pre-pandemic levels in the short to medium term (Chart 1.4, panel b). More importantly, structural headwinds to potential growth, from weak productivity for instance, are raising concerns about longer-term debt sustainability, making sovereign finances more vulnerable to adverse shocks and elevating risks to the financial stability outlook.

1.3 Euro area firms are coping with rising debt service costs

Resilient post-pandemic profitability has helped firms to service the rising cost of debt, but weak growth and high labour costs are creating challenges. The interest payments faced by non-financial corporations (NFCs) have risen further in recent quarters (Chart 1.5, panel a) and are expected to remain close to their current levels or even increase for some corporates in the near future, even if the cost of new borrowing continues to decline. This is because a large share of firms still need to refinance loans and bonds that were originated at low interest rates, before the recent surge in borrowing costs. For example, at the end of 2021, around 25% of firms’ bank loans had interest rates fixed for between two and five years. Firms’ debt repayment capacity has held up relatively well so far, supported by the strong revenue growth seen in recent years (Box 1). At the same time, however, firms’ profitability is weakening and is expected to decline further in 2024, owing to the poor outlook for growth for 2024 (Chart 1.5, panel b) and the fact that labour costs are still growing strongly. Since access to external funding could remain constrained by tight bank lending standards for a longer period of time (Chapter 3), a significant and protracted slowdown in earnings growth would make debt repayments much more difficult to meet, especially for firms that have already drawn on their cash buffers.

Chart 1.5

If profitability weakens, firms’ ability to accommodate rising debt service costs could be challenged, especially in sectors most sensitive to changes in interest rates

a) Interest payments and net entrepreneurial income growth | b) Expected growth in the nominal earnings of listed euro area companies | c) Median interest coverage ratio and cash buffers in selected sectors |

|---|---|---|

(Q1 2005-Q4 2023; percentages, year-on-year percentage point changes) | (2 June 2023-26 Apr. 2024, year-on year percentage point changes) | (Q4 2019 vs Q4 2023, percentages) |

|  |  |

Sources: Eurostat and ECB (MNA, QSA), LSEG, S&P Global Market Intelligence and ECB calculations.

Notes: Panel a: the debt service ratio is the sum of the interest paid in the current and the past three quarters divided by the sum of net operating surplus and property income in the current and the past three quarters for the NFC sector. Net entrepreneurial income is the sum of gross operating surplus and property income net of depreciation. Panel b: analysts’ forecasts for nominal earnings growth for 2024 and 2025 are calculated for the companies included in the MSCI EMU index. Panel c: the cash-to-assets ratio is defined as cash plus cash equivalents over total assets. ICR stands for interest coverage ratio and is defined as the ratio of earnings before interest, taxes, depreciation and amortisation (EBITDA) to interest expense. Firm-level ICR and the cash-to-assets ratio are computed as four-quarter moving averages. “Comm. services” stands for communication services; “Consumer discr.” stands for consumer discretionary goods.

Vulnerabilities are elevated, particularly in those sectors and countries most exposed to the impact of higher interest rates. While the overall debt servicing capacity of euro area firms has been resilient, tight financing conditions have had a bigger impact on some countries and sectors than on others. Among large firms, the ability to meet interest payments from earnings has declined substantially since the end of 2019 in those sectors, such as real estate and discretionary consumer goods, affected by weaker demand on the back of higher interest rates on consumer and mortgage loans (Chart 1.5, panel c). Firms in the real estate sector have seen particularly large declines in their profitability since mid-2022, making them highly vulnerable to continuing tight financing conditions and to downside risks to the growth outlook (Section 1.5). Default rates on bank loans to commercial real estate firms are rising (albeit from low levels), reflecting eroding financial health. The same also applies to loans to small and medium-sized enterprises, since they have smaller liquidity buffers and lower profit margins than bigger firms (Chapter 3). Finally, corporate interest burdens have also increased more strongly in euro area countries where floating-rate lending is prevalent than in countries with a larger share of fixed-rate loans (Box 1). At the same time, if downside risks do not materialise, NFCs with floating-rate loans will also benefit more quickly from the expected declines in market rates than borrowers with fixed-rate loans.

