Published as part of the ECB Economic Bulletin, Issue 2/2025.

Evidence from earnings calls of euro area companies suggests that labour demand is continuing to decline. An earnings call is a conference call that takes place between the management of a publicly listed company and its investors, financial analysts and the press. Earnings calls offer a rich and timely source of economic data which are available at a high frequency.[1]

In this box, we apply textual analysis to a large database of transcripts of corporate earnings calls to construct an indicator of euro area labour demand. We then use our indicator to produce nowcasts and forecasts of the euro area job vacancy rate – a traditional measure of labour demand and a key labour market metric.[2] The database of earnings calls we access contains information on the exact date and time of each earnings call and is updated every two weeks. This allows us to extract information from earnings calls well in advance of official data releases, including those of the job vacancy rate, which are only available with a significant lag.[3]

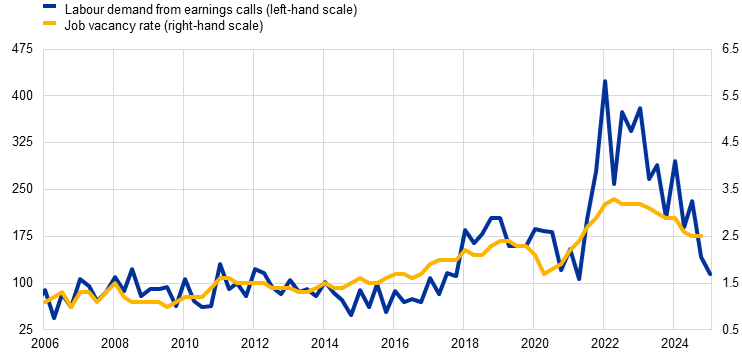

Our measure of labour demand from earnings calls closely tracks the job vacancy rate (Chart A). To construct our indicator, we first restrict our sample of earnings calls to those by companies which were headquartered in the euro area at the time the earnings call took place. This leaves us with a sample of roughly 600 calls per quarter. Next, we add up the number of sentences from earnings calls containing at least one word from a list of keywords that reference the pressures firms face from unmet labour demand following Dueholm, Kalyani and Ozkan.[4] Although it is somewhat more volatile, our indicator closely tracks the euro area job vacancy rate, with a correlation coefficient of around 0.9. In particular, it captures the steady increase in the job vacancy rate between 2016 and 2020 and its sharp rise in 2021. Both our indicator of labour demand and the job vacancy rate peaked in the first half of 2022 and have been trending downwards ever since, suggesting that labour demand is cooling.

Chart A

Indicator of labour demand from earnings calls and the euro area job vacancy rate

(left-hand scale: number of sentences; right-hand scale: percentages)

Sources: Eurostat, NL Analytics and ECB staff calculations.

Notes: The blue line plots the indicator of labour demand derived from earnings calls as described in the text. The yellow line plots the job vacancy rate for the euro area. The latest observations are for the first quarter of 2025 for the indicator of labour demand from earnings calls and the fourth quarter of 2024 for the job vacancy rate.

Data obtained from recent earnings calls suggest that the job vacancy rate will continue to decline modestly (Chart B). To produce an early measure of the job vacancy rate ahead of official data releases, we employ a mixed data sampling (MIDAS) regression approach to generate nowcasts as well as forecasts up to two quarters ahead.[5] MIDAS regressions offer the key advantage of enabling us to predict a low-frequency variable (the job vacancy rate) using high-frequency data (our indicator of labour demand derived from earnings calls). To reduce the potential for model misspecification, we estimate a series of MIDAS regressions over several specifications, including different polynomial lag structures and restrictions on the model’s parameters.[6] We then consider the range and mean forecast from the various specifications. These point to a sustained cooling in labour demand for the current and coming quarters. The job vacancy rate is projected to have hovered at around 2.5% in the first quarter of 2025 and to remain the same in the second quarter – 0.8 percentage points lower than its peak in the second quarter of 2022 but still above its pre-pandemic average of 1.9%. For the third quarter of 2025, our forecasts suggest a marginal decline towards 2.4% with risks broadly balanced, as the range of predicted outcomes is fairly equally distributed around the mean. The profile of our forecasts is broadly in line with projections of economic activity from the March 2025 ECB staff macroeconomic projections for the euro area, suggesting lower momentum in growth in the first half of 2025.