Chart 1.6

Subdued borrowing is contributing to declining indebtedness of euro area corporates

a) NFC financing flows and demand for bank loans | b) Change in corporate indebtedness since Q2 2022, by country |

|---|---|

(Q1 2018-Q1 2024; € billions, index) | (Q2 2022 vs Q4 2023, percentages) |

|  |

Sources: ECB (BLS, BSI, CSEC), Eurostat and ECB (QSA) and ECB calculations.

Notes: Panel a: the “bank loan demand” indicator reflects changes anticipated by banks. It is equal to the difference between the sum of the shares of banks responding that demand for corporate loans is expected to “increase considerably” and “increase somewhat” and the sum of the shares of banks responding that demand for corporate loans is expected to “decrease somewhat” and “decrease considerably”. Panel b: the chart shows the ratio of the gross non-consolidated debt (i.e. including intra-sectoral loans) of NFCs to GDP. Changes in the gross NFC debt-to-GDP ratio are calculated for the period Q2 2022-Q4 2023. The chart does not show Luxembourg, where the gross NFC debt-to-GDP ratio increased from 315.5% in Q2 2022 to 316.8% in Q4 2023. The non-consolidated NFC debt levels for Cyprus include the debt held by special-purpose entities.

Lending standards are expected to remain tight for some time, which could create additional headwinds for firms with high near-term refinancing needs. New borrowing by firms has remained subdued across all borrowing instruments in recent months (Chart 1.6, panel a), particularly for small and newly established firms. To a certain extent, this weakness reflects low demand for external financing because of high borrowing costs and an uncertain business outlook, as well as tight credit standards imposed by lenders. While the cost of new credit has been falling recently as lenders start to price-in the expected decline in central bank interest rates, it remains historically high, with the average interest rate on new bank loans to corporates at above 5% since September 2023. With the outlook for near-term growth subdued and lending standards expected to remain tight going forward, the near-term outlook for corporate borrowing is weak. This could pose a risk to firms’ debt rollover capacity, especially if growth continues to surprise to the downside and if the downward pressure on corporate profitability reduces firms’ capacity to substitute external with internal funding.

The ongoing corporate deleveraging should support firms’ access to external financing once the economy picks up and financing conditions ease. Weak new borrowing since late 2022 and the negative effect of past high inflation on corporate debt ratios have contributed to considerable deleveraging among firms, with the aggregate NFC gross-debt-to-GDP ratio in the euro area declining from 106.4% in the second quarter of 2022 to 98.4% in the fourth quarter of 2023. Although the countries with the highest levels of NFC debt have seen the largest declines in indebtedness (Chart 1.6, panel b), corporate debt levels are still elevated in some jurisdictions. At the same time, the decline in overall indebtedness, as long as it remains orderly, will likely put firms in a better position to access external funding in the medium term, once interest rates start declining and economic activity gains strength.

Box 1

Corporate debt service and rollover risks in an environment of higher interest rates

The rapid increase in interest rates could weaken the ability of firms to service and roll over their debt and, consequently, worsen the outlook for bank asset quality. Since the pandemic, several factors have helped to keep euro area corporate sector profitability remarkably resilient to shocks. First, firms managed on aggregate to improve their revenues as economic activity rebounded after the pandemic. Second, pent-up demand made it easier for them to pass rising energy and input costs (affected by supply bottlenecks and Russia’s war against Ukraine) through to consumers. After the ECB started raising its policy rates in the middle of 2022, however, firms started facing higher costs to service their debts, initially on floating-rate debt and later also on their fixed-rate debt. This box combines firm-level balance sheet data with loan-level data to assess the joint impact of resilient post-pandemic profitability and higher financing costs on the debt servicing capacity of euro area firms. As a measure of debt servicing capacity, the box uses an adjusted interest coverage ratio (ICR).[2] As the financial data of non-listed euro area firms are typically released with a long lag, firms’ earnings in 2023 are estimated using sector and country aggregate earnings growth rates. Interest payments are estimated based on actual lending rates available at the individual loan level.

More1.4 Strong labour markets support household resilience

Euro area households continue to benefit from record employment levels and rising real wages and incomes, with further real wage growth expected ahead. Employment growth remained positive in late 2023, despite some signs of an impending turn in labour markets several months previously (Chart 1.7, panel a). Purchasing Managers’ Indices (PMIs) for employment, which are early indicators of future labour market conditions, have been climbing out of negative territory (values below 50) over the past few months. The continued strength of labour markets can be observed across the board, with only a few countries seeing unemployment rates rise. At the same time, real wage growth picked up enough to turn positive in the third quarter of 2023, pushing up household income. After several difficult years, growth in compensation per employee is expected to outpace inflation in 2024 and beyond amid rapid disinflation (Chart 1.7, panel b), which will considerably bolster the financial situation of households.

Chart 1.7

Labour markets remain robust, while positive real wage and income growth bolsters households’ financial situations

a) Employment growth and PMI indicators for employment | b) Growth in compensation per employee |

|---|---|

(Jan. 2022-Mar. 2024; left-hand scale: indices, right-hand scale: quarter-on-quarter percentage changes) | (2022-26E, annual percentage growth rates) |

|  |

Sources: Eurostat and ECB (MNA), S&P Global Market Intelligence, ECB staff macroeconomic projections for the euro area, March 2024 and ECB calculations.

Notes: Panel a: the latest observation for employment growth is for Q4 2023. Panel b: shaded bars are forecasted values from the March 2024 ECB staff macroeconomic projections.

The cost of new borrowing and outstanding debt service have plateaued, while real income growth is supporting households’ debt servicing capabilities. Interest rates on new and renegotiated mortgages as well as on new consumer loans peaked in the fourth quarter of 2023, likely in anticipation of policy rate cuts later in 2024 (Chart 1.8, panel a). Countries with predominantly variable-rate mortgages have seen their debt service costs increase considerably. At the same time, households’ debt servicing capabilities in countries with mainly fixed-rate mortgages will depend on future interest rates when mortgage fixation periods end. The less rapid rise in interest rates together with the recent pick-up in wages across the euro area led to the aggregate debt service-to-income ratio plateauing as of the fourth quarter of 2023. Additionally, households have likely used excess savings accrued during the COVID-19 pandemic to reduce debt burdens in recent years (Overview, Chart 4, panel a), limiting the overall deterioration in their ability to service their debts compared with the previous hiking cycle between 2006 and 2008.

Chart 1.8

Households’ cost of new borrowing has plateaued, and aggregate debt service seems to be at a turning point, as expectations of future debt servicing capabilities worsen

a) Euro area household debt service ratio and cost of new borrowing | b) Expectations of difficulties making mortgage payments in the next three months, by income quintile |

|---|---|

(Q1 2003-Q1 2024, percentages) | (Jan. 2022-Jan. 2024, percentage of consumers) |

|  |

Sources: Eurostat and ECB (QSA), ECB (MIR, CES) and ECB calculations.

Notes: Panel a: the latest observation for the household debt service ratio is for Q4 2023. The debt service ratio is defined as the ratio of fixed debt service costs (i.e. interest payments plus amortisations) to disposable income. Fixed debt service costs assume identical repayment of principal over the average maturity of the debt and an average interest rate. Disposable income is expressed as a function of income, the average interest rate and the average remaining maturity of the debt stock. Panel b: the percentage of consumers is calculated using survey weights. The total number of households surveyed includes those who report not having a loan or not knowing how to answer. The sample of countries comprises Belgium, Germany, Spain, France, Italy and the Netherlands, and from April 2022 also includes Ireland, Greece, Austria, Portugal and Finland.

Risks to household financial stability appear manageable at present, yet the share of vulnerable households is rising, especially in lower-income brackets. The combination of persistently strong labour markets, expected high wage growth, healthy savings cushions at pre-pandemic levels and the high share of fixed-rate mortgages in the euro area is ensuring that severe risks to the household sector’s financial situation remain contained.[3] However, the share of households expecting to face difficulties in making mortgage payments in the next three months jumped in January 2024 compared with 2023 (Chart 1.8, panel b). This increase is especially pronounced for both lower- and, unusually, middle-income households. Additionally, microsimulations of household survey data suggest that the share of households with a dangerously high debt service-to-income ratio in countries with mainly variable-rate mortgages increased to around 15% as of the fourth quarter of 2023 from a stable level of around 12% in 2021 and early 2022.[4] While debt held by lower-income households makes up only around 11.4% of total household debt in the euro area, the sharp increase in expected difficulties reported by households in the middle income quintile, which accounts for 14.7% of total household debt, could be indicative of a larger financial stability issue in the future, especially if interest rates do not fall as expected in 2024, real wage growth turns out to be much lower than expected and the labour market weakens notably.