Chart B

Forecasting the euro area job vacancy rate

(percentages)

Sources: Eurostat, NL Analytics, Indeed and ECB calculations.

Notes: The solid blue line plots the euro area job vacancy rate up to the fourth quarter of 2024. The grey area indicates the min-max range of forecasts obtained with several MIDAS and unrestricted MIDAS specifications and different variants of the indicator of labour demand from earnings calls. The red dashed line plots the average forecast. The green dashed line plots the average forecast of the job vacancy rate using data on job postings from Indeed in our MIDAS regression forecasting framework. The latest observations are for January 2025 for the underlying indicators of labour demand derived from earnings calls and Indeed job postings. The forecasts cover the period up to the third quarter of 2025.

The short-term forecasts of the job vacancy rate using earnings calls are broadly in line with those derived from alternative indicators of labour demand. Data on vacancies from the online job portal Indeed are another novel and useful source of information on the euro area labour market. Both the number of open vacancies listed on the site and the number of new vacancies posted can help gauge labour demand. As with our indicator of labour demand derived from earnings calls, data from Indeed are timely and available at a high frequency, albeit over a much shorter time horizon.[7] The stock of job vacancies listed on Indeed has steadily declined since late 2023. By the end of 2024, it was around 10% lower than at the start of the year. At the same time, the flow of new job vacancies, considered a more responsive measure of labour demand, has also trended downwards, also indicating a moderation of labour demand. Incorporating these data into our MIDAS regression approach produces forecasts of the euro area job vacancy rate which are broadly aligned with those obtained using information from earnings calls, especially in the short term (Chart B). The forecasts point to a relatively stable job vacancy rate of around 2.5% until mid-2025, with a slight increase expected towards the end of the forecast period.[8]

In summary, transcripts of corporate earnings calls provide timely and useful information on the euro area labour market. Our findings suggest that labour demand will moderate very gradually in the euro area over the coming quarters as the labour market continues to cool overall.

For a further use of earnings calls to inform macroeconomic indicators, see the box entitled “Earnings calls: new evidence on corporate profits, investment and financing conditions”, Economic Bulletin, Issue 4, ECB, 2023.

The job vacancy rate is defined as the number of job vacancies divided by the sum of the number of occupied posts and the number of job vacancies.

The flash estimate of the job vacancy rate in the euro area is typically released around one and a half months after the end of the quarter to which it refers, while the first release is published around three months after the end of the quarter.

See Dueholm, M., Kalyani, A. and Ozkan, S., “Can Earnings Calls Be Used to Gauge Labor Market Tightness?”, On the Economy Blog, Federal Reserve Bank of St. Louis, 18 June 2024.

MIDAS regressions are often used to produce short-term forecasts, as the informational benefits extracted from timely, high-frequency data fade the further the projection horizon stretches into the future (see Foroni, F. and Marcellino, M., “A survey of econometric methods for mixed-frequency data”, Working Papers, Norges Bank Research, No 06, 2013).

In particular, we estimate two different polynomial specifications. First, we include an exponential Almon lag polynomial (see Ghysels, E., Sinko, A. and Valkanov, R., “MIDAS Regressions: Further Results and New Directions”, Econometric Review, Vol. 26, Issue 1, 2007, pp. 53-90). Second, we estimate an unrestricted MIDAS as set out in Foroni, C., Marcellino, M. and Schumacher, C., “Unrestricted mixed data sampling (MIDAS): MIDAS regressions with unrestricted lag polynomials”, Journal of the Royal Statistical Society Series A, Vol. 178, No 1, pp. 57-82, January 2015. Furthermore, for each model specification we consider various windows for smoothing the indicator of labour demand from earnings calls using a moving average.

The database on earnings calls that we access stretches back to the beginning of 2002, while the time series of job postings data from Indeed only start at the beginning of 2018.

The Indeed-based forecast points to a mild increase in the third quarter of 2025 but still within the range of the earnings calls-based forecasts in mid-2025. This might be driven by the higher seasonality of the Indeed data series or the shorter sample available, which helps to push the forecast towards its recent historical highs.