1.5 Correction under way in property markets, notably the commercial segment

Mortgage demand is expected to pick up in the second quarter of 2024, but new lending remains subdued. The steep increase in borrowing costs since the start of the present rate-hiking cycle has, together with subdued consumer confidence and housing market prospects, been the main driver behind the falling demand for mortgages. The decline in demand for new housing loans eased in 2023 and is expected to reverse entirely in the second quarter of this year (Chart 1.9, panel a). If this reversal materialises, it would be the first time in two years that banks have reported net positive demand for mortgages. Expectations that a lower cost of mortgage debt would boost the affordability and attractiveness of housing appear to be the key factor behind this change in outlook. Borrowing costs already declined slightly for four consecutive months between November 2023 and March 2024, bringing the average interest rate from 4.01% to 3.77%. However, the volume of new loans for house purchase remains subdued in 2024 and stands below the lows of 2023 (Chart 1.9, panel b).

Chart 1.9

Banks expect demand for housing loans to increase on the back of lower borrowing costs, but new loan origination remains subdued for the moment

a) Changes in demand for mortgage loans in the euro area | b) New loans to households for house purchase, excluding renegotiations |

|---|---|

(Q1 2020-Q2 2024, net balances of survey responses) | (Jan. 2019-Mar. 2024, € billions) |

|  |

Sources: ECB (BLS, MIR) and ECB calculations.

There are some signs of stabilisation in residential real estate (RRE) prices, but downside risks remain. Euro area RRE prices declined 1.1% year on year in the fourth quarter of 2023. This fall in aggregate euro area RRE prices masks significant differences across countries, with around two-thirds of euro area countries still exhibiting positive price dynamics in the same period. In addition, high-frequency data on RRE prices available for a selected number of countries indicate that the drop in RRE prices in some countries might have slowed or even come to a halt in the second half of last year (Chart 1.10, panel a). The orderly contraction in RRE prices has led to a reduction in overvaluation measures, which is reflected in slightly lower tail risk for euro area RRE prices compared with the third quarter of 2022 (Chart 1.10, panel b). Nonetheless, downside risks remain elevated in some euro area countries, as housing affordability is at low levels owing to high interest rates and high prices, with some markets still showing signs of overvaluation. The tightening in financial conditions has been followed by a stark deceleration in RRE investment, which will likely have a negative impact on supply going forward (Chart 1.10, panel c). The reduction in housing supply and expectations of rising construction prices, albeit much slower than in the recent past, might to some extent mitigate the risk of prices falling substantially going forward.

Chart 1.10

The orderly contraction in RRE prices has reduced tail risks to RRE prices, but significant downside risks are likely to persist in some countries

a) RRE price dynamics in selected countries | b) One-year forward predicted tail risk in euro area RRE prices | c) Survey indicators on residential construction and residential investment growth |

|---|---|---|

(Dec. 2019-Mar. 2024; index: Dec. 2019 = 100) | (Q1 2016-Q2 2024, percentages) | (Jan. 1999-Mar. 2024; left-hand scale: net percentages and percentages, right-hand scale: index) |

|  |  |

Sources: ECB, Europace, Immobiliare.it (Italy), Confidencial Imobiliário (Portugal, sourced from BIS), Arco Real Estate (Latvia), Národná banka Slovenska, Statistics Finland, Indominio.es (Spain), Central Statistics Office (Ireland), Statistics Netherlands, S&P Global Market Intelligence and ECB calculations.

Notes: Panel a: the chart includes monthly data up to December 2023, February 2024 or March 2024 for the following countries: Germany, Ireland, Spain, Italy, Latvia, the Netherlands, Portugal and Finland. The data for Slovakia are quarterly and up to December 2023. An average listing price index is used for Italy, while a hedonic price index based on transaction prices is used for all the other countries. Data for Latvia reflect prices of apartments in Riga and thus only a portion of the country’s real estate market. The data for Portugal capture around 40% of the real estate market, as transactions that do not go through estate agents are excluded. As a result, official country statistics might differ from the data provided here, as they capture the entire market at the cost of lower frequency. Panel b: the chart shows the results from an RRE price-at-risk model based on a panel quantile regression on a sample of 19 euro area countries. The chart shows the 5th percentile of the predicted RRE price growth for the euro area aggregate and the 10th-90th percentile range of this estimate across individual euro area countries. Further details on the methodology can be found in the article entitled “The analytical toolkit for the assessment of residential real estate vulnerabilities”, Macroprudential Bulletin, Issue 19, ECB, October 2022.

The outlook for offices and lower-quality commercial real estate (CRE) continues to deteriorate, which is having a negative effect on the resilience of real estate firms. Transaction activity in CRE markets remains subdued, with almost half as many transactions completing in the last two quarters of 2023 as in the equivalent period in 2022. Furthermore, market intelligence indicates little to no pick-up in activity over the start of 2024. While this low level of market activity is inhibiting price discovery, there is already evidence of a significant price correction occurring in markets, with prices down 8.7% annually as of the fourth quarter of 2023 (Overview). The outlook for the office market is particularly bleak. Increased use of work-from-home options has created a structural drop in demand for this asset, which is reflected in a significant decline in rent growth expectations compared with pre-pandemic dynamics. Lower-quality assets are the most affected, and expectations in this segment continue to deteriorate due to additional concerns about energy efficiency requirements and capital expenditure costs. However, conditions in euro area markets do appear more benign than in the United States, attributable to more extensive working from home in the United States combined with an excess of supply going into the downturn (Chart 1.11, panel a). Falling rental income, rising capital expenditures and higher financing costs pose a triple threat to real estate firms. The largest real estate firms in the euro area have seen their profit margins contract sharply since the start of 2022, which has left around half of them in loss-making territory (Chart 1.11, panel b).

Chart 1.11

The outlook for CRE markets continues to deteriorate, with real estate firms facing increasing profitability pressure

a) 12-month rent growth expectations for the office market | b) Share of firms with negative net profit in the real estate sector and median net profit margin |

|---|---|

(Q4 2023, percentages) | (Q1 2017-Q3 2023, percentages) |

|  |

Sources: RICS, S&P Global Market Intelligence and ECB calculations.

The downturn in RRE markets has remained orderly thus far, while some signs of materialising risk can be observed in CRE markets. The downward adjustment in RRE prices remains orderly, with signs of stabilisation in some countries. Generally, the contraction in RRE prices has been larger in countries where properties showed signs of greater overvaluation at the start of the rate hike cycle. Risks remain tilted to the downside, however, especially in those countries where debt levels are elevated and properties might still be overvalued. The commercial segment has seen a steeper downturn, and rising financing costs pose challenges to the debt servicing capacity of real estate firms, especially where rental income is also under pressure. This development is reflected in positive and rising non-performing loan inflows in banks’ CRE portfolios, although these remain contained for now. Banks’ aggregate exposures are substantially smaller to CRE than to RRE and are unlikely to be large enough at the euro area level to threaten the solvency of the banking system as a whole. However, these exposures are not evenly spread across the banking system, and stress could arise among the euro area’s most exposed banks (Chapter 3). Additionally, an adverse outcome of such a scenario could be amplified by procyclical selling among non-banks, particularly real estate investment funds (Chapter 4).

2 Financial markets

2.1 Markets adjust to expected shift in monetary policy

Expectations of global monetary policy easing have been boosting investor demand for risky assets. The disinflation trend, partly supported by moderating energy prices, has led to investor expectations that major central banks will start to ease monetary policy in 2024. Market participants are currently pricing-in around 115 basis points of policy rate cuts over the next 12 months in the euro area and 95 basis points in the United States (Chart 2.1, panel a). While longer-dated risk-free rates rebounded from the strong decline observed close to the end of 2023, the expected shift in monetary policy still supported risky asset valuations. Increased risk appetite contributed to the strong outperformance of the riskiest asset classes (Chart 2.1, panel b). While some positive economic surprises in the first months of 2024 have led investors to postpone their expectations surrounding the timing of a first policy rate cut, investors remain confident that inflation in advanced economies might reach its 2% target without a deep economic contraction (a “soft landing”).

Chart 2.1

Shift in monetary policy prospects has boosted investor confidence and risk appetite

a) Expected policy rate changes over the next 12 months | b) Global asset class performance since the previous issue of the Financial Stability Review |

|---|---|

(Jan. 2021-May 2024, basis points) | (22 Nov. 2023-7 May 2024, percentages) |

|  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: the latest observations are for 7 May 2024. The chart shows the difference between 1Y1M forward overnight index swap (OIS) rates and current overnight rates (euro area – €STR, United States – SOFR). The equity market bottom and all-time high indicated are based on the daily-close values for the EURO STOXX Index. Panel b: HY stands for high yield; IG stands for investment grade. Performance is based on the following indices: crypto-assets – Bloomberg Galaxy Crypto Index; private equity – FTSE Private Equity Buyout Index (for United States); equities – MSCI ACWI Index; bonds – ICE BofA indices; commodities – Bloomberg Commodity Index Total Return.

Positive real risk-free rates might mitigate some financial stability concerns but might also challenge the most vulnerable corporates. Investor expectations suggest that while policy rates will go down, they will remain well above the zero lower bound. Consequently, long-term real risk-free rates are expected to remain in positive territory – at around 0.25% for the euro area – also in steady state (Chart 2.2, panel a). While the era of negative interest rates in the decade before the inflation outbreak was associated with the rise of a number of financial stability risks, the new regime may bring long-term benefits for the stability of the financial system.[5] Nevertheless, the ongoing period of transition could still expose some vulnerabilities and increase market volatility. For example, the stress seen in the banking sector in March 2023 showed that some individual financial entities are particularly vulnerable to interest rate risk. Since then, market participants have priced in tail risks as skewed to the downside, as reflected in the prices of options on short-term sovereign bonds (Chart 2.2, panel b).

Chart 2.2

Market participants expect long-term real rates to stay higher for longer, but risks for short-term rates are perceived as skewed to the downside

a) Five-year real risk-free rates five years ahead | b) Skewness in implied volatility arising from options on short-term sovereign bonds |

|---|---|

(Jan. 2021-May 2024, percentages) | (Jan. 2021-May 2024, percentages) |

|  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: The latest observations are for 7 May 2024. Panel a: difference between 5Y5Y forward OIS rates (euro area – €STR, United States – SOFR) and 5Y5Y inflation swap forward rates (euro area – HICP ex tobacco, United States – CPI). Panel b: difference between implied volatility in 5% delta put and 5% delta call one-month options on 2Y sovereign bond futures (euro area – Euro Schatz listed on Eurex, United States – US Treasury Note listed on CBOT).

The structure of the corporate bond market has delayed the full impact of higher interest rates on businesses. One way corporates can hedge against the impact of unexpected interest rate changes on their funding costs is to issue fixed-rate bonds instead of floating-rate bonds. In this case funding costs mostly increase when the debt has to be rolled over in a higher-rate environment. Given that fixed-rate bonds are dominant in corporate bond structures in both the euro area and the United States (Chart 2.3, panel a), the aggregated impact of past policy tightening has been smoothed over time.[6] In addition, in the euro area lower-rated corporate borrowers issued a record amount of debt shortly before the onset of the recent tightening cycle, which has also kept the share of bonds maturing in the near term at low levels (Chart 2.3, panel b). This enabled lower-rated borrowers to reduce issuance in 2022 and 2023, which shielded them from the immediate effects of higher risk-free rates and wider spreads on their funding costs. However, increased rollover needs going forward might accelerate the impact of higher rates. Furthermore, the recently observed shift towards shorter debt maturities is leaving lower-rated firms more exposed to future market conditions.

Chart 2.3

High share of fixed-rate corporate bonds and a supportive maturity structure has so far slowed the impact of policy tightening on the most vulnerable issuers

a) Share of fixed-rate corporate bonds by jurisdiction and rating | b) Share of bonds with less than three years to maturity in benchmark euro area corporate bond indices |

|---|---|

(7 May 2024, percentages) | (Jan. 2014-May 2024, percentages) |

|  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: IG stands for investment grade; HY stands for high yield, NR stands for not rated. Calculated for bonds issued in local currency. Investment grade means at least one investment grade rating from Fitch, Moody’s or S&P. Panel b: the latest observations are for 7 May 2024. “Investment grade” refers to bonds included in the ICE BofA Euro Corporate Index, while “high yield” refers to bonds included in the ICE BofA Euro High Yield Index.

Total bond funding costs are still expected to increase further. At the end of 2021, marginal bond funding costs were substantially lower than total bond funding costs in both the euro area and the United States (Chart 2.4, panel a), indicating that pandemic-related policy easing had not yet been fully transmitted. The rapid increase in bond yields over 2022 has reversed these dynamics but, until recently, the overall increase in total bond funding costs had been relatively limited. While current bond yields reflect the policy rate cuts anticipated by investors, the limited scale of the expected easing cycle leaves scope for further total funding cost increases (proxied by the distance to the 45-degree line in the chart). This might put pressure on more indebted corporates, especially if the subdued economic growth currently observed in the euro area continues. In the sovereign bond space, while total funding costs are also expected to increase further, the scale of expected increase varies substantially across individual countries (Chart 2.4, panel b). In contrast to the situation for corporates, it appears that more of the past tightening has already been transmitted to more indebted sovereign issuers than to less indebted ones (the higher the marginal cost of bond funding, the closer it is to the total cost of bond funding). This is because of the significant amount of lower-rated sovereign debt which has already been rolled over at higher rates. In addition, the recent substantial compression of spreads has further mitigated the expected additional increase in average sovereign funding costs.

Chart 2.4

Bond funding costs will increase further as issuers refinance their debt

a) Total versus marginal corporate bond funding costs by jurisdiction | b) Total versus marginal euro area sovereign bond funding costs by country |

|---|---|

(Dec. 2021-May 2024, percentages) | (Dec. 2021-May 2024, percentages) |

|  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: The latest observations are for 7 May 2024. Total funding cost is proxied by the average yield at issue on outstanding fixed-rate bonds weighted by the amount outstanding. When data on yield at issue were not available the coupon rate was used instead. The marginal funding costs are proxied by the average yield-to-worst on outstanding fixed-rate bonds weighted by the amount outstanding. Panel a: calculated for bonds included in ICE BofA indices: Euro Corporate Index, Euro High Yield Index, US Corporate Index, US High Yield Index. Panel b: calculated for bonds included in the ICE BofA All Maturity All Euro Government Index.

2.2 Benign pricing of risk keeps asset prices vulnerable to shocks

Low risk perceptions might mask underlying vulnerabilities and lead to excessive risk-taking. Since the publication of the previous edition of the Financial Stability Review in November 2023, implied volatility indices for risky asset classes have remained subdued both in historical terms and in comparison with the implied volatility in the interest rate markets (Chart 2.5, panel a). Given the role played by diversified equity indices in reflecting broad macroeconomic conditions, volatility indicators based on them (such as VIX and VSTOXX) are perceived as benchmark market-based risk indicators. While low implied volatility in financial markets can support financial stability to the extent that it properly reflects sound fundamentals and a stable risk outlook, it might also reflect some underestimation of financial stability vulnerabilities by market participants (Box 2). In addition, because financial institutions commonly use implied volatility indices in their risk management, prolonged periods of subdued volatility might incentivise excessive risk-taking.[7] This could, in turn, lead to a substantial compression of risk premia (Chart 2.5, panel b) and add to non-linear dynamics during shocks.[8]

Chart 2.5

Most implied volatility indices remain subdued and might incentivise risk-taking

a) Implied volatility indices against the distribution for the last ten years | b) Risk premia versus implied volatility indices for euro area risky assets |

|---|---|

(8 May 2014-7 May 2024, percentiles) | (May 2014-Apr. 2024, percentages) |

|  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: IG stands for investment grade; HY stands for high yield. Based on the following indices for the euro area and the United States respectively: interest rate – SMOVE, MOVE; equity – VSTOXX, VIX; IG credit – Itraxx/Cboe Europe Main 1M Volatility Index, CDX/Cboe IG 1M Volatility Index; HY credit: Itraxx/Cboe Europe Crossover 1M Volatility Index, CDX/Cboe HY 1M Volatility Index. Panel b: for high-yield corporate bonds “risk premia” is proxied by option-adjusted spreads for the ICE BofA Euro High Yield Index while for equities it is proxied by the 5Y CAPE yield over the 5Y real risk-free rate for EURO STOXX.